- The Small County PILT Parity Act (S. 2108) was passed by the U.S. Senate Energy and Natural Resources committee in December 2019.

- PILT would have been $2,035,539 higher, benefiting 45 counties in 15 states had the Small County PILT Parity Act been in place in 2019. Three counties would have seen lower PILT payments.

- Only those counties affected by the population limits currently in the PILT formula would have benefited, not all counties with small populations.

UPDATE: This post was updated in December 2019 to reflect legislation passed by the U.S. Senate Energy and Natural Resources Committee. A previous version of this post reflected a 2018 proposal that was not advanced.

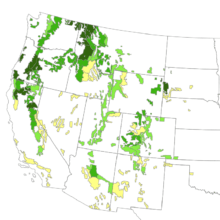

The map below shows counties that would have received higher PILT payments if the Small County PILT Parity Act (S. 2108) had been implemented in 2018 or 2019. These two years are important because SRS payments are included as prior-year payments in 2019 but not in 2018, resulting in a decrease in PILT payments for some counties in 2019.

PILT Proposal: Increase from Raising Population Limits for Small Population Counties

With the PILT Proposal Montana and Alaska Would Have Benefited Most

The Small County PILT Parity Act would increase PILT population limits for small-population counties.

Payments in Lieu of Taxes (PILT) are made by the Department of Interior to local governments that have federal lands within their jurisdictions. The payments compensate counties for the non-taxable status of these federal lands.

PILT is calculated using a formula that includes a payment ceiling for each local government based on population. The payment ceiling is calculated by multiplying a per-capita population threshold amount by the population of the local government (rounded to the nearest 1,000 population). Currently, the payment ceiling for all local governments with populations fewer than 5,000 is calculated using the same population threshold amount.

The Small County PILT Parity Act would create new population thresholds below 5,000 and increase the population threshold amount used to calculate the ceiling for these new population thresholds. As a result, the proposed reform would benefit small-population counties that are limited by the existing population limits in the PILT formula. Table 1 shows the new population thresholds, population threshold amount, and the higher calculated population limits (ceilings).

Background

PILT is a formula-based payment made to local governments, primarily counties, as compensation for the non-taxable status of federal public lands. PILT is calculated by applying a per-acre “entitlement amount” to the number of federal acres in each jurisdiction. This acreage-based entitlement amount is reduced using two criteria: prior-year payments from separate but related federal land compensation payment programs—including the Secure Rural Schools and Community Self-Determination Act (SRS), and federal mineral royalty revenue-sharing—and caps based on each jurisdiction’s population. The population caps are calculated by multiplying each jurisdiction’s population by a population threshold amount. PILT payments may not exceed these calculated population amounts which are higher for counties with larger populations.

PILT was initially adopted by Congress in 1976 to address concerns about the equity and predictability of compensation payments based on annual revenue-sharing arrangements, and due to concern about incentives associated with payments tied to the annual value of commercial activities on federal lands.

The first PILT payment made in 1977 accounted for only 17 percent of the total compensation payments made to counties with Forest Service and Bureau of Land Management Oregon and California Railroad Revested Lands (BLM O&C Lands) within their jurisdictions. The balance of the compensation to local governments came from revenue-sharing payments, including the Forest Service 25% Fund and the BLM O&C 50% payments. Subsequent declines in the value of commercial receipts, primarily from lower timber harvest levels and commodity prices, and cuts to appropriated “transition” payments including the Secure Rural Schools and Community Self-Determination Act (SRS), have resulted in a situation where PILT is now the largest single payment program. In FY 2018, PILT accounted for more than 84 percent of total compensation to Forest Service and BLM O&C counties.

One outcome of the shift in share of payments away from the Forest Service and BLM O&C programs to PILT is a change in the share of payments received by metropolitan vs. rural counties. The population limits in the PILT formula mean that metropolitan counties are more likely to receive higher PILT payments when prior-year payments from other programs decline. Rural counties are often limited by their population and do not receive larger PILT payments as prior-year payments decline.

The proposed reform would create new population thresholds below 5,000 and increase the population threshold amount used to calculate the ceiling for these new population thresholds. As a result, the proposed reform would benefit small-population counties that are limited by the existing population limits in the PILT formula. Table 1 shows the new population thresholds, population threshold amount, and the higher calculated population limits (ceilings).

Table 1: Population thresholds and amounts proposed in the Small County PILT Parity Act

| If the population equals– | the limitation is equal to the population times– | the calculated population limitation (ceiling) equals– |

| 1000 or fewer* | $254 | $254,000 or less* |

| 2000 | $231 | $461,320 |

| 3000 | $212 | $636,000 |

| 4000 | $198 | $793,720 |

| 5000 | $187 | $932,800 |

*The population ceiling for local governments with fewer than 1,000 is calculated using the actual population, not the population threshold rounded to the nearest 1,000.

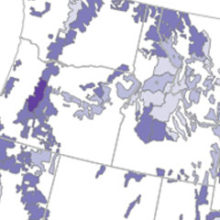

The proposed reform would benefit 45 local governments in 15 states.

Table 2. Explore PILT by County for FY 2107 and 2018

The table below shows that the proposal would have benefited 45 counties in 15 states with populations less than 5,000 had it been in place in 2019. PILT Payments would have increased by $2 million in 2019.

Not all counties with small populations would benefit, only those counties affected by the population limits currently in the PILT formula. In total, 368 local governments eligible for PILT have populations equal to 5,000 or less. Most of these counties are not limited by population because they have relatively few eligible acres. For example, Golden Valley County, Montana, has 31,715 acres of federal land but is not limited by PILT’s population ceiling. Increasing the population limit will have no effect on Golden Valley County’s PILT payment. By comparison, nearby Judith Basin and Petroleum Counties, Montana, each have more than 300,000 eligible acres and are currently limited by population. These counties would see increased payments if the population limits are extended.

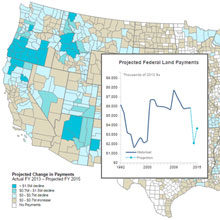

PILT payments would have increased by $2.4 million and $2.0 million in 2018 and 2019, respectively, had reforms been adopted for those years.

The table above shows the total cost of proposed reforms is affected by the value of prior-year payments made to eligible local governments in 2018 and 2019, respectively. For example, the 2019 PILT formula included prior-year payments made under the Secure Rural Schools and Community Self-Determination Act (SRS) for 2017. SRS was not paid in 2016, reducing prior-year payments to eligible counties in the 2018 PILT formula and resulting in a larger PILT authorization. (PILT increased from $464 million in 2017 to $552 million in 2018 and back to $515 million in 2019 largely because SRS was not paid for FY 2016. In other words, every dollar saved by not appropriating SRS results in a $0.38 increase in PILT authorizations.)

SRS was appropriated for 2017 and 2018, meaning these SRS appropriations will be included as prior-year payments in the PILT formula for 2019 and 2020. The cost of the proposed reforms to PILT’s population limits will be close to $2 million for PILT years 2019 and 2020. After 2020, the cost of the proposed reform will depend in part on whether SRS is appropriated after 2018.

Methods note

The population ceilings for 2018 are calculated using the population threshold amounts listed in the proposed regulation adjusted for inflation using the Consumer Price Index. These new population ceilings are used to recalculate the PILT formula for FY 2018. Data to populate and calculate the PILT formula are from Schedule 1 and Schedule 2 published by the U.S. Department of Interior. Payments In Lieu of Taxes National Summary. Washington, D.C.