-

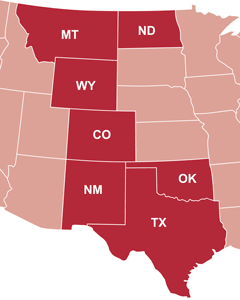

This report includes seven major energy-producing states and a new interactive adds four more (AR, LA, and PA). The study and interactive compare how local governments receive production tax revenue from unconventional oil and natural gas. Read more

-

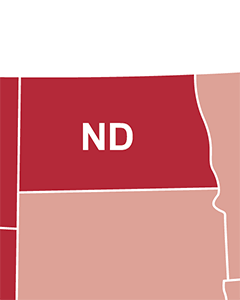

This report compares how North Dakota provides local governments with production tax revenue from unconventional oil extraction compared to other major energy-producing states. Read more

-

This report compares how Wyoming provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how New Mexico provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how Colorado provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

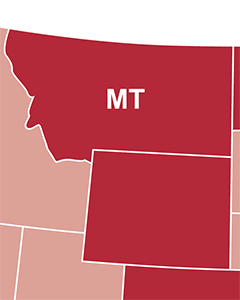

This report compares how Montana provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how Oklahoma provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more

-

This report compares how Texas provides local governments with production tax revenue from unconventional fossil fuel extraction compared to other major energy-producing states. Read more