-

The most effective fiscal policies for communities facing transition away from coal dependency are those that build wealth over time and strengthen community capacity. Read more

-

Rural and isolated communities face wrenching economic and demographic transitions. A solution to uncertainty is to focus on resilience. Read more

-

New fiscal and policy assessments help local leaders understand their exposure to declining revenue and policy barriers during a coal transition. Read more

-

Unlike most countries and state governments, the U.S. has not created a natural resources trust which could help meet volatility and spending challenges facing local and county governments. Read more

-

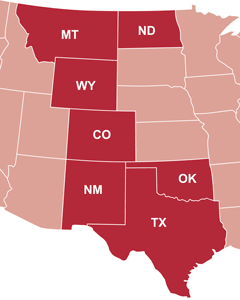

This report includes seven major energy-producing states and a new interactive adds four more (AR, LA, and PA). The study and interactive compare how local governments receive production tax revenue from unconventional oil and natural gas. Read more

-

Compared to other nations and even U.S. states, the federal government is a conspicuous laggard in creating a natural resources trust which would allow for stable, permanent, and ever rising payments to states and local governments without risks to taxpayers. Read more

-

Lower oil prices could be great for the economy, but for the communities dependent on drilling, the price drop may prove challenging for several reasons. Read more

-

Monitoring can help local governments better understand the socioeconomic impacts caused by energy development, and support requests to industry and state government for assistance to implement appropriate mitigation. Read more

-

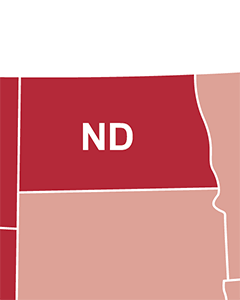

This report compares how North Dakota provides local governments with production tax revenue from unconventional oil extraction compared to other major energy-producing states. Read more

-

This report compares how Wyoming provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how New Mexico provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how Colorado provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

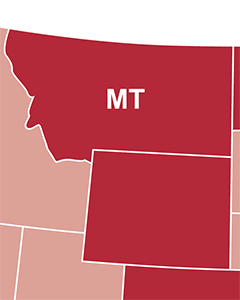

This report compares how Montana provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how Oklahoma provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how Texas provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

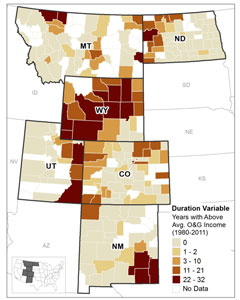

This paper demonstrates that when fossil fuel development plays a prominent, long-term role in local western economies there are negative effects on per capita income, crime rates, and educational attainment. Read more

-

This report explores the challenges for states and local communities caused by unconventional oil and natural gas development, and fiscal best practices that address them. Read more

-

This report analyzes the growing infrastructure and services needs of the Bakken boom and meeting the demands of unconventional energy development. Read more

-

This study analyzes the fossil fuel economy in five Rocky Mountain states—CO, MT, NM, UT, and WY—and how states and communities can maximize benefits and minimize the costs of energy development. Read more

-

This report examines the extent of energy reserves in the U.S. and on western public lands, and their scale in light of domestic production and consumption trends. Read more