Over the last decade, the Office of Natural Resources Revenue has disbursed an average of $2 billion per year to state and local governments from the leasing and production of minerals and energy on federal lands and waters. The extent to which state and local budgets are reliant on federal fossil fuel disbursements, as well as how states manage this revenue, was not previously known.

Why we wrote this: State and local government dependence on federal fossil fuel disbursements is an often overlooked fiscal barrier to the energy transition.

In this report, Headwaters Economics investigates how much states receive from federal fossil fuel disbursements, how they spend (or save) it, and the extent to which these revenue management strategies create risk and dependencies.

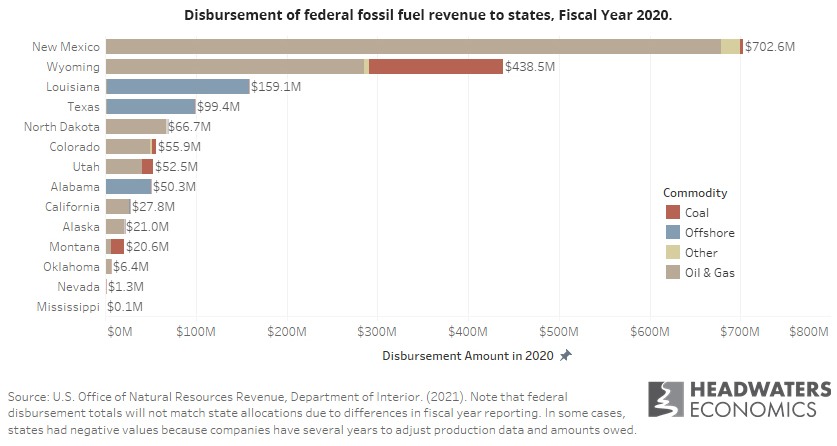

The study includes 14 states: the ten that receive the largest onshore federal fossil fuel disbursements (Alaska, California, Colorado, Montana, Nevada, New Mexico, North Dakota, Oklahoma, Utah, and Wyoming), as well as the four states that receive significant offshore disbursements (Alabama, Louisiana, Mississippi, and Texas). Key findings are highlighted below and the full report is available for download. A companion data download includes complete data tables and detailed descriptions of methods and sources.

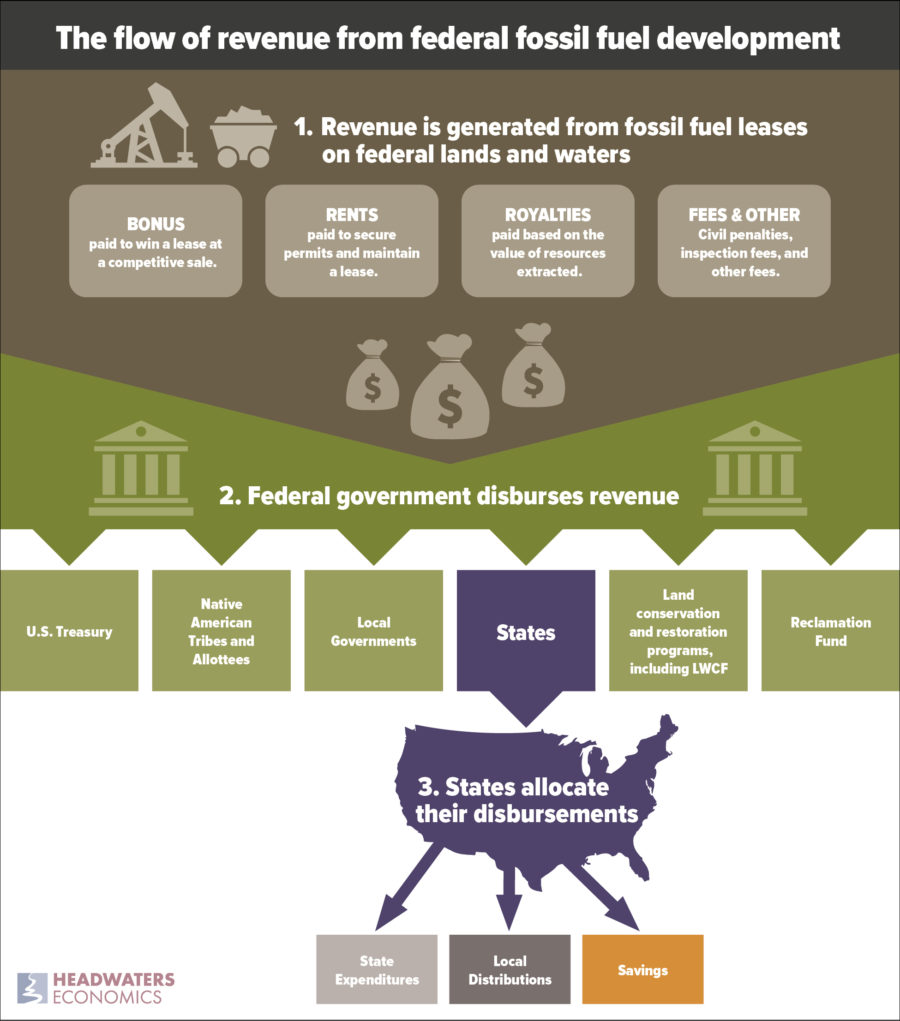

Following the money: From federal leases to state budgets

State and local government dependence on fossil fuel revenue creates uncertainty and instability due to volatile global markets, shifting industry practices, and policy changes. Governments that benefit from fossil fuel extraction often receive revenue from a variety of sources, including from leases and production on private, state, and federal lands. Federal fossil fuel production is a relatively small share of total U.S. production (11% of natural gas and 22% of crude oil in 2019). Yet, some state and local governments receive substantial disbursements from the federal leasing program, heightening their risk of dependence on this revenue source.

Federal fossil fuel disbursements are volatile and unevenly distributed.

Federal fossil fuel disbursements to state and local governments varied, on average, by 16% from one year to the next over the past decade. This volatility poses challenges to long-term planning and budgeting. Disbursements also varied widely between places. Two states, New Mexico and Wyoming, received 72% of all federal disbursements over the last decade. In FY 2020, New Mexico received $702.6 million from federal fossil fuel disbursements (3.28% of the state’s total expenditures), and Wyoming received $438.5 million (9.3% of total state expenditures). In all other states, federal fossil fuel disbursements for FY 2020 represented less than 1% of total state expenditures.

States that spend volatile revenue on operating expenses heighten their risk of dependence.

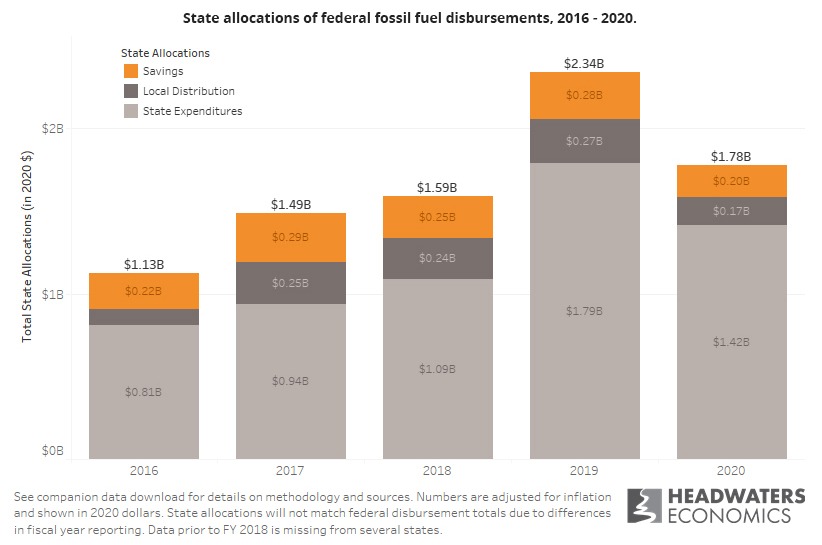

This report examines how states allocate their federal fossil fuel disbursements across three broad categories: (1) state expenditures, (2) local distributions, and (3) savings. In FY 2020, states allocated 80% of their federal fossil fuel disbursements to state expenditures ($1.4 billion). When states rely on volatile revenue for day-to-day expenses, they risk deepening their dependence on that revenue stream. This risk is exacerbated when the state also has a narrow tax structure and/or limited savings.

Dependence can also be local.

At the local level, governments that receive direct federal disbursements may become dependent on federal fossil fuel disbursements even when the state is not. About 9% ($166 million in FY 2020) of total federal disbursements are directly passed through to local governments. However, complex budgeting processes, data gaps, and the unique context of different geographies make it challenging to identify which local governments are most dependent on the federal leasing program. More research is needed to assess local dependence and to create a strategy to strategically coordinate state and federal assistance.

State and federal solutions are needed to reduce dependence.

State and federal reforms are needed to ensure that future minerals development, renewable energy, and other projects on federal lands and waters create long-term wealth for state and local governments as opposed to dependence. States can stabilize volatile revenue streams by diversifying their tax structure and investing money in short- and long-term savings, including budget stabilization funds and permanent funds. In FY 2020, states allocated only 11% ($195 million) of federal fossil fuel disbursements to savings. This likely overestimates the actual amount saved as some states regularly draw on their savings to pay for annual operating costs. At the federal level, reforms to the federal leasing program are needed to stabilize disbursements, such as through a national endowment fund.