The two largest programs (Secure Rural Schools and PILT) are expiring. Reforming these programs represents an opportunity to recognize the broader values of public forests, which extends beyond raw materials to include recreation, as well as scenic vistas and clean water that attract capital and create employment, especially in rural areas.

The research detailed below reviews the the history and context of federal land payments to counties using a variety of tools and anlysis.

Timber Sales, Receipts, and Interactive Maps

These interactive maps show the commercial activities on National Forests such as the timber economy–gross receipts, timber harvest sales, and timber cuts.

- Gross Receipts from Commercial Activities at National Forest, State, and USFS Region Levels, FY 1986-2017

- Timber Sales and Timber Cuts, FY 1980-2018

Research Your County or Region

Headwaters Economics created the Economic Profile System (EPS) in cooperation with the Bureau of Land Management and the U.S. Forest Service. This free tool includes a “Payments from Federal Lands” report that provides a detailed history and analysis of payment data for PILT, the Forest Service, BLM, U.S. Fish and Wildlife Service, Federal Mineral Revenue Sharing from the Office of Natural Resources Revenue.

Users can run custom reports for any county, collection of counties, or states. The reports also include detailed descriptions of each program and links to data sources and methods.

Interactive: County Payments History, Context, and Policy

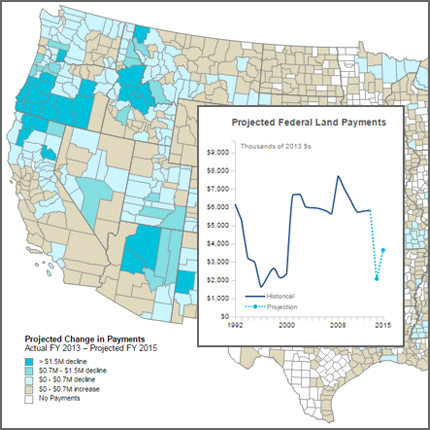

This intreractive provides several views of federal land payments for every county and state. It includes:

- A trend line of payments history going back to 1992, along with a breakdown of the payments received through specific programs;

- Analysis of the percent of county budgets from federal land payments;

- A projection of the change in county payments if the Secure Rural Schools Act (SRS) is not reauthorized;

- And, a map that shows the change in payments if if a single payment PILT reform is adopted.

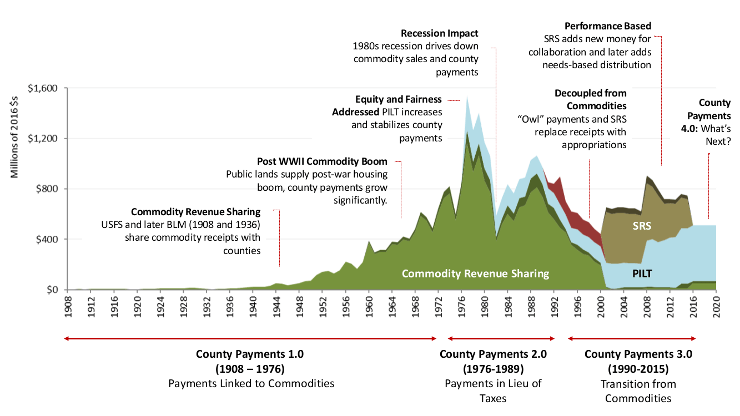

Background and Timeline

The two largest county payment programs–the Secure Rural Schools and Community Self-Determination Act (SRS) and Payments in Lieu of Taxes (PILT)–are expiring. County governments are compensated for the tax-exempt status of federal public lands within their boundaries, and these payments often constitute a significant portion of county and school budgets, particularly in rural counties with extensive public land ownership.

The way payments are funded and distributed also affects how public lands are managed, in turn influencing the kind of economic opportunities available to counties. Congress and the Administration are looking at potential reforms, and Headwaters Economics in 2010 prepared a white paper offering eight reform options as well as analysis of several major proposals in the House, Senate, and from the President.

During the past 100 years, Congress has repeatedly reformed federal land payments to counties, with each change reflecting new economic conditions and changing values of public lands—and a renewed commitment to counties. How this commitment is continued may be the most important policy decision affecting county budgets, economic opportunity, and forest health in public land counties across the country.

Payment programs have been flexible,

adapting to changing economic conditions and public values

Large version (PDF): Historical Timeline of Federal Land Payments

White Paper: Eight Reform Ideas

Our 2010 white paper reviews the the history and context of federal land payments to counties and then considers eight ideas for the reform of county payments, exploring the pros and cons of each, and then evaluates whether each idea will provide stable and predictable compensation to counties, create job opportunities in line with today’s economy, and improve forest health:

- Let SRS expire and return to commodity revenue sharing, where county payments are tied to timber harvest levels and other resource extraction on public lands.

- Reauthorize SRS with no substantive changes.

- Let SRS expire and return to a revenue sharing system based on an expanded definition of “gross receipts” that counts the value of increases in forest health, such as watershed restoration and wildlife habitat improvements.

- Retain SRS payments and change the distribution formula to give proportionately higher payments to counties based on:

- Economic need and development potential.

- Control of wildfire costs by curtaining home-building on fire-prone lands.

- Increases in the value of forest health by public lands.

- The proportion of federal lands in protected status.

- Replace SRS, commodity revenue sharing, and PILT with a tax equivalency program, paying counties the equivalent of what they would be paid in taxes if the land were privately owned.

Headwaters Economics presents the policy options for consideration and discussion in the spirit of determining how to best provide counties with stable and predictable compensation while reinforcing today’s economic and land-health goals. We do not advocate for one idea over another and it is possible that several ideas could be implemented concurrently.

Summary of All County Payments Research

This summary contains a brief description and links to all Headwaters Economics research on county payments.

Essays on County Payments and Oregon

This essay overviews county payment reform and versions ran in the Denver Post, Missoulian, New West, and other western media outlets.

For how county payment reforms could impact Oregon, click here to view an essay that ran in the Medford Mail Tribune, the Salem Statesman Journal, and The Oregonian.