More than a decade of data about the outdoor recreation economy is now available to inform community development and business decisions. The Bureau of Economic Analysis’ Outdoor Recreation Satellite Account (ORSA) tracks the contributions of the outdoor recreation economy to state-level GDP, job types, wages, and more. Headwaters Economics examined the ORSA data for all available years, 2012 to 2023, to discover long-term trends that might shape the future of this evolving sector. Three compelling conclusions stand out.

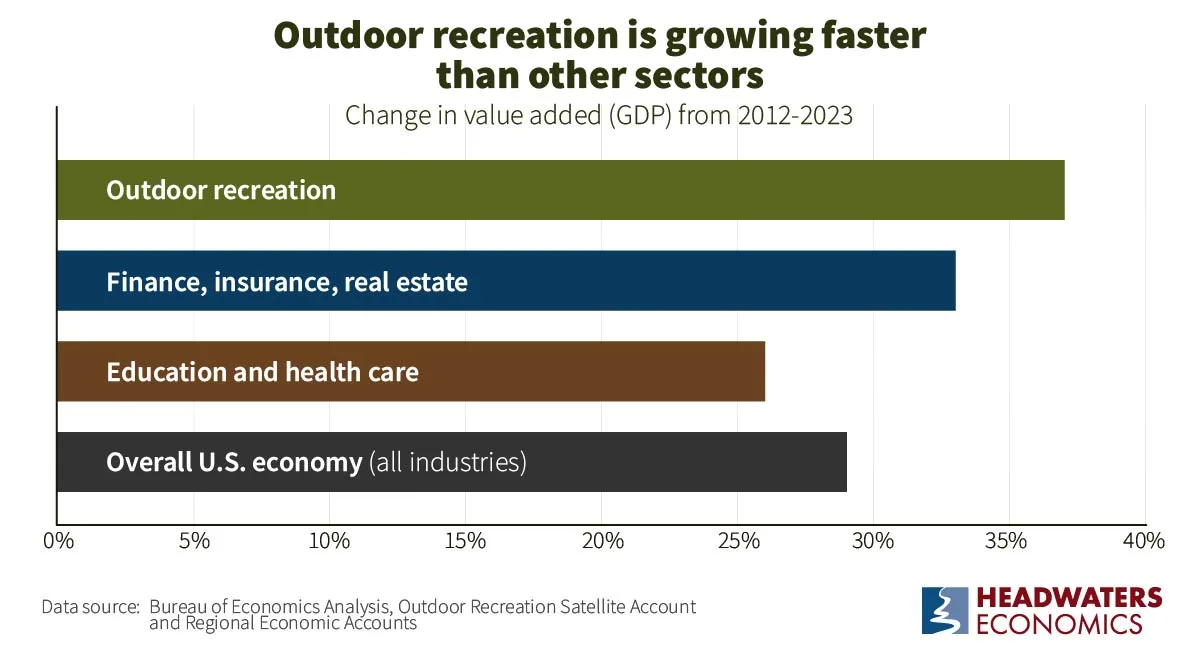

1. Outdoor recreation grew faster than the overall economy over the past decade

The outdoor recreation sector grew by 37% between 2012 and 2023, faster than the overall U.S. economy, which grew by 29%. Outdoor recreation outperformed other nationally important sectors like education and health care (26% growth) and finance, insurance, and real estate (33% growth). As outdoor recreation continues to grow faster than the overall economy, it will become a more significant economic driver with greater influence in local and national policy conversations.

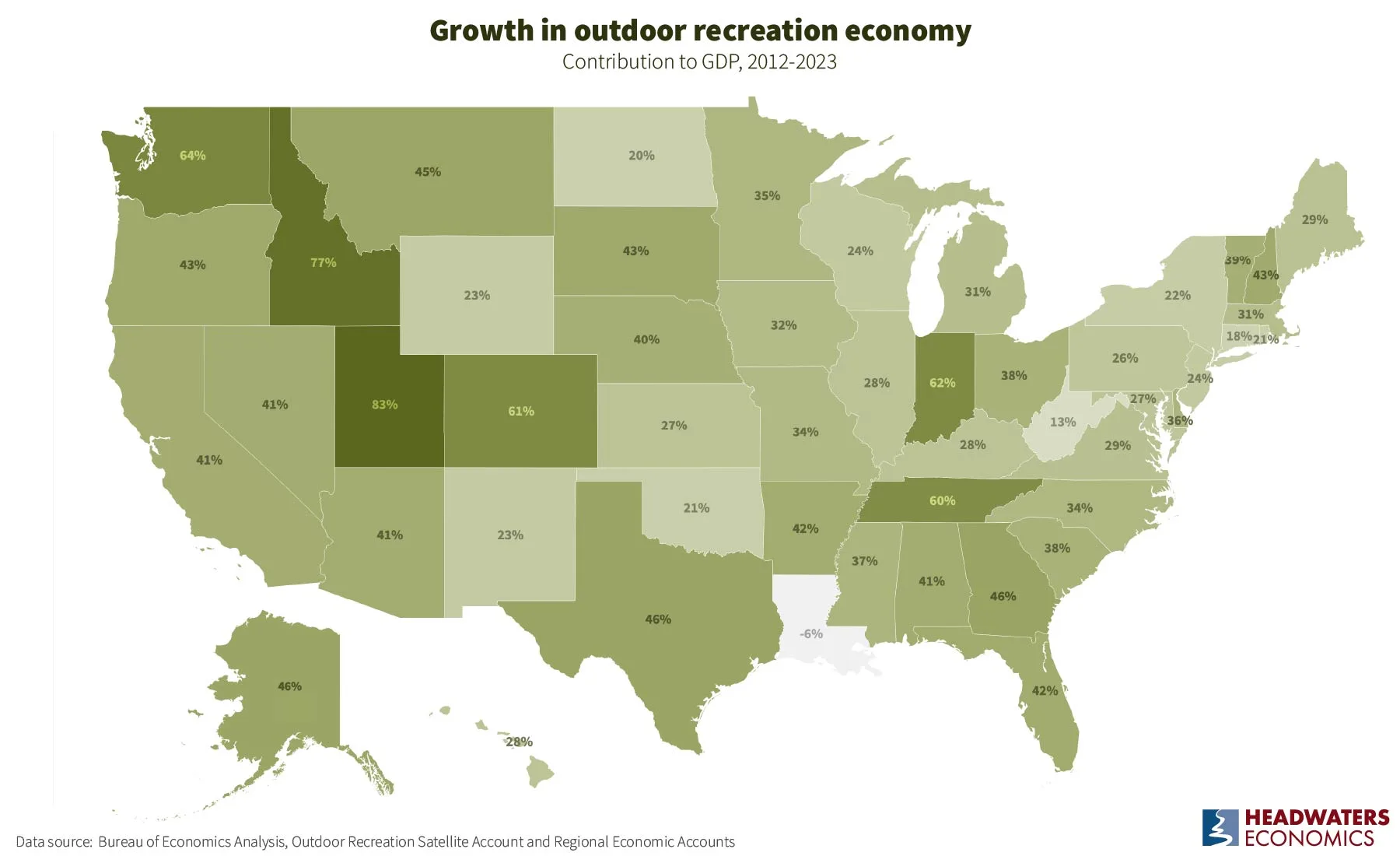

2. Forty-nine states saw growth in their outdoor recreation economy

The size of the outdoor recreation economy increased in 49 states between 2012 and 2023. Only Louisiana and the District of Columbia reported slight declines in their outdoor recreation economies.

The states with the most growth between 2012 and 2023 were:

Utah:

+83%

Idaho:

+77%

Washington:

+64%

Indiana:

+62%

Colorado:

+61%

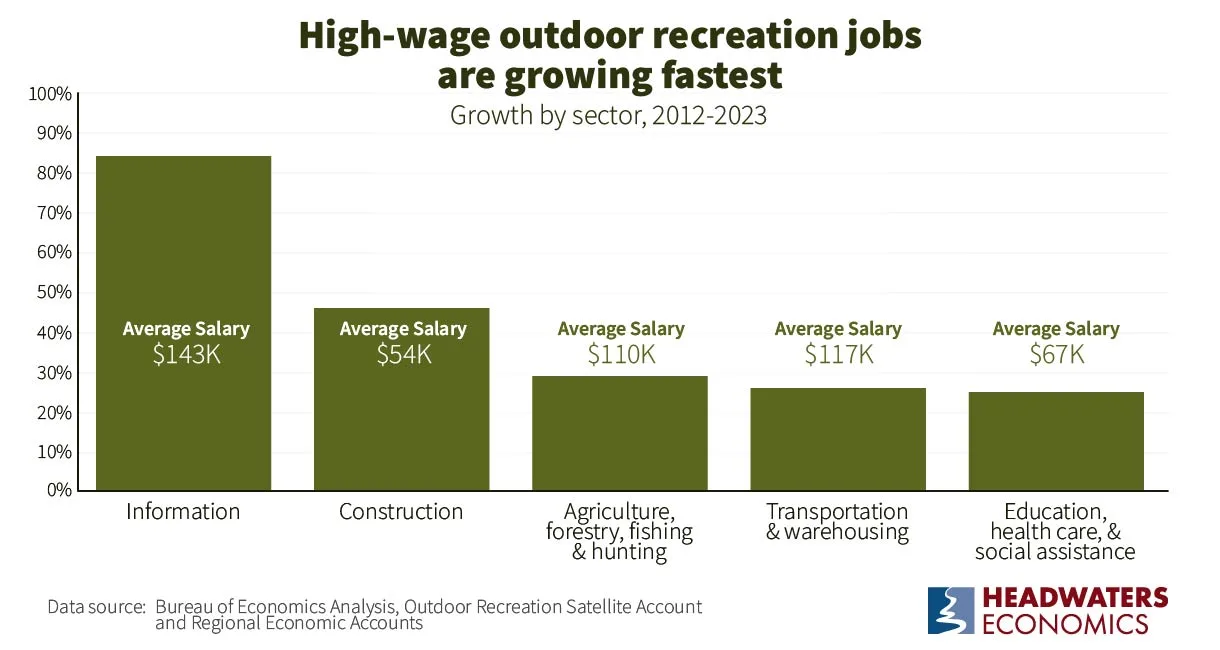

3. High-wage outdoor recreation jobs are growing fastest

The outdoor recreation sector includes jobs across diverse industries. According to ORSA data, the types of jobs with the fastest growth in outdoor recreation since 2012 are skilled trades and professional industries, including information; construction; agriculture, forestry, fishing, and hunting; transportation and warehousing; and education, health care, and social assistance.

While hospitality industries such as hotels, food services, and retail trade still account for the largest share of outdoor recreation jobs, other outdoor recreation industries have experienced faster job growth. In other words, jobs in the outdoor recreation economy now extend far beyond ski lift operators and gear retailers.

The types of jobs with the fastest growth within outdoor recreation tend to be year-round and have higher wages and benefits than hospitality jobs, which are more often seasonal and lower wage. For example, the average wage of someone working in the outdoor-related information sector is $143,000 per year compared to the $46,000 of someone working in the arts, entertainment, recreation, accommodation, and food services sector.

Promoting workforce development in these higher paying industries can further accelerate economic growth, since employees spend money locally for everyday needs, creating a ripple effect. This can help revitalize communities, attract new businesses and entrepreneurs, and retain residents—especially in rural places.

Outdoor recreation is poised to attract more investment

With more than half of Americans participating in outdoor recreation in 2023, the outdoor recreation sector is playing a significant role in diversifying local economies and developing a skilled workforce.

Deliberate plans to support outdoor recreation—such as investments in trails and parks, workforce development, and small business incubation—can help states build an outdoor recreation economy to balance the booms and busts of other economic sectors. For example, Farmington, New Mexico—a community historically dependent on oil, gas, and coal—is investing a 0.25% sales tax toward diversifying its economy, with an emphasis on outdoor recreation to recruit and retain a skilled workforce.

The rapid growth in outdoor recreation also underscores the need for community planning. An influx of visitors and new residents often puts pressure on housing and public finances. Communities that hope to leverage natural amenities into economic potential must proactively plan for these challenges by implementing policies that provide revenue for affordable housing and infrastructure upgrades. State and federal programs like those in the recently passed bipartisan EXPLORE Act seek to help communities plan for growth while meeting the growing demand for outdoor recreation.

As more communities seek to tap its potential, the outdoor recreation sectors’ economic importance will expand, as well as its role in policy choices made at local, state, and federal levels.

Subscribe to our newsletter!

Data Sources & Methods

These analyses are based on estimates produced by the U.S. Department of Commerce Bureau of Economic Analysis (BEA) of the contribution to the economy by outdoor recreation, called the Outdoor Recreation Satellite Account (ORSA). Dollar values are in terms of the contribution of outdoor recreation to national and state GDP, presented in inflation-adjusted (2023) dollars.

The ORSA data provide estimates of the outdoor recreation economy’s contribution to national and state Gross Domestic Product (GDP). BEA also provides estimates in terms of gross output, compensation, and employment estimates for the outdoor recreation economy. Read more about BEA’s ORSA methodology.