- A review of studies, anecdotal evidence, news articles, conversations with insurance industry experts, and analysis of trends indicates it is unlikely that insurance rates and policies alone will determine whether or not a landowner decides to build a new home on wildfire-prone land.

- The most likely way that insurance companies will play a role in reducing wildfire risk is by developing financial rewards, such as lower rates, that are tied to fire-safe practices such as the use of flame-retardant building materials, creation of defensible space, and reduction of flammable fuels near homes.

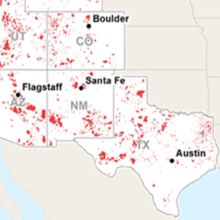

The dangers and costs associated with wildfires are rising and predicted to escalate rapidly in decades to come, primarily because of continued home development on fire-prone lands and the effects of climate change.

Those interested in reducing wildfire risks and costs have asked whether insurance can play a role in making new and existing homes safer.

This briefing paper explores two questions: a) whether insurance rates and policies steer new development away from fire-prone lands; and, b) whether insurance rates and policies reduce the risk from wildfires to existing development.

Insurance rates and policies currently do not appear to consistently drive decisions about whether or not to build homes in wildfire-prone areas.

Insurance costs are increasing and more companies are requiring adherence to fire-safe standards, yet home-building on fire-prone lands continues. According to one estimate, since 1990, 60 percent of new single-family homes in the United States have been built in the wildland-urban interface (WUI).

Insurance rates and policies, as well as education, are encouraging fire-safe building and landscaping practices. Increasingly, communities are using land use regulations to protect existing homes and to require fire-safe practices in new developments.

The cost of defending homes from wildfires is often a state and federal burden; therefore, there is little incentive to local governments and homeowners to build on safer lands. No clear policy alternatives have been developed that would lead to financial penalties for private land management decisions that increase risk or financial rewards for decisions that reduce risk.

To create a strong incentive for improved land use planning and to direct future development away from fire-prone lands, local governments must bear a higher proportion of the firefighting costs.

For interested local governments, Headwaters Economics is working with Wildfire Planning International to provide Community Planning Assistance for Wildfire (CPAW).

Communities can apply now for a CPAW assistance grant to help reduce wildfire risk within the wildland-urban interface through improved land use planning.