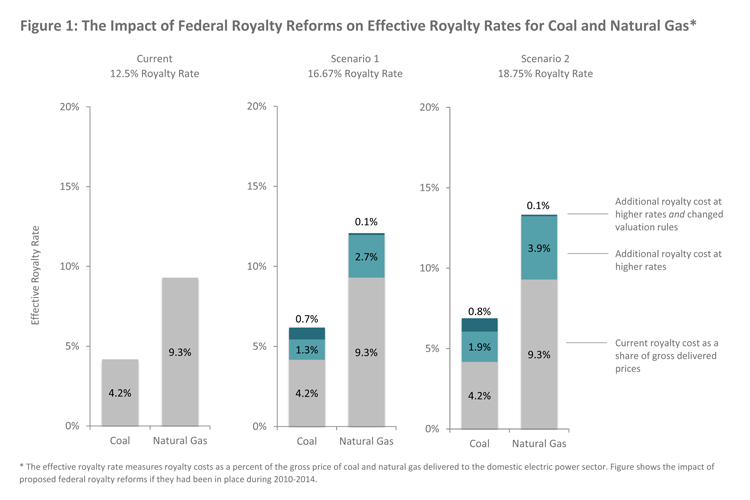

Had proposed royalty rate and royalty valuation reforms been in effect during 2010-2014, royalty costs would have been between 6.2 and 6.9 percent of the gross price of coal delivered to the electric power sector and between 12.1 and 13.4 percent of the gross price of natural gas delivered to the electric power sector.

Increased transparency of the federal royalty program is a stated goal of proposed federal reforms and an important goal of our work. This report makes the data and analysis on federal coal leases utilized in this report available to the public.

Outcomes of Higher Federal Coal and Natural Gas Royalty Rates

The Department of Interior (DOI) is proposing a number of reforms to federal leasing, bonding, and royalty regulations related to oil, natural gas, and coal. The DOI is proposing these reforms to simplify and lower compliance costs, modernize rules to address a rapidly changing energy industry and energy markets, and better align regulations with the DOI’s policy priorities—including securing a fair return to taxpayers and balancing energy extraction, economic development, and conservation goals.

Two of several proposed reforms—higher federal royalty rates and a rule that would change product valuation for royalty assessment—would increase the cost of delivering coal and natural gas to the domestic electric power sector. These two fuels compete for market share in the U.S. electric power sector based on the relative cost of delivering these fuels from mines and wells to power plants. Persistent low natural gas prices are driving a transition away from coal to relatively less costly natural gas. New regulations on mercury emissions from coal-fired power plants and the Clean Power Plan will raise the cost of coal-fired electricity generation and contribute to additional fuel switching from coal to natural gas. In this context, royalty reform is of particular concern to coal-dependent states and communities. If increase royalty costs raise the price of coal relative to natural gas, proposed reforms could further reduce already weak demand for coal in domestic electric power markets.

In this report, we estimate how higher federal royalty rates and royalty valuation reforms could increase the cost of delivering natural gas and coal extracted from federal leases to U.S. power plants.

The figure above shows that federal royalty costs are already a larger share of total delivered costs for natural gas (9.3%) compared to coal (4.2%). We find that proposed reforms would increase federal royalty costs for natural gas by a larger amount compared to coal. Had proposed royalty rate and royalty valuation reforms been in effect during 2010-2014, royalty costs would have been between 6.2 and 6.9 percent of the gross price of coal delivered to the electric power sector and between 12.1 and 13.4 percent of the gross price of natural gas delivered to the electric power sector.

This result suggests that federal royalty reform is not likely to cause additional fuel switching from coal to natural gas in the electric power sector and therefore reforms should not be viewed as a significant challenge to the coal industry specifically. A large body of research shows that fiscal policy has a limited effect on fossil fuel production, and it should also be recognized that a small cost advantage for federal coal relative to natural gas is unlikely to result in significant new demand for coal production.

Discussion

Coal increasingly is being replaced by natural gas in U.S. domestic electric power markets. In 2013, coal production fell below one billion tons annually for the first time in 20 years. By 2015, natural gas surpassed coal as the leading source for domestic electric power generation for the first time ever. Some analysts see this trend continuing. For example, UBS (a global financial services firm) recently projected a decline in U.S. coal consumption of 22 percent by 2020 and 49 percent by 2030. These projections are based on current market trends, primarily driven by persistent low natural gas prices. UBS predicts that demand for coal would decrease further if the Clean Power Plan carbon targets are fully implemented and if renewables accelerate faster than expected.

Our report finds that comprehensive federal royalty reforms are not likely to cause electric power plants to prefer additional switching from coal to natural gas should ease concerns that royalty reform will negatively affect coal-dependent states and communities. Previous research shows that small changes in the cost of delivering coal to the domestic power sector when compared to natural gas will have little to no effect on domestic energy markets. The opposite is also true—a small price advantage for coal relative to natural gas is unlikely to result in significant new demand for coal production.

Another concern is that higher federal rates could drive substitution between federal and non-federal coal leases in Wyoming and Montana (where the large majority of federal coal is produced), or between federal coal leases in these states and non-federal coal leases in other states. We do not expect this to occur for several reasons. First, natural gas already pays higher royalty rates on state-owned lands in Montana and Wyoming and in other states (with natural gas royalties ranging from16.67% to 25%).

Second, Wyoming and Montana have typically applied federal coal royalty rates to state coal leases. We expect this to continue because of the dominant ownership position of the federal government. State and privately owned coal is typically interspersed within larger BLM holdings, and it is difficult, particularly for large existing mines, to substitute non-federal resources to avoid higher royalty costs.

Third, little substitution is expected across states from federal to non-federal coal basins. The Powder River Basin (PRB), where the coal resource is predominantly federally owned, is expected to maintain a cost advantage over other U.S. coal basins due to inexpensive mining costs and transportation rates. Further, substitution between basins is expensive due to the different heat and pollution characteristics of coal in different regions of the U.S. and the costs associated with retooling boilers and pollution control equipment installed in existing coal-fired power plants to handle these different qualities.

The last mitigating factor is that royalty reforms would not take effect immediately. Given the long timeline it will take to phase in higher royalty rates and the slow pace of change in the capital-intensive electric power sector, few significant changes should be expected in the short-term beyond coal-fired power plant retirements already planned.

Increased transparency of the federal royalty program is a stated goal of proposed federal reforms and an important goal of our work. To that end, we provide the data on federal coal leases we utilize in this report and our analysis of it available to the public. We compile and organize data from a variety of federal sources, estimate data gaps, and do additional calculations that improve access to and understanding of current federal coal leases.