Today’s headlines are rife with contradictory rhetoric about the health of the oil and gas industry. Getting past hyperbole is critical to informed public policy decisions about how to manage state and federal lands, what tax policies best reflect long-term interest of communities, how to protect air and water resources, and how to encourage a healthy energy industry.

This report uses graphical analysis to offer a snapshot of Utah’s oil and natural gas industry in early 2012. The figures address production volume and value, drilling activity, and the role of energy production in Utah’s economy. The purpose of this report is to educate decision makers and the public about the current health of Utah’s oil and gas industry and what factors are affecting the state of the industry.

We found that oil and gas drilling activity has made a strong recovery in Utah since reaching a recession-induced low in 2009, a trend that we are seeing region-wide. That comeback is being led by the strength of oil prices and increased oil drilling activity within the state. However, Utah’s relatively low share of proven national oil reserves means that industry attention is primarily focused in states with higher proven oil reserves.

Production Volume | Production Value Trends | Drilling Activity | Resource Availability | Oil & Gas Revenue | Tax Rate | Mining Employment | Conclusions

Summary Findings

- Price is the most important driver of industry investment decisions. The strength of oil prices and low prices for natural gas explain why oil drilling has helped lead a recovery of drilling activity in Utah.

- Since the recession, both oil and natural gas production are up in Utah; natural gas production is at pre-recession highs and oil production is at its highest point in twenty years. The only other states with increasing production in both oil and natural gas are North Dakota and Colorado.

- Drilling activity following the 2008 recession is occurring in Utah at the same rate as other Rocky Mountain States. In Utah, rig activity at the end of January 2012 had reached 72 percent of its twenty-year high (also in 2008).

- In 2011, rig activity in the Rocky Mountain states, and western North Dakota, exceeded the heights reached during the natural gas boom of the 2000s. Utah’s share of regional and national onshore drilling activity has changed little over the past decade. At the end of January, 2012, for example, Utah’s share of rig activity for the five state area also including Colorado, Montana, New Mexico, and Wyoming was 14.1 percent, up slightly from 11.9 percent from 2005-2008.

- Compared to other western energy producers–Colorado, Montana, New Mexico, North Dakota, and Wyoming–Utah had the lowest effective tax rate on oil and natural gas activity in FY 2011. As a result, the state receives the least value in tax revenue from oil and natural gas production.

- All mining jobs, including oil and gas related employment, constitute just under one percent of total employment statewide.

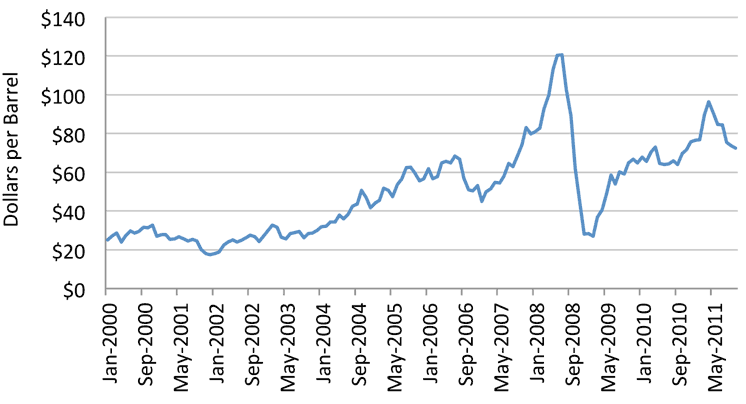

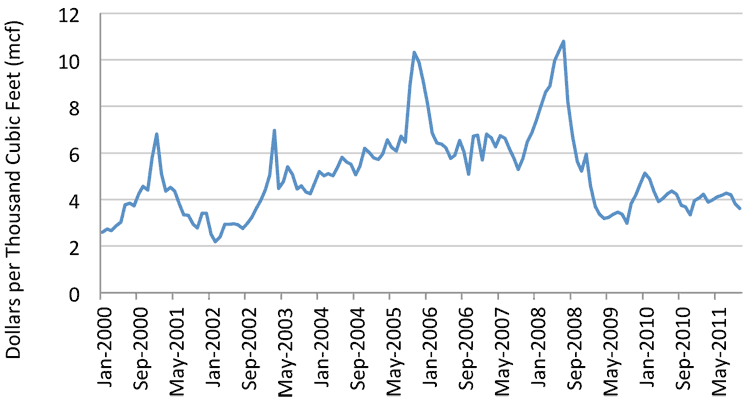

Price, the Paramount Factor in Industry Investment, Favors Oil

Price is the most important driver of industry investment decisions. Price volatility over the last decade led to booms and busts in drilling activity, while the spread between oil and natural gas prices1 has evolved to favor the development of oil over natural gas. The result is relatively slow activity in natural gas exploration and production contrasted with frenzied unconventional oil development in North Dakota and elsewhere. This section reviews oil and natural gas prices, production levels across the interior West, and production values of oil and natural gas.

Utah Crude Oil First Purchase Price

U.S. Natural Gas Wellhead Price

Production Volume in Utah Increasing

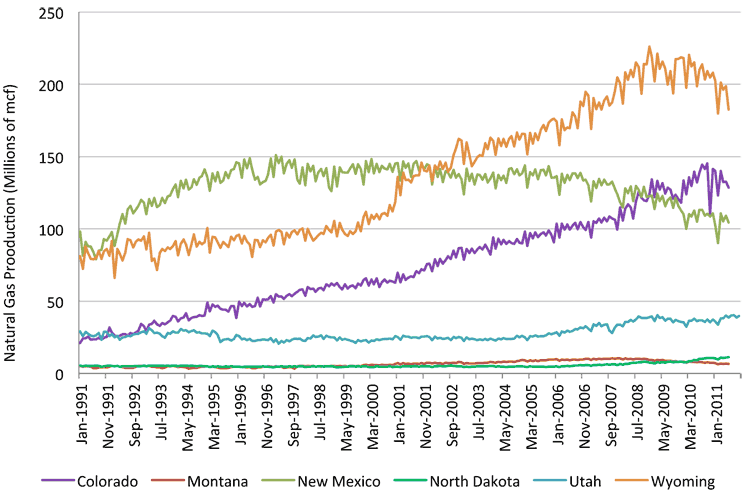

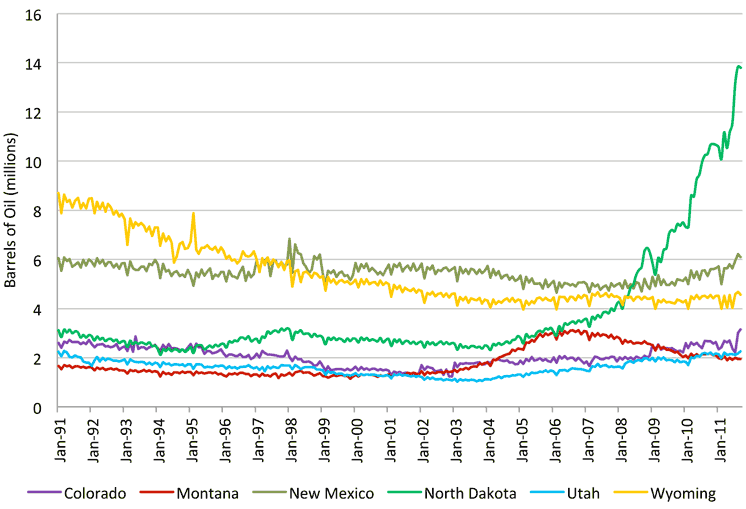

Monthly production data through October, 2011 are shown in the following two charts. Since the recession, both oil and natural gas production are up in Utah. The only other states with increasing production in both oil and natural gas are North Dakota and Colorado. Utah ranks fourth in natural gas production, and fifth in oil production among energy producing states in the Interior West.1

Natural Gas production is at pre-recession highs with monthly production over 40,000 mcf in July and August of 2011. Only one other month exceeded 40,000 mcf in March of 2009.

Natural Gas Wellhead Production

Oil production has increased steadily from 2000 with new drilling technology and high prices. Production has yet to recover to highs from the mid 1980’s, but current production levels represent 20 year highs.

Crude Oil Production

Production Value Trends in Utah on Track with Peers

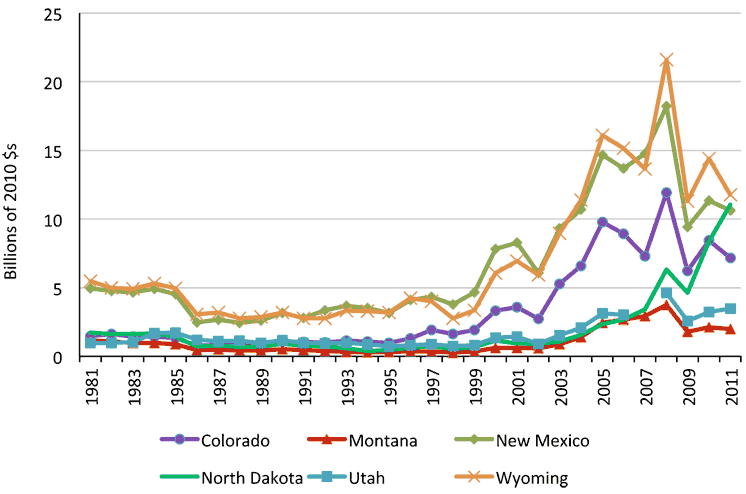

Production value is a good measure of the size and value of the oil and gas industry between states. Production value is the gross value of all oil and natural gas extracted from Utah in a given year.

Production value declined in all six states after oil and natural gas prices plummeted in 2008 due to the effects of the global and national recession.3 Utah’s oil and natural gas industry appears to be emerging from the recession as well as any of its peers with the notable exception of North Dakota. North Dakota’s production value, based on its massive unconventional oil resources, has increased by more than 50 percent for the first 10 months of 2011 compared to 12 months of 2010. Utah has already exceeded 2010 production value by 15 percent through just the first 10 months of 2011. Every other state’s production value has not yet achieved 2010 values, with Wyoming the furthest behind based on that state’s current dependence on natural gas relative to oil.

Oil and Natural Gas Annual Production Value

*2011 production value through October. Utah data not available for 2007.

Drilling Activity Recovering in Rockies, Booming in North Dakota

Trends in drilling activity are important both as indicators of industry preferences for regions and resources, and because it serves as a good proxy for employment trends. Nationally, on average of more than three-quarters of oil and gas employment is associated with drilling and exploration.4

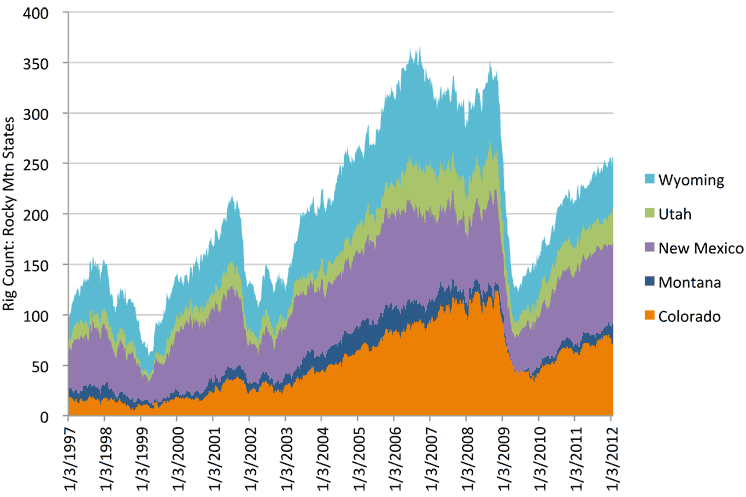

National drilling rig counts are an important measure of trends in domestic fossil fuel energy development activity. Because a majority of oil and gas industry jobs are associated with the drilling phase, drilling activity (as measured by rig counts) serves as a good proxy for employment trends. Drilling rig activity in the Rocky Mountain energy-producing states, not including North Dakota, has recovered to about 70 percent of its height during the natural gas rush, as measured in total weekly rig counts for the five states.5

Rig Counts in Rocky Mountain States (Weekly, 1/3/1997 – 1/27/2012)

Among the Rocky Mountain States, rigs today are distributed in roughly the same pattern among the states as during the natural gas rush in 2005-2008.

| Average Share of Rig Activity Jan 2005 – Nov 2008 |

Share of Rig Activity Jan 27 2012 |

|

|---|---|---|

| Colorado | 30.2% | 27.7% |

| Montana | 5.8% | 7.4% |

| New Mexico | 26.4% | 32.0% |

| Utah | 11.9% | 14.1% |

| Wyoming | 25.7% | 18.8% |

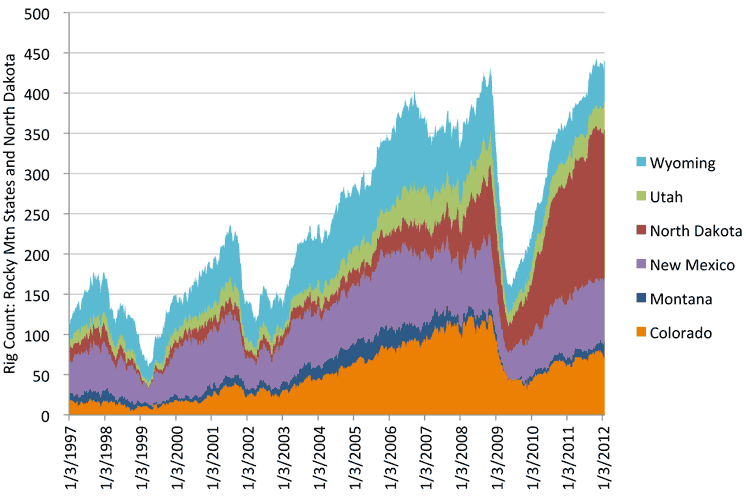

When North Dakota is added to the picture, it becomes evident where the real growth in post-recession drilling activity has occurred. With North Dakota included, the total drilling activity in the region surpassed the height of the natural gas rush the week of September 23, 2011, when the total number of active rigs reached 432.7 As of January 27, 2012, the weekly rig count was 438.

Rig Counts in Rocky Mountain States and North Dakota (Weekly, 1/3/1997 – 1/27/2012)

Drilling Recovery in Utah Led by Exploration for Unconventional Oil

As of January 27, 2012, there were 36 active rigs in Utah according to Baker Hughes. Of the rigs, 19 were drilling for oil, and 17 for natural gas. The rig activity is fairly concentrated: 17 rigs are active in Uintah county–5 oil, 12 natural gas; 11 active rigs are in Duchesne County, all drilling for oil; and the remaining 9 rigs are located in Carbon, Grand, San Juan, and Sevier counties.

Utah reached its highest level of weekly rig activity in August 2008 during the natural gas rush, with 50 rigs operating. During the natural gas rush, Utah’s Uintah County achieved the eighth highest level of average activity in a year (among the 6 states). Uintah County also experienced the second largest drop in activity in consecutive years (2008-2009). This was the fifth highest drop in activity overall (including non-consecutive years) among all counties in the 6 states.

Industry interest in Utah’s resources appears to be increasing. In 2011, 1,516 APDs were logged representing a 28 percent increase in volume from 2010. Neighboring Colorado actually witnessed a drop in volume from 2010 to 2011 of 23 percent, although the total number of APDs at play is about four times greater than in Utah.8

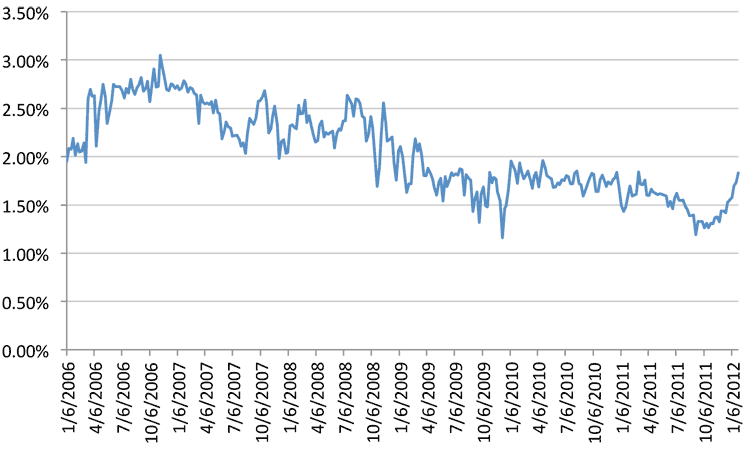

About 1.8 percent of all U.S. land rigs are currently operating in Utah. From 2006 through the present, Utah’s average share of all national land-based rig activity has averaged 2 percent. Utah had its highest share ever of U.S. land rig activity in late 2006, when the share topped 3 percent briefly for one week.9

Rigs in Utah as Share of All U.S. Land Rigs, 2006 – Jan 2012

Activity on Par with Resource Availability

The table below compares data from the U.S. Energy Information Administration on estimated proved reserves in the nation and state for three types of fossil fuels. Estimates for crude oil reserves and dry natural gas were last reported by the EIA for year-end 2009, and for natural gas liquids for year-end 2008.10 At this time, Utah’s share of reserves ranged from 1.3 percent of proven natural gas liquid reserves to 2.7 percent of dry natural gas. These shares are very similar to Utah’s claim of all drilling activity nation-wide, suggesting that drilling activity tends to follow the quality of the resources most in demand.

| Crude Oil (2009) | Dry Natural Gas (2009) | Natural Gas Liquids (2008) | ||||

|---|---|---|---|---|---|---|

| Volume, Million Barrels | Share of National Total | Volume, Billion Cubic Feet | Share of National total | Volume, Million Barrels | Share of National Total | |

| U.S. | 20,682 | 272,509 | 9,275 | |||

| Colorado | 279 | 1.4% | 23,058 | 8.5% | 716 | 7.7% |

| Montana | 343 | 1.6% | 976 | <.01% | 11 | <.01% |

| New Mexico | 700 | 3.3% | 15,598 | 5.7% | 804 | 8.7% |

| North Dakota | 1,046 | 5% | 1,079 | <.01% | 55 | <.01% |

| Utah | 398 | 2% | 7,257 | 2.7% | 116 | 1.3% |

| Wyoming | 583 | 2.6% | 35,283 | 13% | 1,121 | 12.1% |

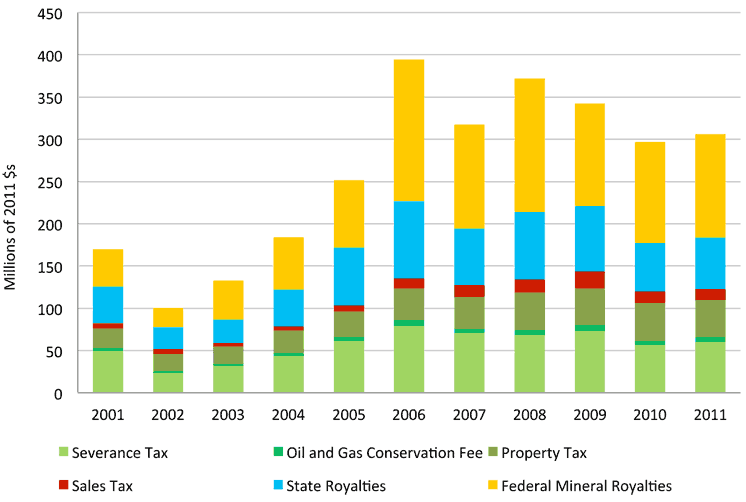

Oil and Gas Revenue in Utah Topped $300 million in 2011

Oil and natural gas production can provide significant tax revenue to state and local governments. These revenues are important resources for avoiding the harmful impacts of energy booms and maximizing the opportunities they present. Utah collected more than $300 million in tax and royalty revenue in FY 2011. In 2009, oil and natural gas revenue of $342 million made up 1.8 percent of total state and local government revenue of $19.2 billion.11

| Fiscal Year | Oil and Natural Gas Severance Tax | Oil and Gas Conservation Fee | Property Tax, Oil and Natural Gas Extraction | Sales Tax, Oil and Natural Gas Extraction | Oil and Natural Gas State Royalties | Federal Mineral Royalty Distribution, Oil and Natural Gas | Total Oil and Natural Gas Tax and Royalty Revenue |

|---|---|---|---|---|---|---|---|

| 2001 | 49,697,785 | 3,470,350 | 23,051,408 | 6,502,959 | 42,932,399 | 44,286,345 | 169,941,246 |

| 2002 | 23,441,594 | 2,121,954 | 20,930,577 | 5,449,796 | 25,924,793 | 22,456,237 | 100,324,952 |

| 2003 | 32,470,504 | 2,359,845 | 20,218,597 | 3,791,010 | 27,966,482 | 46,186,764 | 132,993,203 |

| 2004 | 43,554,695 | 3,203,354 | 27,209,165 | 4,758,386 | 43,721,254 | 61,708,898 | 184,155,752 |

| 2005 | 61,687,187 | 4,188,996 | 30,586,561 | 7,188,936 | 68,318,231 | 79,588,527 | 251,558,438 |

| 2006 | 79,456,074 | 6,177,983 | 38,344,479 | 11,104,847 | 91,835,193 | 167,863,601 | 394,782,178 |

| 2007 | 70,863,777 | 5,142,191 | 37,389,886 | 14,153,456 | 66,618,269 | 123,253,903 | 317,421,482 |

| 2008 | 68,415,951 | 5,648,825 | 44,805,226 | 15,322,210 | 79,966,086 | 157,810,019 | 371,968,317 |

| 2009 | 73,123,629 | 7,040,051 | 43,858,358 | 19,657,133 | 77,672,200 | 120,978,824 | 342,330,194 |

| 2010 | 57,330,577 | 4,275,276 | 44,862,932 | 13,478,761 | 57,400,382 | 119,284,364 | 296,632,293 |

| 2011 | 59,855,286 | 5,784,545 | 44,007,762 | 13,291,610 | 60,909,236 | 122,236,696 | 306,085,135 |

Oil and Natural Gas Tax and Royalty Revenue

Utah Has Lowest Effective Tax Rate of Six Western States

Calculating the effective tax rate is the best way to compare the amount of revenue Utah receives relative to other energy producing states. The effective tax rate measures actual taxes paid based on gross production value, taking into account different tax structures, tax rates, deductions, and incentives.

Utah has the lowest effective tax rate based on production, property, and sales tax collections from oil and natural gas activity in FY 2011. As a result, the state receives the least value in tax revenue from oil and natural gas production.

| State | Production Taxes | Property Taxes | Sales Taxes | Total Tax Revenue | Oil and Natural Gas Production Value | Effective Tax Rate |

|---|---|---|---|---|---|---|

| Colorado | $64,982,616 | $284,315,832 | $25,154,632 | $374,453,080 | $6,785,746,679 | 4.4% |

| Montana | $210,335,320 | $210,335,320 | $2,012,566,089 | 10.5% | ||

| North Dakota | $594,422,795 | $73,675,294 | $668,098,089 | $6,629,885,189 | 10.1% | |

| Utah | $65,639,831 | $44,007,762 | $13,291,610 | $122,939,203 | $3,851,030,599 | 3.3% |

| Wyoming | $174,006,343 | $155,935,575 | $27,722,728 | $357,664,646 | $3,618,357,300 | 11.4% |

Mining’s Share of Employment Less Than One Percent

The table below conveys employment data for the mining industry, including oil and gas extraction, as a share of all employment in Utah, as well as Colorado and New Mexico for comparison. In 2010, total mining activity represented less than one percent of employment in Utah.12 In an effort to capture proprietor employment we also reviewed data for the self-employed which is available for 2009. It shows that 0.2 percent (422) of all of all proprietors in the state were employed in mining in 2009.13

| Utah | Colorado | New Mexico | State Region | U.S. | |

|---|---|---|---|---|---|

| Private | 82.2% | 82.8% | 75.8% | 81.3% | 83.1% |

| Mining | 0.9% | 1.1% | 2.4% | 1.3% | 0.5% |

| Oil & Gas Extraction | 0.1% | 0.4% | 0.6% | 0.3% | 0.1% |

| Mining (Except Oil & Gas) | 0.4% | 0.2% | 0.5% | 0.3% | 0.2% |

| Support Activities for Mining | 0.4% | 0.5% | 1.3% | 0.6% | 0.2% |

| Non-Mining | 81.3% | 81.7% | 73.5% | 80.0% | 82.6% |

| Government | 17.8% | 17.2% | 24.2% | 18.7% | 16.9% |

This table uses employment data from the Bureau of Labor Statistics, which does not report data for proprietors or the value of benefits and uses slightly different industry categories than those shown on previous pages of this report.

Conclusions

Oil and gas drilling activity has made a strong recovery in Utah since reaching a recession-induced low in 2009. Nationally, drilling activity is at just more than one hundred percent of the twenty-year high last reached during the 2008 natural gas surge. In Utah, rig activity at the end of January 2012 had reached 72 percent of its twenty-year high (also in 2008).

The level of drilling activity is a good indicator of trends in oil and gas employment. The location and pace of drilling is sensitive to a variety of factors, primarily price but also technology and the discovery of new resource plays. Drilling activity can shift quickly between geographies and resource types.

That drilling activity has recovered so quickly in Utah and the region suggest strong capacity on the part of industry to respond to market opportunities. However, Utah’s relatively low share of proven national oil reserves means that industry attention is primarily focused in states with higher proven oil reserves.

The opportunity for Utah is important, but in context it is a relatively small driver of employment growth. The rapid change in drilling activity also makes the employment benefits uncertain over time. The tax revenue contributions are more significant from the state perspective, and are distributed over a longer period of time.

The employment benefits are also concentrated in a couple of counties where drilling is taking place, explaining why energy-producing areas can be so hard hit by boom-bust cycles of energy development.

Varying tax rates seem to have little effect on industry activity, but play a significant role in state’s and community’s ability to mitigate impacts.

Our review of drilling rig activities and movement shows that the oil and natural gas industries are healthy, responding quickly to emerging opportunities as prices rebound and resource plays are perfected. The state has little influence over price, but it can help communities prepare for and manage impacts through smart tax policy.

Endnotes

- 1. Energy Information Administration, Monthly U.S. Crude Oil First Purchase Price by Area, Dollars per Barrel. 2011 http://www.eia.gov/totalenergy/data/annual/showtext.cfm?t=ptb0518; Monthly Natural Gas Wellhead Prices by Area (Dollars per Thousand Cubic Feet). 2011. http://www.eia.gov/dnav/ng/ng_pri_sum_dcu_nus_a.htm. ↑

- 2. Energy Information Administration. Monthly Crude Oil Production by Area, 1981‐2011. http://www.eia.gov/totalenergy/data/annual/showtext.cfm?t=ptb0518; Natural Gas Gross Withdrawals by Area, 1981‐2011. http://www.eia.gov/totalenergy/data/annual/showtext.cfm?t=ptb0518 ↑

- 3. Utah State Tax Commission. Annual Reports. The Oil and Gas Severance Tax applies to all interest owners of oil, gas, and natural gas liquids. It is based on the value at the well of oil and gas produced, saved, sold, or transported from the field where it is produced. The tax rate ranges from 3 to 5 percent based on the sales price of the oil or gas. The Oil and Gas Conservation Fee is 0.2 percent of the value at the well of oil, gas, and natural gas liquids produced, saved and sold, or transported from the production site. It applies to all interest owners in the well. http://tax.utah.gov/research/reports.html. State of Utah Property Tax Division, Annual Statistical Reports. http://propertytax.utah.gov/. Utah State Tax Commission. Economic and Statistics, Sales Tax Quarterly Taxable Sales Reports, 2000‐2011. State Detail Reports, Oil +Gas Extraction (SIC 1311‐1389). http://tax.utah.gov/esu/sales‐quarterly. Utah Trust Lands Annual Reports. Total Revenue by Type. http://trustlands.utah.gov/. U.S. Office of Natural Resources Revenue Statistical Information, Federal Mineral Royalty Disbursement by Commodity Type, http://statistics.onrr.gov/. ↑

- 4. Reporting U.S. data for 2008. U.S. Department of Commerce. 2010. Census Bureau, County Business Patterns. ↑

- 5. Rig count information from Baker Hughes. ↑

- 6. Source: Baker Hughes. ↑

- 7. The highest weekly rig count (total for the six states pictured here) for the natural gas boom of the 2000s was 432 active rigs, reached in November 2008. Source: Baker Hughes. ↑

- 8. Colorado logged 4,659 APDs in 2011, 5,996 in 2010. The all‐time high was recorded in Colorado Oil and Gas Commission, January 20, 2012 Staff Report. http://cogcc.state.co.us/Staff_Reports/2012/2012_01SR.pdf. ↑

- 9. Source: Baker Hughes, North American Rotary Rig Counts. Jan. 27, 2012.

- 10. Estimations are under constant revision and new technologies can lead to revised (higher) estimates. Data from EIA proved reserves tables based on state‐reported data, linked from: http://205.254.135.7/state/state‐energy‐profiles‐notes‐sources‐data.cfm. These estimates may differ from supply data available from other EIA programs. ↑

- 11. Data in these tables are drawn from Utah state data as noted in Note 3 on page 4. See also Headwaters Economics, 2011. Fossil Fuel Extraction and Western Economies, https://headwaterseconomics.org/energy/oil-gas/maximizing-benefits/, for a complete discussion of state tax data sources. ↑

- 12. U.S. Department of Labor. 2011. Bureau of Labor Statistics, Quarterly Census of Employment and Wages, Washington, D.C. ↑

- 13. U.S. Department of Commerce. 2010. Census Bureau. Nonemployer Statistics. Washington, D.C. ↑