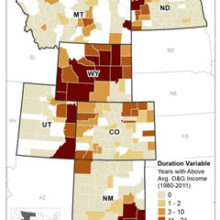

Drilling for oil and natural gas is a high-impact economic activity that presents opportunities and challenges for state and local governments seeking to reconcile the benefits of job and revenue growth with the impacts of rapid industrialization and population growth.

State Approaches Differ Greatly

Across the country, there are various approaches to taxing oil and natural gas activity, and to spending, sharing, and saving these revenues. In no case has any single state put together a complete package of fiscal “best practices.” Yet each state employs part of a viable fiscal solution and can learn from what others are doing.

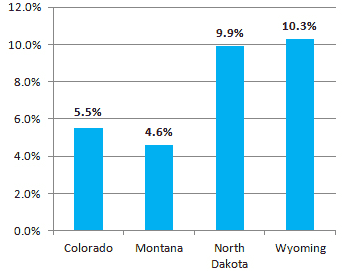

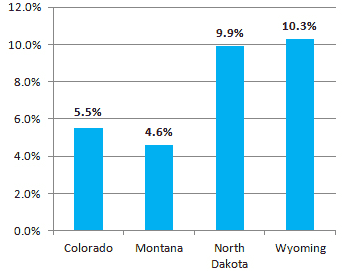

Oil and Natural Gas:

Effective Tax Rate on New Unconventional Wells

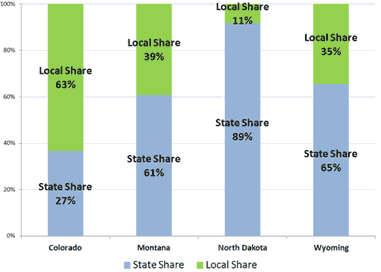

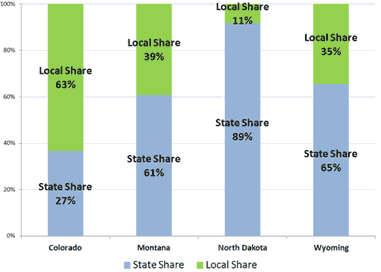

State vs. Local Share of Oil and Natural Gas Tax and Royalty Revenue Distributions, FY 2011

Four Main Fiscal Policy Challenges

Any successful oil and natural gas fiscal policy must address four main challenges:

- Amount: The costs of addressing energy impacts often exceed tax revenues. Studies and regional examples show that governments could remove incentives or raise tax rates without harming production.

- Timing: Tax policies can introduce major time-lags between impacts associated with the build-up of oil and natural gas activities and the arrival of revenues to address those impacts.

- Distribution: Energy revenue accrues to local governments where production takes place, while related impacts often occur in adjacent communities where workers live but no wells are drilled.

- Volatility: Price fluctuations and drilling activity can accelerate or end quickly, making it difficult for communities to meet financial commitments, conduct multi-year projects, and anticipate impacts.

Summary

The rush to develop unconventional oil and natural gas resources—underway in many parts of the nation and on the horizon in others—requires more wells compared to conventional oil and natural gas, meaning higher costs, more jobs, and greater impacts to extract an equivalent amount of oil or natural gas.

State and local fiscal policy—how oil and natural gas resources are taxed and how the revenue is distributed and invested—is the cornerstone of balancing positive and negative impacts of energy development. Fiscal policies that collect too little revenue and at the wrong time, fail to distribute it to the communities experiencing significant impacts, or pursue risky spending and saving strategies all contribute to problems associated with oil and natural gas development.

Fortunately, fiscal policy can be improved and this brief overviews some of the key practices needed to avoid the aforementioned pitfalls. These policies allow energy development to pay its way in terms of mitigating impacts, replace the value of non-renewable resources removed from a place, and provide tools to invest for a secure economic future. They should be pursued as part of a broad energy and economic development strategy that also includes technical and planning assistance to state and local governments and agencies as well as robust monitoring of the outcomes of energy development.