Definitions and Data Sources

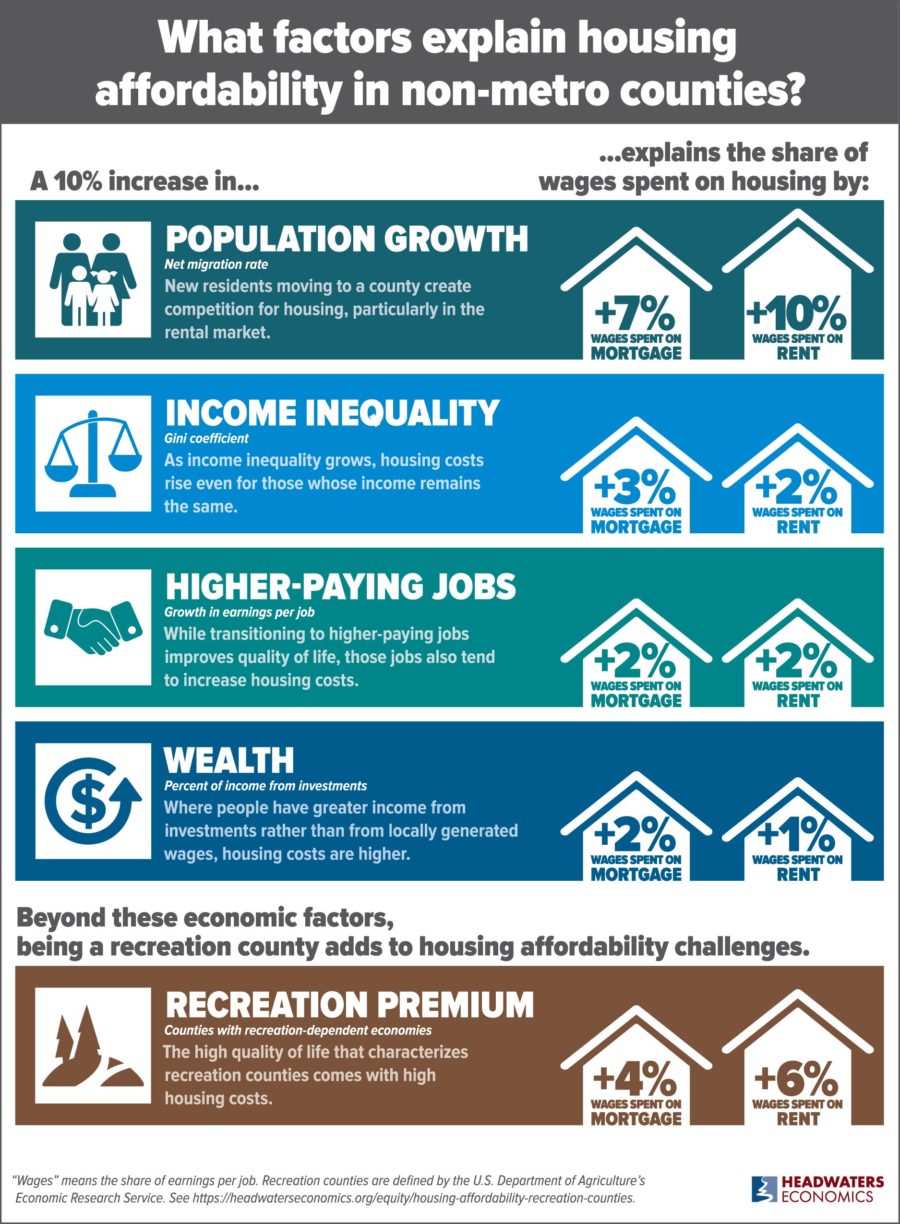

We define “housing affordability” as the share of earnings per job used to pay for monthly mortgages or rent. This measure captures the relationship between working residents’ income and housing.

“Wages” refers to monthly earnings per job, as provided by the Bureau of Economic Analysis (Regional Economic Accounts 2019).

Monthly mortgage and rent costs are from the U.S. Census Bureau, American Community Survey, 2019.