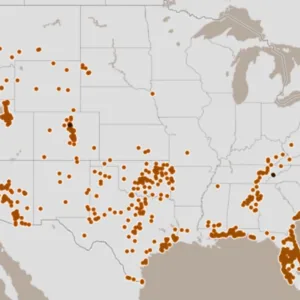

Thousands of Americans lose their homes to wildfires every year, triggering a cascade of economic consequences. Rebuilding to wildfire-resistant standards offers a chance to reduce the risk of future disasters. But communities often miss the opportunity when faced with daunting obstacles including underinsurance, strained finances, and logistical hurdles. These challenges can spark resistance to wildfire-related building standards, as wildfire survivors and local leaders worry that stronger building codes will add costs and delays to rebuilding efforts. And homeowners may assume that having burned once, their neighborhood is unlikely to burn again. But wildfire risk can return quickly, as soon as 10 to 30 years in some ecosystems of southern California, and wildfire risks are growing across much of the United States.

Communities that have suffered home losses due to wildfires—from Los Angeles County, CA, to Lahaina, HI, to Stillwater, OK—need viable options for efficiently rebuilding safer, more durable homes that will reduce future wildfire risks. Achieving that will require strong building standards, adequate insurance coverage, and financial assistance for some homeowners.

To inform rebuilding solutions following wildfire disasters, Headwaters Economics together with the nonprofit Insurance for Good answered three questions: (1) How much economic loss could be avoided by building homes to wildfire-resistant standards? (2) What level of financial investment is needed to build wildfire-resistant homes following disasters? And (3) What types of programs could help homeowners afford the necessary upgrades?

We found that rebuilding to wildfire-resistant standards is a highly cost-effective strategy that can significantly reduce future economic losses—by up to 43%—while adding relatively little to construction costs for homeowners, especially when supported by building codes and insurance coverage.

These findings are described in more detail below, demonstrating that fundamentally, homeowners, insurers, businesses, and local and state budgets are better off rebuilding communities to wildfire-resistant standards.

1. Avoidable losses show that wildfire-resistant homes are a smart investment

Wildfires, like other disasters, have broad economic consequences affecting everything from state budgets to employment. When homes burn, businesses close, jobs are lost, tourism slows, housing becomes more expensive, and tax revenue falls – reducing funds for schools, fire departments, and road maintenance. If long-term residents and businesses leave the community, economic recovery can stall. The consequences beg the question: If we build homes that can survive fires, how many of these losses are avoidable?

To answer this question, it is important to know what share of home losses can be avoided by building or retrofitting homes to wildfire-resistant standards, especially when property owners combine that construction with wildfire-resistant landscaping and upkeep. Researchers with the National Bureau of Economic Research found 43% fewer homes were destroyed when built to wildfire-resistant standards in a large sample of California wildfires. Other economic impact studies estimate that 60% of wildfire-resistant homes survive wildfires. These estimates offer valuable data on the power of building codes to reduce fire damage.

When we spare homes, we also avoid broader financial losses, both private and public, and spare governments some of the high costs of disaster recovery, which include everything from paying for clean up to providing temporary housing. What’s more, each home that survives has a positive impact on the survivability of neighboring homes since it won’t play a role in spreading fire farther. A 43% reduction in home losses would avoid billions of dollars in disaster recovery annually. What’s more, saving homes keeps communities intact, sparing people the hardship of rebuilding or relocation.

For example, the January 2025 Los Angeles fires that destroyed more than 11,500 homes provide a snapshot of the economic consequences of major wildfires that might be avoided by building or rebuilding to wildfire-resistant standards. According to the data released by UCLA in March 2025, the total property and capital losses of the Los Angeles fires will likely exceed $100 billion. The estimated declines in wages, gross domestic product, and municipal budgets could add billions beyond this. When we apply the research showing a 43% reduction of home losses with wildfire-resistant construction, it suggests that rebuilding the destroyed Los Angeles homes to wildfire-resistant standards could avoid $43 billion in economic losses the next time the area is threatened by a major wildfire.

Rebuilding in Los Angeles to wildfire-resistant standards could avoid $43 billion in economic losses the next time those neighborhoods are threatened by a major wildfire.

Beyond California, evidence of potential savings can be seen in the outcomes of other recent wildfire disasters.

The August 2023 wildfire in Lahaina, HI, was the deadliest U.S. wildfire in a century, killing 102 people and burning 5,527 residential units. Less than a year after the disaster, the state Legislature allocated $1 billion in recovery funds for emergency housing, rental assistance, and victims’ relief. Independently, Maui County was also forced to prioritize recovery efforts in its budget, despite expecting a decline in tax revenues directly related to the fire. In March 2025, county officials said that federal recovery dollars fell far short of Maui’s needs, which have exceeded $6.8 billion for housing, water system repairs, health care, and other rebuilding requirements.

After the Marshall Fire destroyed nearly 1,000 homes in Superior, CO, in 2021, federal, state, and local taxpayers had to cover millions of dollars for recovery costs. For example, the town of Superior was forced to raise local sales taxes to cover fire costs and replace revenue losses stemming from businesses closing and residents leaving after the fire. In the Marshall Fire’s wake, the degree to which homes have been built to wildfire-resistant standards has varied widely, contributing to potential future risk.

No building code can completely fireproof a community, but research shows that wildfire-resistant building codes can meaningfully reduce home and economic losses, particularly when coupled with vegetation management, neighborhood design, and firefighting defensive measures. Building to wildfire-resistant standards can also help preserve insurability in the face of rising risk, enabling people to get back on their feet more quickly. While the benefits of building homes to high wildfire-resistant standards are clear, the costs remain a valid concern for many communities and homeowners.

2. Costs to rebuild to wildfire-resistant standards pale in comparison to economic losses

The January 2025 wildfires in Los Angeles provide a tragically relevant test case for measuring the cost of building more wildfire-resistant homes. Knowing that building to wildfire-resistant standards can reduce home losses and save communities money in the long run, we calculated what it could cost to rebuild all 11,500 destroyed single-family homes to California’s current wildfire building code, Chapter 7A. By state law, only 60% of the destroyed homes fall within areas mapped by the state as requiring Chapter 7A building standards due to high wildfire hazard. For the other 40% of destroyed homes, rebuilding wildfire-resistant homes is beneficial for reducing future risks, but is not required.

According to Headwaters Economics’ research published in 2022 and 2024, rebuilding single-family homes to wildfire-resistant standards has been shown to cost, on average, less than 10% more than typical construction. We estimate that rebuilding the average 2,000 square-foot home to meet California’s Chapter 7A wildfire-resistant building requirements adds $30,000 to construction costs.

Rebuilding homes to wildfire-resistant standards has been shown to cost less than 10% more than typical construction.

In Los Angeles County the median home values in the destroyed neighborhoods exceeded $1 million, and so the additional building expense of $30,000 per home is roughly 3% of each home’s value and less for higher-value homes. Even so, $30,000 is not a cost that most homeowners who have just lost everything can afford to pay. If each of the 11,500 households whose homes were destroyed had to pay $30,000, the total rebuilding cost to reach wildfire-resistant standards would exceed $345 million.

Fortunately for many victims of the Los Angeles fires, it is a cost they will not have to fully absorb. Due to California’s building codes and insurance coverage regulations, the actual total cost to homeowners may be closer to $147 million rather than $345 million – saving homeowners roughly $198 million. In the next section we explain how these savings are realized and who will benefit.

California’s building codes and insurance coverage regulations will help many rebuild stronger homes

California’s building codes and laws regarding insurance coverage create unique financial advantages for many of the people who lost their homes in the Los Angeles fires. In California, state law (CA Ins Code § 10103) requires that homeowners’ insurance policies that cover full replacement costs include coverage for building code upgrades – sometimes called “Law and Ordinance Coverage.” This law helps cover the costs of bringing a home up to current building codes after a loss, even if that cost exceeds the standard dwelling coverage limits. Homeowners will get up to 10% of the value of their dwelling coverage to pay for these upgrades.

This has meaningful implications for homeowners who lost their homes in the Los Angeles fires. If they had full replacement insurance coverage and were in an area requiring Chapter 7A codes, insurance will fully pay for rebuilding their homes to meet the wildfire-resistant standards required for Chapter 7A. Among the 6,600 destroyed homes located in areas covered by Chapter 7A building codes, those with full replacement insurance coverage will pay $0 to rebuild to wildfire-resistant standards. If all 6,600 were fully insured, the total cost savings to homeowners would approach $200 million.

Residents outside of Chapter 7A areas, regardless of how comprehensively they are insured, either must pay for wildfire-resistant upgrades out-of-pocket or forego the opportunity to reduce their risk. This is the case for owners of the 4,900 homes—more than 40% of the homes that burned—that were not located in Chapter 7A areas. With no wildfire code in place to trigger the code upgrade coverage, insurers will not pay extra for “above code” upgrades. Unfortunately, these households not covered by Chapter 7A also have the lowest median incomes. In other words, the least affluent residents will not be able to benefit from California’s strong building code and mandated code upgrade coverage. These households will have to pay approximately $30,000 each (roughly $147 million in total) to rebuild their homes to wildfire-resistant standards.

Beyond California’s wildfire-resistant building codes

Rebuilding all of Los Angeles County’s destroyed homes to even higher standards, such as the Insurance Institute for Business & Home Safety (IBHS) Wildfire Prepared Home™ standard, is worth considering given the demonstrated potential for avoiding future economic losses.

Upgrading all 11,500 homes to the Wildfire Prepared Home™ standard would cost up to $5,000 more per home. This standard is similar to California’s current wildfire building code with some notable additions including: (1) the use of noncombustible material for gutters and downspouts, (2) deck protections that include enclosing the under-deck area with noncombustible mesh, and (3) the use of noncombustible fencing and landscaping materials within five feet of a home.

The total $205 million in additional costs to meet high wildfire resistance construction standards for all homes impacted by the fires is less than 1% of Los Angeles County’s annual budget. And given the potential for a 43% reduction in home losses in a similar fire, it suggests that for every $1 spent on rebuilding wildfire-resistant communities, $210 could be saved in avoided future losses. (See Data Sources and Methods)

Every $1 spent on rebuilding wildfire-resistant communities could save $210 in avoided future losses.

While we focused on the difference in construction costs between non-wildfire-resistant versus wildfire-resistant homes, the total cost of rebuilding and the need for financial assistance will be higher than what we estimated since many of the homeowners impacted by the Los Angeles fires were likely underinsured.

3. Solutions & funding to build communities that are ready for the next wildfire

Our research suggests three important, cost-effective policy solutions that can help communities reduce the long-term harm of future wildfire disasters by upgrading and rebuilding to wildfire-resistant standards.

1) Adopt building codes. Building codes and defensible space requirements are highly effective tools for protecting homes and property owners’ finances. They are necessary to meaningfully reduce wildfire risk since piecemeal requirements by insurance providers and voluntary measures offer less protection. One homeowner can voluntarily mitigate risk, but their exposure remains high if their neighbors have not also mitigated for wildfire.

California is unique in its adoption of a statewide wildfire-resistant building code. While Colorado and Oregon have initiated the process, they have yet to fully enact codes. State and local governments alike face challenges due to political resistance. However, as more insurance policies are canceled and wildfire losses mount, the political will to act is growing.

States and communities can adopt wildfire standards like Chapter 7A, the IBHS Wildfire Prepared Home™, or the International Wildland-Urban Interface Code to require home hardening and defensible space, including critical “Zone 0” requirements that improve ember-resistance within the first five feet of the home. Research has shown the cost of building new homes to these standards is relatively low, especially in the context of rebuilding when also paired with insurance coverage for code upgrades.

2) Require insurance coverage for code upgrades. Most states do not require insurers to provide additional coverage for rebuilding homes to meet updated building codes. Colorado has a similar policy to California’s, and in Florida code upgrade coverage must be offered to policyholders, but at an extra cost. In many states, code upgrade coverage is not even required to be offered.

Expanding these policies nationwide could significantly ease rebuilding costs for homeowners and reduce future insurance claims. States can require that standard homeowners policies include a minimum of 10% of dwelling coverage for code upgrades. Insurers could also offer policy endorsements to cover safer, “above-code” rebuilding, as is done in the Gulf Coast for IBHS FORTIFIED roofs. Several state wind pools offer this no-cost endorsement to policyholders, which pays a small additional amount for installation of a FORTIFIED roof at the time of a qualifying loss. California’s FAIR plan could consider a similar endorsement for wildfire mitigation to reduce future risks.

California’s combination of a strong wildfire building code and mandated insurance coverage for code upgrades offers a rare model for cost-effective disaster recovery for those who live in areas where Chapter 7A applies. Most states across the country lack such policies, creating a situation in which homeowners will struggle to afford to rebuild more wildfire-resistant homes following disasters.

3) Provide funding assistance for rebuilding and upgrades. While strong wildfire building codes and insurance policy protections can substantially decrease homeowner costs for rebuilding to wildfire-resistant standards following disasters, these laws will not change overnight. Investments from private foundations, businesses, and governments can help bridge the gap, which will be especially important in rebuilding efforts where building codes and insurance code coverage are lacking. Examples of funding programs that could be adapted to support wildfire-resistant construction include the following:

- Federal programs have supported risk-reduction measures in communities around the country for decades, such as grants through the Federal Emergency Management Agency, the Department of Housing and Urban Development, and USDA Forest Service. Some grants go directly to states or local governments, which can then be used for property-level or community-scale risk reduction or rebuilding. While the future of these federal programs is uncertain, continued and augmented federal support for disaster risk reduction is fiscally responsible, given the mounting evidence of recovery cost savings that benefit taxpayers. In addition, the Small Business Administration makes loans to both businesses and households for rebuilding after disasters. These loans can be increased up to 20% through the Mitigation Assistance program to cover the cost of disaster mitigation.

- State programs in hurricane-prone areas have shown how targeted state-level grants and tax incentives can promote community risk reduction. Some states have created their own risk-reduction grant programs. Alabama’s program provides grants to help residents build IBHS FORTIFIED roofs, paid for by licensing fees on insurers operating in the state, while a new hurricane mitigation grant program in Louisiana draws from general revenues. New Mexico is adapting these models for wildfire risk, and other states including Colorado and Washington are considering this approach. Beyond grants, some states are encouraging household risk-reduction investments through tax credits, such as the South Carolina tax credit for homeowners who adopt measures to lower the risk of hurricane damages, although tax credits benefit primarily higher-income taxpayers.

- Local government efforts range from establishing climate resilience districts that enable communities to tax themselves for risk-reduction investments (akin to levee districts), issuing bonds to be repaid with user fees on things like stormwater, electricity, or new development, and providing certification programs. For example, Colorado’s Boulder County Wildfire Partners Program provides residents with wildfire education, offers $500 rebates for specific risk-reduction actions, and helps homeowners earn certification that may help them qualify for retained insurance or discounted rates. However, locally-funded options are limited, especially in rural communities with a smaller tax base.

At all levels of government, a strong economic case can be made for public investment in disaster risk reduction as taxpayers are stuck paying avoidable disaster recovery costs. Ultimately, rebuilding communities to wildfire-resistant standards and retrofitting existing homes will create widespread economic benefits for homeowners, insurers, businesses, and public budgets, as it minimizes future losses.

4. Data Sources and Methods

We used two prior studies to estimate the differences in cost between traditionally built single-family homes versus wildfire-resistant homes that meet Chapter 7A and Insurance Institute for Business & Home Safety (IBHS) Wildfire Prepared Home™ standards:

- Construction Costs for a Wildfire-Resistant Home, California Edition (July 2022)

- Retrofitting a Home for Wildfire Resistance, Costs and Considerations (June 2024)

Our analysis does not include data for other types of structures that are destroyed by wildfires, such as detached garages, multi-family housing, and businesses.

According to our estimates, building the average 2,000 square-foot home (i.e., two-story home with a 1,000-square-foot footprint) to meet California’s Chapter 7A building requirements can add $30,000 to building costs (beyond the costs to build a non-wildfire-resistant home). The additional costs are, in large part, attributable to requirements for exterior walls, under-eaves, and decking, but also include several lower-cost items such as ember-resistant vents. The cost of building to wildfire-resistant standards will generally increase with the size and complexity of the home. However, the cost can vary according to characteristics, such as roof shape, deck size, and the type or presence of a garage or accessory buildings, that are independent of interior square footage.

Beyond Chapter 7A, IBHS Wildfire Prepared Home™ also requires: (1) the use of noncombustible material for gutters and downspouts, (2) deck protections that include enclosing the under-deck area with noncombustible mesh, and (3) the use of noncombustible fencing and landscaping materials within five feet of a home. These additional requirements can add approximately $5,000 per home for new construction. In total, meeting the IBHS Wildfire Protected Home™ standards could require an upfront investment of $35,000 per home.

According to the CAL FIRE Damage Inspection database, as of May 2025, 11,519 single-family homes had been categorized as destroyed or suffered major damage from the Eaton and Palisades fires. Nearly 60% of the destroyed homes (6,637 homes) were in neighborhoods where Chapter 7A applies. The remaining roughly 40% of homes (4,882 homes) were in neighborhoods where Chapter 7A does not apply.

Among the approximately 6,600 destroyed homes located in areas covered by Chapter 7A building codes, those with full replacement insurance coverage will pay $0 to rebuild to wildfire-resistant standards. If all 6,600 were fully insured, the total cost savings to homeowners would approach $200 million. Residents with destroyed homes outside of Chapter 7A areas, approximately 4,900 homes, will have to pay approximately $30,000 each ($147 million in total) to rebuild their homes to wildfire-resistant standards.

We estimate that upgrading all 11,500 homes to the Wildfire Prepared Home™ standard would cost approximately $5,000 more per home, or roughly $58 million. Our total estimate for meeting high levels of wildfire-resistance in the Los Angeles County rebuilding effort is $205 million, which includes $147 million to address building in areas outside of Chapter 7A areas and $58 million to meet the additional Wildfire Prepared Home™ standards for all 11,500 impacted homes. Beyond this gap, underinsurance will severely constrain the ability of homeowners to rebuild.

Acknowledgments

Dr. Carolyn Kousky, the founder of Insurance for Good, contributed knowledge and expertise to this analysis. She is the author of Understanding Disaster Insurance: New Tools for a More Resilient Future.