-

North Dakota Not Returning Adequate Oil Revenue to Local Governments

This report compares how North Dakota provides local governments with production tax revenue from unconventional oil extraction compared to other major energy-producing states.

-

Wyoming Oil Taxes: Highest Rate, Large Savings Compared to Other States

This report compares how Wyoming provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states.

-

Local Governmments in New Mexico Receive Lowest Share of Oil Revenue

This report compares how New Mexico provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states.

-

Colorado Lags Other States in Taxing Oil, Incentives Increase Volatility

This report compares how Colorado provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states.

-

Montana Oil Tax Policy: No Long-Term Savings, Exposure to Volatility

This report compares how Montana provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states.

-

Oklahoma on Oil: Big Tax Breaks and Low Returns to Local Governments

This report compares how Oklahoma provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states.

-

Texas Oil Policy: Low Taxes, No Permanent Savings to Offset Volatility

This report compares how Texas provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states.

-

Fiscal Lessons for State and Local Governments

This report explores the challenges for states and local communities caused by unconventional oil and natural gas development, and fiscal best practices that address them.

-

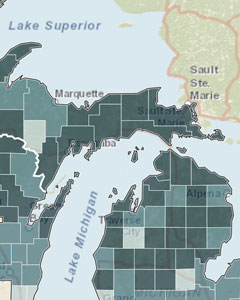

The Upper Peninsula’s Economy and a Changing Climate

This post summarizes the Climate Adaptation Report which provides a description of key economic sectors at greatest risk from extreme weather or long-term climate shifts and is intended to prepare the region’s forests, water resources, and communities for a less certain future.

-

Report: Colorado’s Oil and Natural Gas Industry

This graphical analysis reviews the status of Colorado’s oil and gas industry including production, drilling activity, tax policy, its role in Colorado’s economy.

-

Unconventional Oil and North Dakota Communities: State Fiscal Policy Unprepared for Impacts of Energy Development

This report analyzes the growing infrastructure and services needs of the Bakken boom and meeting the demands of unconventional energy development.

-

Report: The Status of Utah’s Oil and Gas Industry

This graphical analysis shows that Utah’s oil and gas industry was recovering at the time of the report.

-

Fossil Fuel Extraction and Western Economies

This study analyzes the fossil fuel economy in five Rocky Mountain states—CO, MT, NM, UT, and WY—and how states and communities can maximize benefits and minimize the costs of energy development.

-

Federal Land Payments to Counties: Background Analysis, History, and Context

Research on the history and context of county payments which play an important role in many rural communities–influencing public lands management, economic development, and funding for local schools, roads, and public safety.

-

Fiscal Impact of the Montana Legacy Project

These studies review the fiscal impact on Mineral and Lake counties of the Montana Legacy Project.

Mark Haggerty

If you are interested in these topics and want to learn more, contact us.