-

The Context and Status of Colstrip’s Coal-Fired Power Plant

A guide to planning for the long-term social, economic and environmental well-being of the community of Colstrip, Montana.

-

President’s Budget Proposal Cuts County Payments

New analysis and interactive map show how the President’s budget proposal cuts county payments and the impact for every county in the nation.

-

Communities at Risk from Closing Coal Plants

This post compares economic and demographic characteristics of communities where coal-fired power plants have recently retired or are scheduled to retire.

-

Time to Create a Natural Resources Trust

Unlike most countries and state governments, the U.S. has not created a natural resources trust which could help meet volatility and spending challenges facing local and county governments.

-

As Energy Market Forces Shift Coal Woes West, Transition Planning Should Follow

The new Administration’s plans to remove coal regulations should not dampen efforts to shift coal transition planning West to assist displaced workers and diversify coal-dependent communities.

-

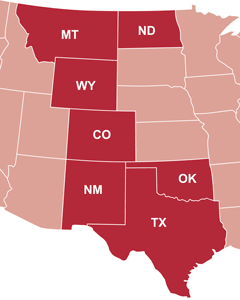

Federal Coal Program in Context

Explore the Socioeconomic Context of the Federal Coal Leasing Program

-

County Payments Research

County governments are compensated for the tax-exempt status of federal public lands within their boundaries. These payments often constitute a significant portion of county and school budgets, particularly in rural counties with extensive public land ownership.

-

Economic Conditions in Communities Dependent on Federal Coal

This blog draws on federal data and research to describe more about the local economies of the communities dependent on federal coal.

-

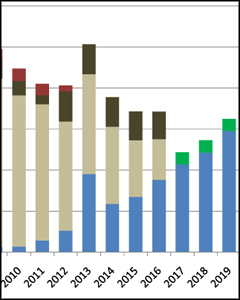

Changed Electric Power Markets Create New Volatility for Coal

Lower overall coal generating capacity—the outcome of coal fired power plant retirements and a demand for coal that rises and falls depending on natural gas prices—will create new volatility for coal jobs and for counties, schools, and states that depend on tax revenues from coal.

-

Wildlife Refuge Payments: Reforms and Funding

How national wildlife refuge payments–especially important to rural counties–could be reformed and funded.

-

Reforming Wildlife Refuge Payments

How county governments can benefit from reforming wildlife refuge payments.

-

Planning for Montana’s Energy Transition

While Montana is likely to experience relatively small impacts, coal-dependent communities in Eastern Montana are likely to feel the acute effects of job losses and declining tax revenue in the coming decades.

-

Outcomes of Higher Federal Coal and Natural Gas Royalty Rates

Analysis shows that proposed federal royalty reforms will increase the cost of delivering natural gas to domestic power plants by a greater amount than coal.

-

Coal Royalty Reform: Impact on Prices, Production, and State Revenue

The proposed federal coal royalty reform rule could have substantial revenue benefits for federal and state governments, limited impact on coal production or prices on federal lands, and increased transparency.

-

County Payment Reform Ideas, and Analysis of Recent Proposals

Reform ideas for future county payments from Headwaters Economics as well analysis of proposals made in the House, Senate, and by the President.

-

Will Federal Coal Valuation Reforms Hurt the Coal Industry? Yes And No

The Office of Natural Resources Revenue recently proposed a new rule that would change the way federal coal is valued for royalty purposes. Will it hurt the industry? Yes and No.

-

Unconventional Oil and Gas Revenues to Local Governments

This report includes seven major energy-producing states and a new interactive adds four more (AR, LA, and PA). The study and interactive compare how local governments receive production tax revenue from unconventional oil and natural gas.

-

Federal Coal Royalty Valuation: Current Structure, Effective Rates, and Reform Options

This report reviews problems with the current federal royalty system, estimates current effective royalty rates, and offers several reform options.

-

Time for a U.S. Natural Resources Trust?

Compared to other nations and even U.S. states, the federal government is a conspicuous laggard in creating a natural resources trust which would allow for stable, permanent, and ever rising payments to states and local governments without risks to taxpayers.

-

Falling Oil Prices: Good for the U.S. Economy, Bad for Shale Communities?

Lower oil prices could be great for the economy, but for the communities dependent on drilling, the price drop may prove challenging for several reasons.

Mark Haggerty

If you are interested in these topics and want to learn more, contact us.