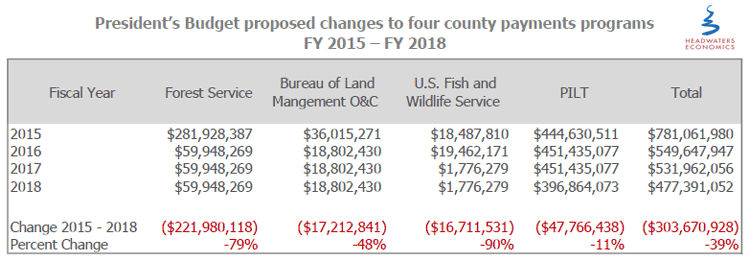

- The President’s budget proposal cuts county payments. If approved, total payments would decline by $304 million (39 percent) from FY 2015 to FY 2018. The cuts would hit rural western counties, boroughs, and schools most acutely with payments falling by as much as 97 percent.

- The President’s budget would limit Payments in Lieu of Taxes (PILT) to the most recent ten-year average and would not renew funding for the U.S. Fish and Wildlife Service Refuge Revenue Sharing payments (RRS) and the Secure Rural Schools and Community Self-Determination Act (SRS).

- Congress is seeking longer-term solutions that include full funding for PILT, a short-term reauthorization of SRS, and creating an endowment to stabilize payments to counties and, over time, eliminate the need for appropriations.

This map compares payments made in FY 2015 to estimated payments for FY 2018 for a scenario where funding for SRS and RRS is not renewed and PILT funding is limited to the most recent ten-year average.

Background

Since 1908, the federal government has made payments to state and local governments that compensate for the non-taxable status of public lands.

In 2015, these payments totaled approximately $781 million for four of the largest programs—the Secure Rural Schools and Community Self-Determination Act (SRS) payments for Forest Service and Bureau of Land Management O&C lands, U.S. Fish and Wildlife Service Refuge Revenue Sharing payments (RRS), and Payments in Lieu of Taxes (PILT).

President’s Budget Proposal Cuts County Payments

The President’s FY 2018 proposed budget proposes to limit PILT funding to the most recent ten-year average of payments ($397 million) and eliminate funding for SRS and RRS.

If this occurs, the Forest Service, BLM, and US FWS would make revenue sharing payments to local governments based on the value of commercial receipts generated on these lands. As a result, total payments would decline by 39 percent, from $781 million in FY 2015 to $477 million in FY 2018.

*Click to enlarge.

Cuts Would Hit Rural Counties Most Acutely

Many rural counties where a large proportion of land is in public ownership are dependent on county payments to fund local services, including roads, schools, and public safety.

In contrast, metropolitan counties that also receive county payments have larger more diversified tax base and are less exposed to budget and service cuts if county payments decline.

If PILT appropriations are capped and SRS and RRS are not funded, payments will decline by a larger amount for the most dependent rural boroughs, counties, and schools compared to their urban peers. The lower PILT appropriated amount would be shared proportionately among eligible governments. Without SRS and RRS, rural boroughs and counties limited by the PILT formula would receive a relatively smaller share of the total PILT authorization.

In addition, school districts are not eligible to receive PILT, so eliminating SRS would hurt rural schools disproportionately.

Longer-Term Solutions

The President’s FY 2018 budget proposal establishes the Administration’s priorities, and it is only the first step in a long process that also must win the support of Congress.

Congress also is considering action on county payments; such as a recent bill that would reauthorize SRS for two years, and sending a letter to Senate Appropriations Committee from 34 senators in support of full funding for PILT.

The Senate Committee on Energy and Natural Resources also held a hearing on May 2, 2017 to explore longer-term solutions to provide fiscal certainty for counties with non-taxable federal lands.

Headwaters Economics testified about a policy proposal to create an endowment that would stabilize payments to counties and, over time, eliminate the need for appropriations.

Map Data Sources and Additional Resources

- U.S. Department of Interior, Payments in Lieu of Taxes (PILT), 2016 Annual Report, Washington, D.C.

- U.S. Department of Agriculture, Forest Service, Additional payment information, ASR 18-1, Secure Rural Schools Act Titles I, II and III Report, Washington, D.C.

- U.S. Department of Agriculture, Forest Service, Additional payment information, ASR 10-3, Payment Detail (county), Washington, D.C.

- U.S. Department of Interior, Fish and Wildlife Service, Realty Division, Refuge Revenue Sharing Payments, Washington, D.C.

- U.S. Department of Interior, Bureau of Land Management, O&C Lands, Secure Rural Schools Official Payments.

Commercial Activities on National Forests

Headwaters Economics produced two interactive maps that help users better understand the commercial activities on National Forests such as the timber economy–gross receipts, timber harvest sales, and timber cuts–at a variety of scales.

- Gross Receipts from Commercial Activities at National Forest, State, and USFS Region Levels, FY 1986-2017

- Timber Sales and Timber Cuts, FY 1980-2018

Economic Profile System: Federal Land Payments

Download socioeconomic reports of communities, counties, & states, including aggregations and comparisons. The Economic Profile System (EPS) uses federal data sources, including the Bureaus of Economic Analysis, Census, & others. EPS is also known as the Human Dimensions Toolkit by the Forest Service.

Within EPS, the Federal Land Payments report shows local government detail on payments made to compensate for non-taxable federal lands, including Payments in Lieu of Taxes, federal mineral revenue sharing payments, and other payments from the Forest Service, Bureau of Land Management, and U.S. Fish and Wildlife Service.

Federal Land Payments to Counties: Background Analysis, History, and Context

Research on the history, context, and potential reforms to county payments which play an important role in many rural communities–influencing public lands management, economic development, and funding for local schools, roads, and public safety.