Megan Lawson, PhD, uses economic and demographic analysis to better understand the issues communities face, particularly related to land use, outdoor recreation, sustaining a diverse economy, and changing demographic and income trends. Megan holds a Ph.D. and Masters in Economics from the University of Colorado, and has a B.A. in Biology from Williams College.

Many households receive a large part of their income from sources other than their current jobs—including investment income, retirement savings, and welfare benefits. These income sources, together known as “non-labor income,” make up a large and rapidly growing economic driver. Because non-labor income is not connected to a job, it is an often overlooked and relatively unfamiliar component of local economies.

As non-labor income grows rapidly, particularly in rural places, it has the potential to transform the economies and affordability of many communities. Understanding the opportunities and challenges that growing non-labor income bring to communities may help places more effectively manage these changes.

This essay outlines the components of this “hidden paycheck,” its role in county economies, and the factors such as public lands that bring non-labor income into a community.

Background

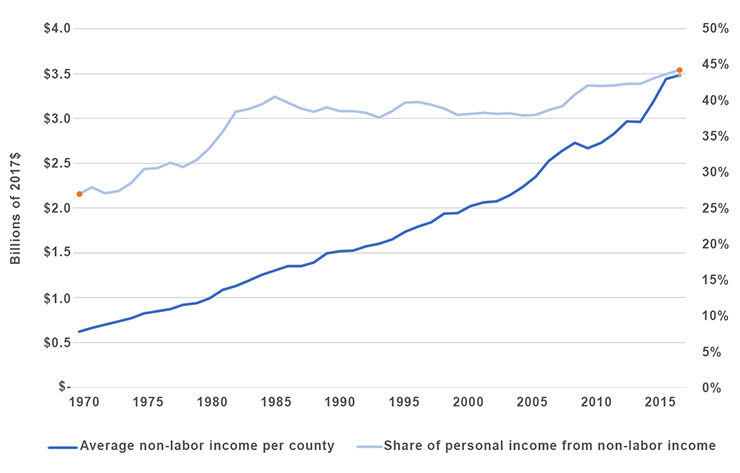

Non-labor income has grown substantially over the past several decades, both in terms of total dollars and as a share of household income (Figure 1). In 1970, counties in the western United States had an average of $619.6 million in non-labor income (adjusted for inflation), which was 27% of all personal income in the counties. In 2016, counties had an average of $3.5 billion in non-labor income, which was 44% of all personal income in western counties.

Figure 1. Average non-labor income and share of total personal income from non-labor sources in western counties, 1970-2016.

Non-labor income can be divided into three main categories: investment-related (e.g., dividends, interest, and rents), aging-related (e.g., Medicare and Social Security), and hardship-related (Medicaid and unemployment benefits). In 2016, investment-related income made up half of all non-labor income, aging-related made up 29%, and hardship-related made up 15%. These shares have been relatively constant over time, but the share from aging- and hardship-related payments has been growing, largely due to rising Medicare and Medicaid payments.

Less urbanized communities are particularly dependent on non-labor income sources. In 2016, non-labor income exceeded labor earnings in 75 of 180 (42%) rural counties in the West. Non-labor income made up an average 48% of total personal income in rural western counties in 2016, ranging as high as 69% of income in San Juan County, Washington.

Components of Non-Labor Income

The effect this influx of money has on rural places depends on what types of non-labor income dominate the local economy. Consider the two counties in Table 1, in which 63% of personal income came from non-labor sources in 2016: Huerfano County, Colorado, and Blaine County, Idaho.

In Blaine County, home of Sun Valley resort, almost all non-labor income comes from investments: 89% of all non-labor income comes from investment-related sources, 8% comes from age-related payments, and 2% comes from hardship-related payments. Contrast this with Huerfano County, where non-labor income is more evenly divided: 40% is from investments, 31% is from age-related payments, and 23% is from hardship-related payments.

Implications for Rural Communities

The composition of non-labor income in Table 1 paints a quick portrait of the community: Blaine County is a resort area that has attracted wealthy residents, with relatively few seniors and lower-income households. Huerfano County has an older population driven by both long-term residents and retirees new to the area, and many households have low income. In Blaine County, 8.5% of residents live in poverty; 20.8% of Huerfano County residents live in poverty.

| County | % of personal income from non-labor sources | Share of non-labor income, by type | ||

|---|---|---|---|---|

| Investment-related | Age-related | Hardship-related | ||

| Blaine County, Idaho | 63% | 89% | 8% | 2% |

| Huerfano County, Colorado | 63% | 40% | 31% | 23% |

Beyond these two example communities, the components of non-labor income are associated with particular socioeconomic trends. Investment-related income is associated with a higher share of residents with college degrees, somewhat older residents, and lower poverty rates. Age-related income is associated with fewer residents with college degrees, higher poverty and unemployment rates, and a substantially older population. Hardship-related income is associated with higher poverty and unemployment rates, and high rates of out-migration from a community.

The different types of non-labor income have different implications for a community’s economy. Additional investment-related income is associated with higher levels of employment and higher average wages in construction, finance, health care, retail, and professional services. Additional age-related income is more mixed: the level of employment and average wages are higher in finance and in health care, lower in construction, and there is no effect on professional services. Age-related income is associated with more employment in retail and no relationship to average wages in retail. Hardship-related payments do not have as strong a connection to economic sectors: there is no relationship to performance of the construction, retail, and professional services sectors. More hardship-related payments are associated with greater employment in finance but lower average wages per job, and greater employment in health care with no associated change in average wages per job.

Public Lands and Non-Labor Income

Public lands create scenic and recreation amenities that attract new residents, particularly those whose income does not depend on finding a job in the community such as retirees, entrepreneurs, and the wealthy.

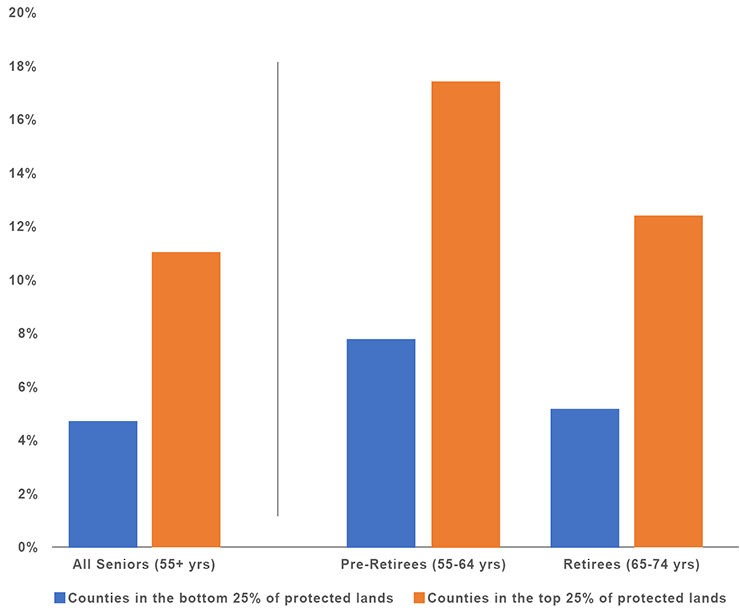

Seniors, in particular, have been moving to places with protected public lands, which include national parks, national monuments, and wildlife refuges (Figure 2).

Figure 2. Average net migration rate, 1970 to 2010, by age, for western counties based on protected public lands.

When seniors move to these places, they bring their nest eggs with them. Between 1970 and 2016 in nonmetro counties, non-labor income grew more than twice as fast in places with the most protected public lands, compared to places with the least protected public lands. Most of the growth in non-labor income in these communities is due to growth in investment-related income, which grew 3.5 times as quickly in counties with the most protected public land. Age-related income also contributed to growth, increasing nearly twice as fast in nonmetro counties with the most protected public lands, compared with counties with the least protected public lands. There is no significant difference in the growth of hardship-related payments over time between places with a high and low amount of protected public lands.

When communities attract retirees seeking lower cost of living but do not provide opportunities for younger, working-age residents to move to or stay in the community, they face the possibility of a rapidly aging community with a limited economic future. During the past several decades, many nonmetro communities have been losing their young, working-age residents to metro areas, university towns, and booming tourism communities like Summit County, Colorado. (See Todd, L. 2017. Infographic: Where in the West young people are moving. High Country News https://www.hcn.org/articles/state-of-change-where-is-the-young-west.)

We find that places with the most protected public land were significantly more likely to retain their working-age population: between 2009 and 2013, 19% of places with the most protected public lands lost working-age residents; 32% of places with the least protected public land lost working-age residents (American Community Survey, U.S. Census Bureau). The difference is even greater when we look at communities that also are growing in the share of retirees: 23% of these retirement counties with a lot of public land are losing working-age residents while 58% of retirement counties with the least protected public land are losing working-age residents.

These findings suggest that places with the most protected public lands have been attracting new non-labor income and at the same time are less likely to lose their younger work force and associated labor earnings.

Non-Labor Income is Not an Economic Silver Bullet

Non-labor income, particularly related to investments, brings new money into communities regardless of the strength of the local job market. This new money then supports more jobs and higher average wages per job across many economic sectors. However, non-labor income also brings with it several challenges that can affect a community’s long-term resilience, including rising cost of living, dependence on the performance of stock markets, and dependence on national policies.

When left unchecked, non-labor income can eventually crowd out labor income in a community. When people move to a rural community with income tied to non-labor sources (or jobs they work remotely), their income often does not reflect local job market conditions. While new non-labor income can inject much-needed money into the local economy, it also can drive up cost of living, particularly around housing. Over the long term, an influx of non-labor income can make a community unaffordable for those employed locally. This challenge is played out in high-amenity resort communities around the West as workers move farther from the community core. Research by Hunter et al. suggests that in some high-growth, high-amenity places, the increases in income for locals can by outstripped by rising cost of living.

As non-labor income from investments moves into communities, particularly in places known to attract investment income such as those with protected public land, leaders can seek solutions from other communities that have dealt with similar challenges. Programs such as employee housing and affordable housing lotteries can help mitigate the crowding-out of local workers if the programs are big enough to make a meaningful impact.

If non-labor income crowds out labor income, local businesses and government become dependent on non-labor income to support local businesses and property tax rolls. During recessions, communities dependent on investment income will be particularly hard hit. In Teton County, Wyoming (home of Jackson Hole Resort), where investment-related income alone made up 82% of all personal income in 2007, the recession caused investment-related income to drop nearly 40% and personal income around the county dropped by 16%.

If local governments recognize this dependence on non-labor income, they can help mitigate the effects of recessions on local tax revenue using fiscal policies that recognize likely recessions, not just the booms.

Finally, in communities with a large share of income from aging- and hardship-related payments, national and state policies to reform Medicare, Medicaid, and Social Security payments will have an outsized effect. In 2016, 28 of 414 western counties had at least 20% of household income from either aging- or hardship-related payments. Many of these communities are in Indian Country, and others are concentrated in formerly timber-dependent communities. Leaders in these communities must be aware of their dependence on non-labor income sources and ensure they are engaged with national policy debates that will affect them.

Conclusions

Non-labor income is a large and growing source of income, and the trends described in this essay will likely continue as more people retire and a larger share of the population has investments in the stock market. Non-labor income has the advantage of being separate from local labor markets, allowing people to move for reasons other than jobs, including quality of life and access to public lands. These trends will be particularly strong and have an outsized effect on communities in parts of the rural West with a large share of public lands.

Communities with significant amounts of the protected public lands that attract non-labor income are well positioned to capitalize on their natural resources as a means of drawing new residents. This is particularly true of places that are connected to markets by being within driving distance of a major city or airport with service to major cities. The most isolated communities, far from cities and major airports, are more likely to see their dependence on non-labor income sources rise, bringing new money into communities with struggling job markets but also increasing uncertainty associated with stock market fluctuations and federal and state policy changes.

This relatively unknown source of income brings the potential for rising employment and wages, but also presents a challenge that communities must anticipate. Local strategies around affordable housing, fiscal policies that allow for financially resilient local governments, and engagement with state and national policies that affect Medicaid and Medicare can help communities avoid the pitfalls of dependence on non-labor income.

Researchers need a better understanding of the mechanism by which non-labor income, particularly investment-related, crowds out labor income, and strategies that can be used to mitigate this effect. By learning the characteristics of those communities that have been able to attract non-labor income and at the same time grow local jobs and income, places are more likely to capitalize on the opportunities non-labor income sources present.

Suggested Reading

- Hunter, L.M., J.D. Boardman, and J.M.S. Onge. 2005. The Association Between Natural Amenities, Rural Population Growth, and Long‐Term Residents’ Economic Well‐Being. Rural Sociology 70(4): 452-469.

- Lambert, D.M., C. Clark, M.D. Wilcox, and W.M. Park. 2007. Do migrating retirees affect business establishment and job growth? An empirical look at southeastern non-metropolitan counties, 2000-2004. The Review of Regional Studies 37(2): 251-278.

- Lawson, M. 2019. Recreation Counties Attracting New Residents and Higher Incomes. Bozeman, MT: Headwaters Economics. https://headwaterseconomics.org/economic-development/trends-performance/recreation-counties-attract/.

- Lawson, M.M., R. Rasker, and P.H. Gude. 2014. The importance of non-labor income: an analysis of socioeconomic performance in western counties by type of non-labor income. Journal of Regional Analysis & Policy 44(2): 175.

- Stockdale, A., and M. MacLeod. 2013. Pre-retirement age migration to remote rural areas. Journal of Rural Studies 32: 80-92.

- Todd, L. 2017. Infographic: Where in the West young people are moving. High Country News. https://www.hcn.org/articles/state-of-change-where-is-the-young-west.