Diversifying Revenue on New Mexico State Trust Lands

New activities can help guarantee and diversify future revenue from New Mexico state trust lands, providing stable and continued funding for public education and other beneficiaries.

New Mexico’s management of revenue from state trust lands is model fiscal policy. While most other revenue is spent, all nonrenewable revenue generated from state trust lands—including oil and natural gas royalties—is invested in the Land Grant Permanent Fund (LGPF). This policy has done more to diversify and stabilize New Mexico’s revenue from oil and natural gas than any other fiscal decision made by the state government. Nearly 90% of all state trust land revenue is allocated to the LGPF. Prudent fiscal management has successfully built the LGPF to more than $23 billion as of June 2021. In FY 2020, beneficiaries (such as public schools) received $784 million in investment distributions from the LGPF, and distributions are on track to top $1 billion annually in the coming years. Thoughtful stewardship of New Mexico’s state trust lands and prudent fiduciary management provide durable, predictable revenue for beneficiaries.

Given the stable position of the LGPF, the New Mexico State Land Office (SLO) has a unique opportunity to diversify revenue generated on state trust lands. State trust land revenue offsets the need to appropriate State General Fund revenue (from income or gross receipt taxes, for example) to support beneficiaries’ budgets, allowing these other state revenues to be spent elsewhere. Successful revenue diversification combined with stable disbursements from the LGPF give the SLO capacity and flexibility to manage state trust lands for diverse land management activities.

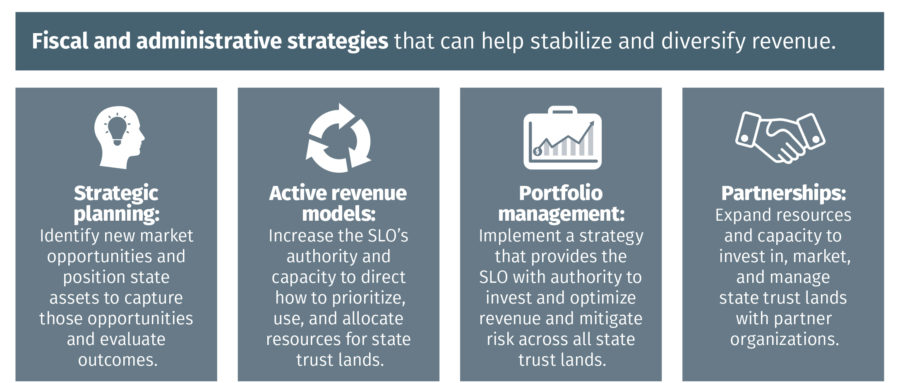

In this report, we provide insights into how the SLO can diversify revenue; better align trust land management with state goals for economic development, energy, and policy; and further reduce dependence on oil and natural gas activity. This research is informed by interviews with SLO staff, staff in other state land offices, and experts familiar with state trust lands in New Mexico and nationally. Our research reinforces three focus areas: land management activities, fiscal and administrative strategies, and improved stewardship of oil and gas activities.

Currently the SLO faces two key structural obstacles that permeate many of the ideas in this report. First, the SLO is not able to use its own funds to upgrade or improve its lands. The SLO needs expanded funding and partnerships to grow and diversify revenue from new land management activities. Second, the SLO needs additional staffing capacity to proactively and strategically plan, partner, and implement revenue diversification activities.

While no land management activities can replace royalties from oil and gas, New Mexico is in a fortunate position because it has built up its Land Grant Permanent Fund to more than $23 billion, ensuring continued distributions to beneficiaries. Prudent management of this fund can provide durable and predictable revenues for beneficiaries. Given the security of the LGPF, the SLO should be emboldened to try new strategies to diversify revenue.

Subscribe to our newsletter!