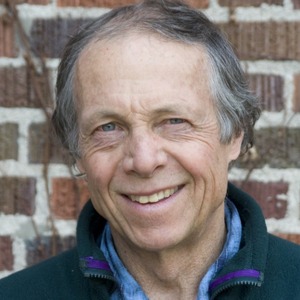

John Duffield, PhD, is currently an emeritus Research Professor in the Department of Mathematical Sciences at the University of Montana, where he taught from 1974-1996. He is also the owner of a natural resource economics research firm, Bioeconomics, Inc., which he founded in 1989. John was born and raised in Montana and educated in public schools at Mystic Lake and Thompson Falls. He has a B.A. in economics from Northwestern University and a Yale PhD in economics. Over the last 45 years John has participated in a wide range of environmental and natural resource issues including air pollution standards, instream flow, endangered species, hunting and fishing values, fair market values for state school trust lands, and public lands management. John has participated in a number of nationally significant natural resource damage cases including serving as the economic expert for the Alaska Native Class in the Exxon Valdez oil spill case. Most recently John was the lead economist for the State of Alabama in the Deepwater Horizon oil spill case.

In a market economy where wildlife and environmental resources like clean air and water are not priced, there is an incentive to ignore and/or overuse these unpriced, or nonmarket, resources and services. This essay provides a brief overview of how economic methods for valuing wildlife and other environmental resources—an approach called “nonmarket valuation”—has been used to inform natural resource policy decisions on private and public lands.

This is written from a personal perspective, reflecting in part on the work that I and my colleagues have done over the last four decades. The first part of this essay describes the general context for this work. The following section offers several research applications that illustrate the breadth of issues. This section also highlights cases where nonmarket valuation has made a difference in conservation decisions.

Overview

Looking back, the existing research on the economics of fish, wildlife, and related natural environments, particularly with respect to Montana, is surprisingly extensive and varied. This is probably because Montana is blessed with some of the most important, unique, and largely intact land, water, and wildlife resources in North America. These resources attract recreationists who, in turn, may be the subject of economic studies. Several of the very first economic studies of the demand for outdoor recreation were for Montana sites, including a 1959 study by Marion Clawson of Glacier Park. Studies have since been undertaken relating to elk, deer, and antelope hunting, stream and lake fishing, waterfowl and upland game bird hunting, wildlife viewing, wolf recovery in Yellowstone National Park, grizzly bear recovery, instream flow values, and numerous other topics.

While many of these are academic or agency-funded research efforts on a rather modest scale, Montana has also been a focus of one of the most extensive (and expensive) studies of the value of fishing ever conducted. The latter was in the context of a Superfund case (State of Montana v. Atlantic Richfield Company) involving historic metals mining and smelting at Butte and Anaconda. One trigger to this lawsuit was the discovery of arsenic in well water in Bonner, Montana, more than 100 miles downstream on the Clark Fork River where a century’s worth of toxic sediments had accumulated in the forebay behind Milltown Dam. An empirical issue in the case was the economic value to be placed on the foregone use of this fishery by Montana anglers. Both the State of Montana and the Atlantic Richfield Company developed complex economic demand models for this fishery. The economists involved included Daniel McFadden, who in 2000 was awarded the Nobel Prize in Economics for his pioneering work on models of individual choice, of the kind he helped apply in the Montana case.

Our research team at the University of Montana participated in the recreation work and led the groundwater economics studies at Butte and Milltown. This nonmarket valuation work and related restoration planning led to a $470 million settlement just prior to going to trial. Among other actions, Milltown Dam, located at the confluence of the Blackfoot and Clark Fork Rivers just above Missoula, and the bulk of the toxic sediments has since been removed.

Working on environmental economic issues requires a number of different skill sets. There is an obvious need to collaborate with natural scientists in characterizing the biological population or ecosystem or hydrologic system at issue. Also, unlike some economic fields like finance or macroeconomics with their abundance of long-term government data sets, in environmental economics one may often have to create his or her own data through survey research. My research partners since the mid-1980s have included Chris Neher, an economist with expertise in survey design, database management, and econometrics (model estimation), and Dr. David Patterson, who teaches statistics and sampling.

There are several different types of nonmarket valuation methods, including some based on observed behavior, such as the travel cost model. By looking at travel cost as a kind of spatially varying price—where visits from greater distances have higher costs and lower per capita participation—it is possible to infer an economic demand model for the site. This idea was first suggested in 1947 by Harold Hotelling at the University of South Carolina. This was in response to a query from the then-director of the National Park Service on how to value recreational use of national parks. By the late-1950s, empirical studies using this approach had been developed.

The other basic approach to valuing recreation and other nonmarket commodities is to use survey techniques to ask people about the values they would place on nonmarket commodities. One such approach is called “contingent valuation” in the sense that respondents provide a valuation statement contingent on the hypothetical situation posed. One of the first such applications was in the early 1960s by Robert Davis, then a graduate student at Harvard, who asked visitors to Baxter State Park in Maine whether they would still have taken their trip to this park if their travel costs had been higher. In other settings, survey participants have been asked whether they would donate a given amount for some environmental improvement, or vote yes in a hypothetical referendum on some issue like open space or pollution control, for a given increase in property taxes. Other methods derive in part from the previously mentioned work of McFadden. It is beyond the scope of this brief essay to discuss these and other methods in detail; however, some suggested readings are included at the end of this piece.

Which methods can be applied depend on the type of use at issue. One common distinction is between direct use and passive use. The former includes all types of direct on-site uses such as fishing, hunting, wildlife observation, and subsistence use. Passive use refers most commonly to the value individuals may place on just knowing that a species exists and is viable (existence value) or that future generations will be able to also enjoy the use of the given species (bequest value). For example, U.S. residents contribute money to the World Wildlife Fund for the protection of pandas in China or to Audubon for penguins in Antarctica. These are wildlife that the respondents will almost certainly never see themselves. This concept was first suggested in 1967 by John Krutilla, an economist at Resources for the Future, a Washington, DC, research institute.

It is fair to say that the development of nonmarket theory and methods is intertwined with and in part motivated by a sea change in the values Americans placed on recreation and other amenity-related uses of the environment after the prosperity that followed the hard years of the Great Depression in the 1930s and World War II in the 1940s. This change in values is also reflected in the passage of significant environmental legislation at the national level. From a personal perspective, my career path has been intertwined with the legal framework that emerged as my postwar generation was coming into adulthood. First was the Wilderness Act in 1964. The Wild and Scenic Rivers Act in 1968 was next, soon followed by the Clean Water Act, the Clean Air Act, the National Environmental Policy Act, the Endangered Species Act, Superfund (or CERCLA, Comprehensive Environmental Response, Compensation, and Liability Act of 1980) and, immediately following the 1989 Exxon Valdez oil spill, the Oil Pollution Act of 1990.

Soon after beginning work on an economics Ph.D. at Yale in 1970, I chose to work on the economics of wilderness preservation as a thesis and, thanks to my advisor’s suggestion, I was fortunate to enlist John Krutilla on my committee. The choice of a wilderness topic probably reflects my formative years at a remote Montana Power Company hydroelectric plant, Mystic Lake, just a few miles off the northeast corner of Yellowstone National Park. Our little community of nine families and a one-room school were at the end of a 20-mile gravel road that came south from Fishtail, Montana. We shared that location with a trailhead into what became in 1978 part of the Absaroka-Beartooth Wilderness.

Of course I did not anticipate the major change in environmental policies that has occurred in my lifetime. As it has turned out, I and my colleagues have worked extensively within the framework of the environmental laws enumerated above. The following section provides a short chronology of some of our earlier work on conservation decisions involving public lands and waters.

Applications to Conservation Decisions

My first work in the area of environmental economics began in the mid-1970s. This included benefit-cost analysis of proposed dams including Auburn Dam on the American River near Sacramento. I was aware of an important case at the time concerning the proposed Hells Canyon Dam on the Snake River. This was a classic preservation-versus-development case that began as a conventional Federal Power Commission (FPC) license proceeding and issuance of a license to the developer in 1964. However, the license was challenged by the Secretary of the Interior, and in Udall v. Federal Power Commission in 1967 the Supreme Court remanded the matter to the FPC noting that whether nondevelopment of the canyon might be in the public interest was largely unexplored in the record: “…if the Secretary is right in fearing this additional dam would destroy the waterway as a spawning ground for anadromous fish [salmon and steelhead] or seriously impair that function, the project is put in an entirely different light. The importance of salmon and steelhead in our outdoor life as well as in commerce is so great that there certainly comes a time when their destruction might necessitate a halt in the so called ‘development’ or ‘improvement’ of waterways.”

This statement by the Supreme Court has turned out to be prophetic, but for the case at hand, despite benefit-cost commentary to the contrary by John Krutilla in 1969, the FPC chose to build Hells Canyon Dam. In a sign of the state of nonmarket valuation at the time, John in his testimony also commented that existence values were likely to be significant, but that these values “were not taken into account in our computations because there are no currently known techniques or methodology whereby one might do so.” Nonetheless, this case is a significant benchmark for the serious consideration given to amenity values.

Closer to home and further along in the emergence of nonmarket valuation tools, a rural electric cooperative filed a license application in 1978 to construct and operate a hydroelectric project at Kootenai Falls in northwest Montana. By that point contingent valuation had been used to estimate passive use values, beginning with a study of air pollution impacts on visibility from the Navajo generating plant at Four Corners. The proposed 144-megawatt project at Kootenai Falls included a dam at the crest of the falls, which has been characterized as the last major undeveloped waterfall in the Pacific Northwest. I participated in a study initiated in 1981 as part of the State of Montana’s evaluation of the project in an environmental impact statement. In 1981 and 1982 we implemented both a travel cost and contingent valuation study to estimate direct recreation use values as well as passive use. Another element of the argument against the dam was that the falls and the surrounding area are a spiritual site for the Kootenai Indians.

In April 1984, the administrative law judge (ALJ) hearing the case chose to reject the utility’s license application. The ALJ’s decision turned on the esthetic and recreation values: “The conflicting interests instrumental in the denial of the application are the changes in the sensual and recreational values that would be caused to the Kootenai Falls by the proposed Project, and the adverse effect the Project would have on the Kootenai Indians to whom the Kootenai Falls have a special meaning. Even if there were no adverse effect on the Kootenais, the undesirable changes in the sensual and recreational values under these circumstances would result in a denial of the license.” All of the state’s recreation and indirect (passive use) values were accepted into evidence, but only the contingent valuation estimates for direct recreation use at the site were judged to be credible.

This case is noteworthy in that despite opposing testimony, for perhaps one of the first times, contingent valuation estimates for recreational use were relied on in a legal proceeding. The Kootenai Falls decision is only the second of two cases where the Federal Energy Regulatory Commission or its predecessor FPC has denied a license application for a major hydroelectric project. The other was on the Namekagon River in Maine in 1954.

Following this thread of nonmarket valuation in the context of water resource development, we also had our contingent valuation work relied on in the context of the Missouri River water reservation process which began in 1985. In this case the administrative law judge relied on our estimates of fishing recreation and gave instream uses an earlier priority date over competing irrigation withdrawal rights from 70 conservation districts. Through this period, proposed dams were subjected to much closer scrutiny for fishery impacts. By the early 1990s the tide had turned and dams were beginning to be removed. Some of the first of the major hydroelectric dams to be removed were Elwha and Glines Canyon dams on the Elwha River, with headwaters into the Olympic National Park. This decision was supported by a passive use study by John Loomis at Colorado State who found the value of a recovered Elwha River salmon fishery to exceed the cost of dam removal and foregone future hydroelectric generation. Recently we participated in a Department of Interior-funded national survey that included passive use in an analysis of removing Iron Gate and the other major dams on the Klamath River, once the third-largest salmon fishery on the West Coast. Based on the findings of the study, there is a preliminary agreement to remove the dams.

In the late 1980s we were also estimating passive use values in terrestrial contexts, including evaluating elk winter range acquisitions in the Paradise Valley north of Yellowstone National Park. Because of this prior work on public lands management issues, we were invited by the National Park Service to work on an EIS stemming from the 1987 Northern Rockies wolf recovery plan. In 1990 and 1991 we surveyed park visitors in Yellowstone and found that, overall, visitors strongly favored wolf reintroduction and that many were willing to donate to efforts to restore wolves. Biologists estimated the number of wolves that could be supported long-term in the recovery area (100 wolves), and also estimated the direct impacts of wolf predation on elk populations and livestock based in part on experience in Alberta and Minnesota where wolves were present. We estimated the costs of a full recovery as averaging $937,000 per year ($31,000 livestock loses, $465,000 foregone value to hunters due to reduced elk populations, and management costs of $441,000 per year). We implemented a random sample of national households as well as a subsample of all listed phone numbers in the three-state region of Idaho, Montana, and Wyoming. We found that for the national sample, supporters of wolf recovery outnumbered opponents by a 2:1 ratio, but within the three-state region, opinion was more closely divided with 49% in favor, 43% opposed, and 8 percent didn’t know. The net existence or passive use annual value (after subtracting out the values for those opposed) for the national sample was estimated to be $8.3 million per year. The estimated existence value benefits of wolf recovery were much larger than the associated costs at about an 8:1 benefit cost ratio for the national sample.

We also examined the impact of wolves on tourism in the park. Visitors were asked how they would change their visitation to the park if wolves were present: either increase, no effect, or decrease. Based on visitor expenditure data in the three-state region by out-of-region visitors, wolves were expected to provide an additional $19.5 million in annual expenditure prior to any multiplier effects on the three-state economy. From the perspective of a regional economic accounting framework, this change has a positive effect on the regional economy. The benefit cost analysis and regional economic analysis on wolf recovery basically answered the question: Does wolf recovery in Yellowstone make economic sense? As is well known, in January 1995, 29 gray wolves from Canada were relocated into Yellowstone National Park and the wilderness areas of central Idaho. The action was the culmination of an extensive planning effort, including 160,000 public comments on the wolf recovery EIS, the most of any other prior or then-current federal planning effort.

In 2005, some 10 years after wolf reintroduction, we had an opportunity to revisit the issue of the economic impact of wolves on park tourism. By that point, wolf-watching in the park was well established and concentrated in the open country of the Lamar Valley. Respondents were asked whether they would have come to the park if wolves had not been present. We found the percentage of annual Yellowstone visitation attributable to wolves averaged 3.7% over the year, which amounts to a total $35.5 million additional spending by out-of-region visitors. Our earlier estimate based on 1991 data and corrected for inflation to 2005 dollars was $27.7 million, well within our 95% confidence interval for the 2005 study. Most wolves seen in the park are in the Lamar area where roughly two to four packs may be active in a given year, or roughly 20 to 40 wolves. Relative to the annual spending impact, these might be called million-dollar wolves. To conclude this brief review of several case studies concerning public lands and waters, by the 1990s nonmarket valuation estimates of direct recreation were being relied on for both important policy decisions as well as in some litigation settings. The same can be said for contingent valuation estimates of passive use with regard to policy, but still to date I am not aware of cases where these types of values have been accepted by the courts.

Suggested Reading

The attached set of references provides an entry point into the economic literature on nonmarket valuation. The Primer edited by Champ et al. (2003) provides an accessible introduction to methods and many references to key papers. Another useful overview that introduces more of an ecological economics perspective is the panel report by the National Research Council (2005) on valuing ecosystem services. The remaining suggested readings are case studies that illustrate both methods and the range of issues.

One large set of 120 case studies from around the world has been assembled by The Economics of Ecosystems and Biodiversity (TEEB) office in Geneva, Switzerland, which is a global initiative of the United Nations Environment Programme. With the motto “Making nature’s values visible,” its objective is to mainstream the value of biodiversity and ecosystems into decision-making at all levels. Our wolf recovery analysis (Duffield 2010) was selected as one of 17 North American case studies. Their perspective is that wolf recovery is an example of a biodiversity conservation action that benefits the local economy.

Another complex conservation case study is the impact of Glen Canyon Dam on the Colorado River through Grand Canyon National Park. Peaking flows at the dam have impacted an endangered fish (the humpback chub) as well as anglers and whitewater boaters and washed away scarce beach habitat in the canyon (Neher et al. 2017).

Nonmarket valuation has become important in litigation settings. In the case of the Exxon Valdez oil spill, we have published several papers on how nonmarket valuation of foregone subsistence use by Alaska Natives fared in this setting (Duffield, Neher, and Patterson 2014). A related area of focus for nonmarket valuation is measuring foregone use of tribally-owned cultural and natural resources. Studies for tribes include the Blackfeet, Hopi, Quapaw, Salish-Kootenai, and Penobscot (Duffield, Neher, and Patterson 2018).

A prominent current preservation-versus-development issue is the proposed development of a large gold mine proposed in the headwaters of the major rivers in the Bristol Bay area of southwestern Alaska (Dobb 2010). This relatively intact ecosystem supports the world’s largest sockeye salmon fishery and the livelihoods of Bristol Bay’s Alaska native villages where subsistence is a way of life. We have led several ecosystem services valuation studies of this area (Watson et al. 2007), including work for the U.S. Environmental Protection Agency on a potential withdrawal of this area from mining development under a Clean Water Act section 404c designation. Parenthetically, the idea for this essay’s title came from a book by Seth Kantner (2009) about his life growing up in arctic Alaska.

A relatively new research direction is our current work in road ecology. Our papers coauthored with Marcel Huijser (2013) provide a benefit cost model for mitigating wildlife-vehicle collisions with wildlife crossing structures and fences. Empirical applications have included whitetail deer in the western United States and the rodents (capybara) of unusual size found in Brazil.

- Champ, P.A., K.J. Boyle, and T.C. Brown, eds. 2003. A Primer on Nonmarket Valuation. The Economics of Non-Market Goods and Resources, Vol. 3. Basingstoke, UK: Springer Nature.

- Dobb, E. 2010. Alaska’s Choice: Salmon or Gold. National Geographic. December 2010.

- Duffield, J. 2010. Local Value of Wolves beyond Protected Areas, USA. Available at The Economics of Ecosystems & Biodiversity: Case Studies www.TEEBweb.org/resources/case-studies.

- Duffield, J., C. Neher, and D. Patterson. 2018. Natural Resource Valuation with a Tribal Perspective: A Case Study of the Penobscot Nation. Applied Economics 51(22): 2377-2389.

- Duffield, J., C. Neher, and D. Patterson. 2014. Oil spill in northern waters: Trial outcomes and the long term in the case of the Exxon Valdez. Arctic Review of Law and Policy 5(1/2014): 38-74.

- Huijser, M., F. Abra, and J. Duffield. 2013. Mammal road mortality and cost-benefit analysis of mitigation measures aimed at reducing collisions with capybara (Hydrochoerus hydrochaeris). Oecologia Australis 17(1): 129-145.

- Kantner, S. 2009. Shopping for Porcupine: A Life in Arctic Alaska. Minneapolis, MN: Milkweed Editions.

- National Research Council. 2005. Valuing ecosystem services: toward better environmental decision-making. Washington, DC: National Academies Press.

- Neher, C., J. Duffield, L. Bair, D. Patterson, and K. Neher. 2017. Testing the Limits of Temporal Stability: Willingness to Pay Values Among Grand Canyon Whitewater Boaters across Decades. Water Resources Research. DOI: 10.1002/2017ER020729.

- Watson, A., J. Sproull, and L. Dean. 2007. Science and stewardship to protect and maintain wilderness values. 8th World Wilderness Congress Symp. Proc. RMRS-9-49. Fort Collins, CO: USDA Forest Service. srs.fs.usda.gov\pubs\contents\28910.