The bipartisan Forest Health for Rural Stability Act (S. 1693) would establish a federal land endowment. It could resolve key challenges of federal land payments to counties by:

- stabilizing and growing revenue over time,

- delivering predictable and fair compensation to counties, and

- providing flexibility to address economic and forest management needs.

A new proposal for a federal land endowment could stabilize the system of federal payments to counties with public land. Federal payments to public land counties have huge impacts on counties’ fiscal and economic well-being. Further, county payments methodology creates incentives and disincentives that affect the management of public lands.

The current fiscal and economic crisis due to the COVID-19 virus emphasizes the need to restructure the fiscal relationship between counties and public lands. The proposal gives counties the capacity to build wealth and fiscal stability when the economy is strong, reducing the need and cost of future federal relief efforts.

The county payment system—revenue-sharing payments and discretionary appropriations from Congress—has failed to provide predictable and fair compensation to public land counties. This failure has exacerbated fiscal crises in rural communities and left them unprepared to meet the economic challenges and opportunities for public lands counties in the 21st-century economy.

The bipartisan Forest Health for Rural Stability Act (S. 1693) was introduced in Congress in November 2019 by senators Wyden and Merkley of Oregon and senators Crapo and Risch of Idaho. This proposed legislation would establish a federal land endowment to resolve key challenges of federal land payments to counties. It would stabilize and grow revenue over time, eliminate the need for annual congressional appropriations, and provide flexibility to address economic and forest management needs in public land counties.

Read the legislative text, a one-page summary of the bill, and a longer summary.

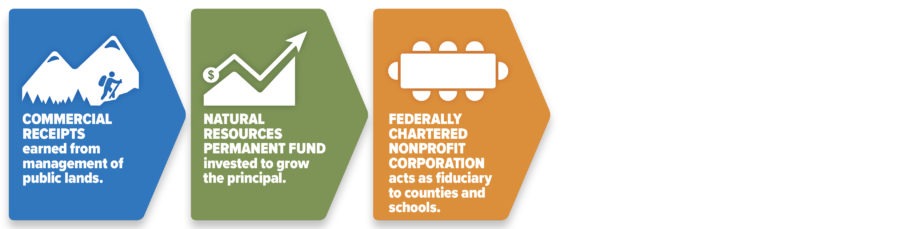

Today Commercial Receipts are Spent Annually

Federal land management agencies—including the USDA Forest Service, Bureau of Land Management, and U.S. Fish and Wildlife Service—generate commercial receipts from land management activities such as timber harvest, grazing leases, and recreation permits including ski area leases. These receipts are spent annually in one of two ways: direct revenue-sharing or congressional appropriations.

Table 1: Counties receive payments through direct revenue-sharing or congressional appropriations

| Federal Land Management Agency | Direct Revenue-Sharing Program | Congressional Appropriation Program |

|---|---|---|

| USDA Forest Service | Forest Service 25% Fund | Secure Rural Schools Act |

| Bureau of Land Management | O&C 50% Revenue Sharing | Secure Rural Schools Act |

| US Fish & Wildlife Service | Refuge Fees & Receipts | Refuge Revenue Sharing |

Counties elect to receive either direct revenue-sharing payments or authorized appropriations from Congress. When counties elect to receive congressional appropriations, receipts are used to subsidize the cost of appropriations. Depending on the federal land management agency—USDA Forest Service, Bureau of Land Management, or U.S. Fish & Wildlife Service—there are different programs for both direct revenue-sharing payments and Congressional appropriations (Table 1). However, this system of annual receipts and appropriations has failed to provide predictable and fair compensation to counties.

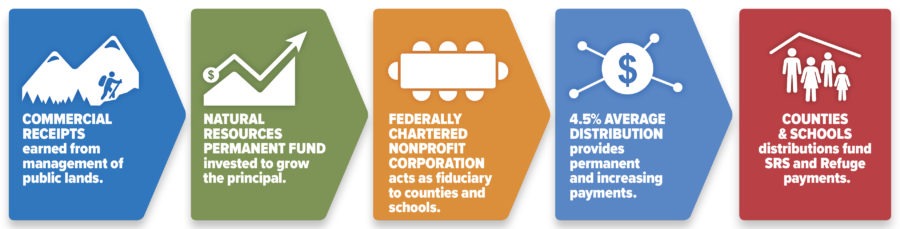

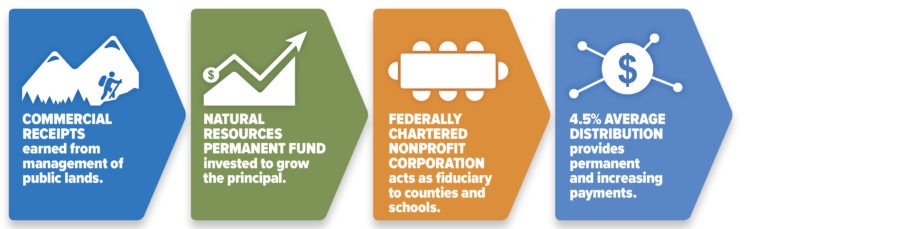

Establishing The Natural Resource Permanent Fund

The Forest Health for Rural Stability Act would revise and stabilize the fiscal relationship between public lands and local governments by investing receipts in a newly established natural resource endowment or permanent fund (Fund). Receipts from the existing direct revenue-sharing programs (USDA Forest Service 25% Fund, BLM O&C 50% Revenue Sharing, and Refuge Revenue Sharing) would be deposited in the Fund and the principal would be invested to earn income. Distributions from the Fund would become the permanent and dedicated source of funding for the Congressional appropriation programs (Secure Rural Schools Act (SRS) and the Refuge Revenue Sharing Act (RRS)).

This proposed legislation would resolve key challenges by stabilizing and increasing revenue over time, which would eliminate the need for cycles of conditional appropriations and provide flexibility to address economic and forest management needs in public land counties.

The endowment model also could begin to articulate an integrated public lands policy that better aligns land management, economic development, and county payments to benefit communities seeking to diversify and grow economies related to public lands.

Protecting the Fund

The Forest Health for Rural Stability Act would charter a new nonprofit corporation (Corporation) to manage the Fund. Moving the Fund out of the Treasury ensures the principal balance of the Fund is held in perpetuity. The Corporation would be established to be the fiduciary that acts solely on behalf of county and school district beneficiaries. The Corporation would be managed by a board of directors comprising county government and school district representatives and those with expertise in fund management and economic development.

Guaranteeing Permanent, Stable Distributions

The Fund’s Board would be responsible for defining an investment strategy that maintains the permanent value of the Fund (by inflation-proofing the Fund) and ensures stable and predictable distributions. The investment strategy would seek a return of 5% net of inflation and would distribute an average of 4.5% of the ending Fund balance over a three-year period.

Securing Payments to Counties and Schools

The proposal establishes a minimum payment equal to payments made in FY 2017 to counties and schools from the three direct revenue-sharing programs (Forest Service 25% Fund, O&C 50% Revenue Sharing, and USFWS Refuge Fees & Receipts). Forest Service counties would be guaranteed a minimum payment based on their FY 2017 payment, whether it was from direct revenue-sharing (Forest Service 25% Fund) or Congressional appropriations (SRS).

The proposal also sets a maximum payment equal to the highest payment each county received historically from SRS and RRS. Once distributions from the Fund are large enough to make the maximum payment, additional commercial receipts would be no longer invested and would be distributed directly to counties. The proposal creates the ability for individual counties to establish accounts in the Fund to continue to invest receipts after the maximum payment is reached. In effect, counties that have reached the maximum payment can continue to use the Fund as a mutual fund, investing annual receipts on their own behalf.

Capitalizing the Fund

The Fund would grow in value as additional commercial receipts are deposited in the Fund. If the 4.5% distribution from the Fund was less than the minimum payment defined for each county, Congress will appropriate the difference. The proposal allows for Congress to transfer other monies to the Fund. The bill’s primary sponsors (Oregon’s and Idaho’s senators) are seeking a one-time payment into the Fund when it is established that will be sufficient to make the minimum payment in the first year.

Counties would be able to opt-out of the Fund. The proposal allows for a five-year period for counties to choose to participate.

More SRS Funds to Counties

The proposal makes one substantial change to the SRS law: it repeals Title II of SRS and delivers 15% of funds directly to counties under Title III. Title III is expanded to include permitted uses under the repealed Title II.

The federal land management agencies (USDA Forest Service, BLM, and U.S. Fish and Wildlife Service) would be responsible for calculating payment distributions using the SRS and RRS formulas, including Title III amounts. These payment schedules would be delivered to the Corporation, which would distribute the payments to eligible states and local governments. (SRS payments would be sent to states that have discretion about the allocation of payments among counties and school districts.)

This commentary is based on a presentation by Mark Haggerty to the National Association of Counties (NACo) Public Lands Committee in February 2020 about funding and reforming “county payments” programs. NACo has endorsed the Forest Health for Rural Stability Act.

Headwaters Economics has worked with counties toward a long-term funding fix and payment reforms since 2010. Our recent work has focused on establishing an endowment to fund Secure Rural Schools (SRS) and Refuge Revenue Sharing payments and ideas to permanently fund and reform PILT.