Everyone wants to know: at what price does the U.S. shale revolution sputter? During the last decade, the dramatic increase in North American natural gas production unleashed by horizontal drilling and “fracking” led to a surplus that crashed prices. As a result, companies quickly moved capital and resources to oil.

Could falling global oil demand combined with increased U.S. production crash the oil price too? Yesterday’s close in the $70s makes one wonder. Lower oil prices could be great for the economy.

For the communities dependent on drilling, however, the price drop may prove challenging for several reasons:

First, using North Dakota as an example, fracking in the Bakken has resulted in a dramatic increase in oil production.

But extracting oil from shale requires more wells to maintain production compared to conventional oil fields. The “drilling treadmill” makes for bigger booms, expanding employment and income benefits, but also heightens and extends public costs.

Communities in North Dakota and Montana, for example, are struggling to meet the challenges of paying for infrastructure and services.

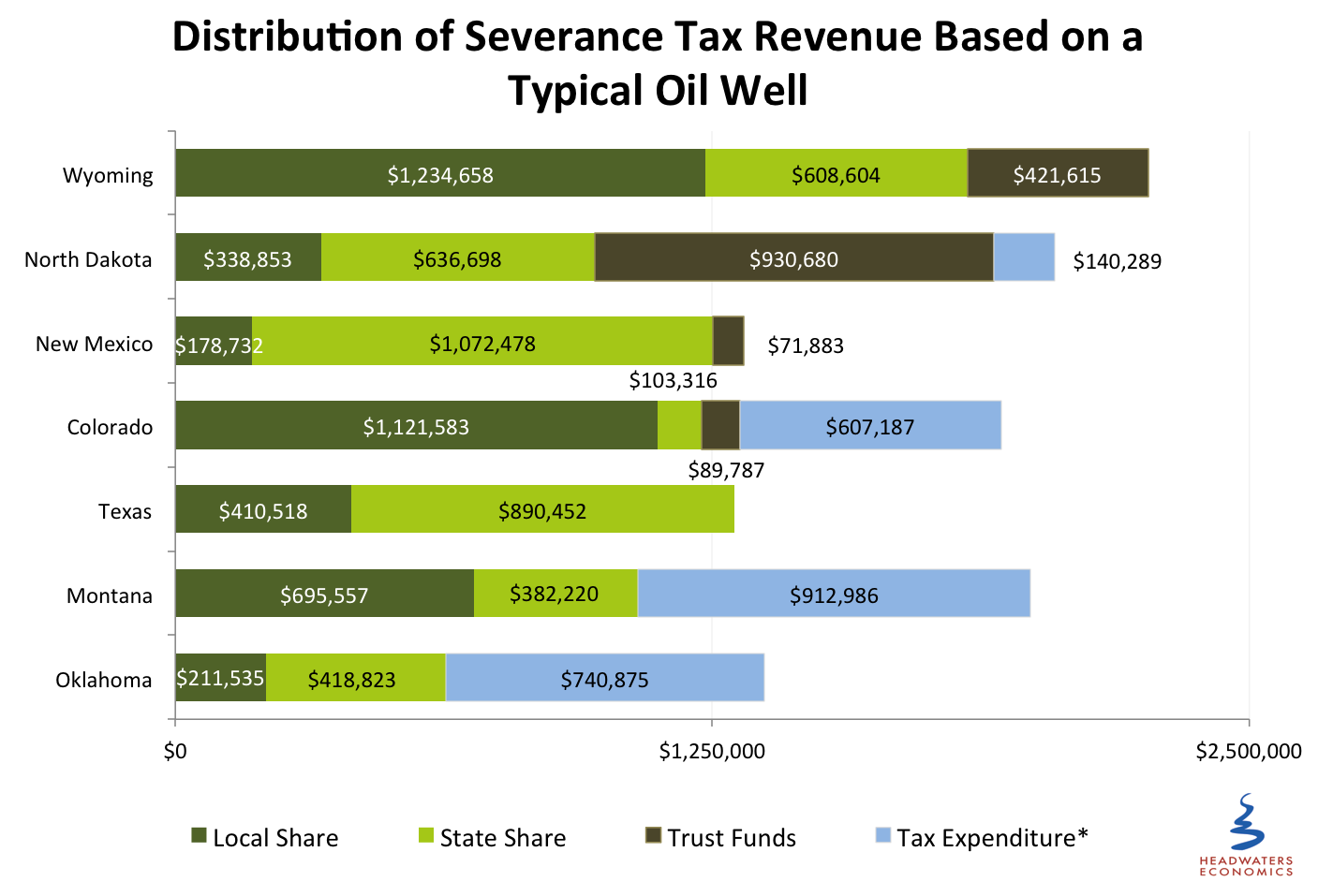

Third, as the above chart shows, tax policies have consequences. North Dakota shares relatively little of the oil wealth generated with local communities and has incentives that lower tax rates when prices fall.

This all means that if prices drop, but not enough to slow drilling (the breakeven price for oil in the core of the Bakken could be as low as $28), then communities will have less money to deal with the same intensity of drilling.

Most western legislatures will meet in January. Falling prices should refocus state and local leaders on understanding the needs of shale communities and what states can do to help them benefit amid continuing uncertainty.

*Tax Expenditure refers to the value of production tax incentives and tax relief funded with production tax revenue.