Tax Policy

Tax policy creates incentives and disincentives that affect how communities experience population change, resource extraction, and natural disasters. Our research helps local leaders and state and federal policymakers understand the long-term impacts of tax policy decisions.

Local revenue to fund long-term infrastructure costs

Communities need resilient revenue strategies to fund the long-term costs of capital improvements and infrastructure.

Diversifying revenue on New Mexico state trust lands

New activities can help guarantee and diversify future revenue from New Mexico state trust lands, complementing the successful Land Grant Permanent Fund.

Federal Fossil Fuel Disbursements to States

States tend to spend, rather than save, federal fossil fuel disbursements, potentially making them vulnerable to economic transitions.

Fiscal policy is failing rural America

State and federal fiscal policies hurt rural communities by limiting how local governments can grow, diversify, and invest revenue.

The health and fiscal vulnerability of rural recreation counties

Where rural recreation counties rely on public funding for health care, fiscal solutions should diversify the ways local governments can save and spend.

Building a Federal Land Endowment

The bipartisan Forest Health for Rural Stability Act would establish a federal land endowment and resolve key challenges of federal land payments to counties.

Recent Tax Policy Posts

-

Local revenue to fund long-term infrastructure costs

Communities need resilient revenue strategies to fund the long-term costs of capital improvements and infrastructure. Read more

-

Diversifying revenue on New Mexico state trust lands

New activities can help guarantee and diversify future revenue from New Mexico state trust lands, complementing the successful Land Grant Permanent Fund. Read more

-

Federal Fossil Fuel Disbursements to States

States tend to spend, rather than save, federal fossil fuel disbursements, potentially making them vulnerable to economic transitions. Read more

-

How state and local budgets are vulnerable to climate change

Climate change has the potential to destabilize general operating budgets and constrain access to lending markets. These presentations share promising solutions for “climate-proofing” budgets. Read more

-

Why fiscal policy solutions are necessary

This panel discussion, with examples from Montana and New Mexico, examines how fiscal policies have failed rural communities. Read more

-

Fiscal policy is failing rural America

State and federal fiscal policies hurt rural communities by limiting how local governments can grow, diversify, and invest revenue. Read more

-

The health and fiscal vulnerability of rural recreation counties

Where rural recreation counties rely on public funding for health care, fiscal solutions should diversify the ways local governments can save and spend. Read more

-

Building a Federal Land Endowment

The bipartisan Forest Health for Rural Stability Act would establish a federal land endowment and resolve key challenges of federal land payments to counties. Read more

-

PILT Proposal Would Help Small-Population Counties

Analysis shows raising Payment in Lieu of Taxes (PILT) population limits for small-population counties would have increased total payments by $2 million in 2019. Read more

-

Endowing Federal Public Land Counties

Reforming county payments by establishing a permanent Trust to fund Secure Rural Schools (SRS). Read more

-

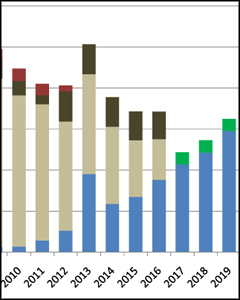

Comparing Coal Fiscal Policies for Western States

Coal fiscal policies vary widely across the West in terms of how revenue is generated, set aside in permanent savings, or spent by state and local governments. Read more

-

President’s Budget Proposal Cuts County Payments

New analysis and interactive map show how the President’s budget proposal cuts county payments and the impact for every county in the nation. Read more

-

Time to Create a Natural Resources Trust

Unlike most countries and state governments, the U.S. has not created a natural resources trust which could help meet volatility and spending challenges facing local and county governments. Read more

-

Federal Coal Program in Context

Explore the Socioeconomic Context of the Federal Coal Leasing Program Read more

-

County Payments Research

County governments are compensated for the tax-exempt status of federal public lands within their boundaries. These payments often constitute a significant portion of county and school budgets, particularly in rural counties with extensive public land ownership. Read more

-

Wildlife Refuge Payments: Reforms and Funding

How national wildlife refuge payments–especially important to rural counties–could be reformed and funded. Read more

-

Reforming Wildlife Refuge Payments

How county governments can benefit from reforming wildlife refuge payments. Read more

-

Outcomes of Higher Federal Coal and Natural Gas Royalty Rates

Analysis shows that proposed federal royalty reforms will increase the cost of delivering natural gas to domestic power plants by a greater amount than coal. Read more

-

Coal Royalty Reform: Impact on Prices, Production, and State Revenue

The proposed federal coal royalty reform rule could have substantial revenue benefits for federal and state governments, limited impact on coal production or prices on federal lands, and increased transparency. Read more

-

County Payment Reform Ideas, and Analysis of Recent Proposals

Reform ideas for future county payments from Headwaters Economics as well analysis of proposals made in the House, Senate, and by the President. Read more