Findings & Graphic

This report presents data and analysis that evaluate the revenue, price, production, and transparency implications of federal royalty reform on coal deliveries to the domestic power sector.

- The arm’s length reform proposed by ONRR would have no effect on revenue, prices, production, or transparency.

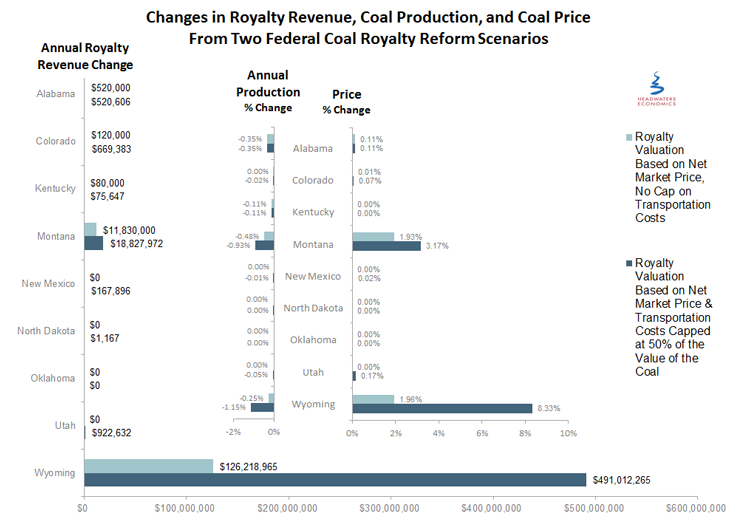

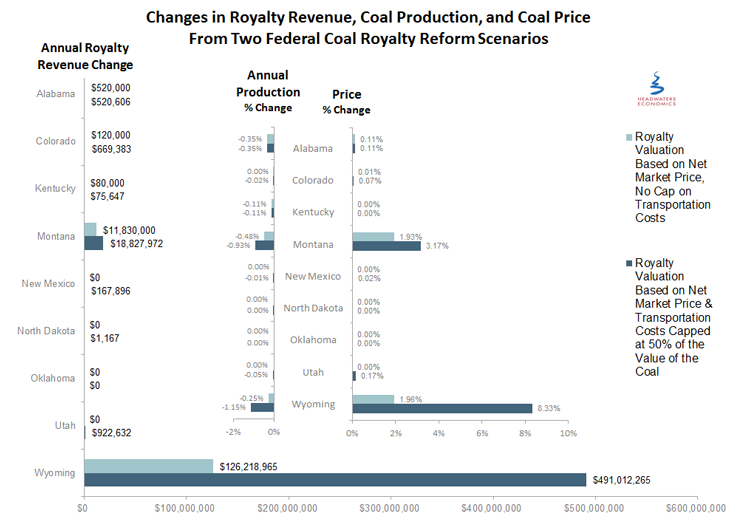

- Responding to the proposed rule’s request for comments about how the regulation could be finalized, we found that if the proposed rule is implemented using net delivered prices it would increase federal royalties and transparency. Federal royalty revenue would increase by $139 million annually (a 20% increase), with 91 percent of new revenue generated in Wyoming. On average, gross delivered prices would rise by $0.28 per ton, or a 1.6 percent increase. Demand for coal for the domestic power sector would fall by nearly one million tons annually, a 0.2 percent decline.

- If transportation cost deductions were limited to 50 percent of the net delivered price of coal, federal revenue would increase by $512 million annually (a 73% increase) with 96 percent of the additional revenue coming from Wyoming. On average, gross delivered prices would rise by $1.17 per ton, or a 6.7 percent increase. Demand for coal for the domestic power sector would fall by 4.3 million tons, a one percent decline.

- At the state level, higher federal royalty distributions to the states outweighs declines in state tax revenue that would occur due to tax interactions that lower the taxable value of state severance taxes where royalties are deductible expenses, and from the small declines in production. The largest changes in revenue, price, and production are expected to occur in Montana and Wyoming. Montana would receive between $5.1 and $8.8 million in additional annual revenue. Wyoming would receive between $58 and $234 million in additional annual revenue.

These findings are shown in Figure 1 in terms of revenue, delivered prices, and production had reforms been in place from 2008 to 2013. (The ONRR scenario would have no effect on revenue, prices, or production–and is not shown in the figure).

Figure 1:

Concerns with Current Royalty Valuation

Concerns with the current regulation related to coal royalty valuation include: that the current regulation is unwieldy for industry and ONRR to follow; that the current regulation lacks transparency; and that the current regulation is outdated and changes in the coal market may have led to undervaluation of federal coal in some instances. For example, companies have arguably exploited a loophole that allows mines to transfer coal for low mine prices to affiliates who then remarket coal to consumers at the higher full commodity value of the coal.

Reforms that would utilize the first arm’s length sale price would address the first concern by using contract prices for royalty valuation. The challenges associated with this analysis, however, speak to the opaque nature of the current regulation and this reform would do little to add transparency. ONRR’s assessment that proposed reforms would not generate additional revenue suggests arm’s length price reforms would not effectively close the “affiliate” loophole. This is at least partially due to the fact that the loophole would remain open for independent brokers.

Further reforms that would use net delivered prices could lead to greater transparency by revealing to the public the prices used for royalty valuation. These reforms also appear to be the most efficient and effective way to value federal coal for royalty assessment without introducing new distortions with regard to contract and sale structures.

We hope these data and analysis will be useful to decision makers, states and communities seeking to understand the likely outcome of changes to federal coal royalty regulations, and the impact these changes are likely to have on governmental revenue and on coal prices and production.

Headwaters Economics also has submitted a manuscript that is in review at the Journal of the Association of Environmental and Resource Economists (JAERE). The manuscript details the data, methods and detailed results for peer review and publication.