The U.S. federal government is a conspicuous laggard in creating a natural resources trust. Today, the federal government spends every penny of oil, natural gas, coal, timber, and other natural resource revenue generated from public lands as it comes in. The boom in shale oil and natural gas in this country increased royaltyand bonus revenue, but if prices continue to weaken, these revenues will fall, with significant fiscal implications.

Consider the issue of revenue sharing. The federal government shares a portion of the royalty and bonus revenue it earns from leasing federal resources directly with state and local governments where resources are extracted. These revenues compensate for the non-taxable status of federal lands and help pay for the impacts associated with drilling, mining, and logging (local governments build and maintain roads, provide public safety, water and sewer capacity, and services to the population that moves into these communities during resource booms).

When large federal distributions during booms are high, local and state governments have used the revenue to fund services, but also to lower local taxes. But when revenues fall as markets—or policies—change, the loss of federal payments can cause fiscal stress for communities now dependent on these annual revenue sharing payments. As a result, Congress has often resorted to using general taxpayer funds to either keep the payments high or to subsidize continued extraction—often to the detriment of competing public land values or policy goals.

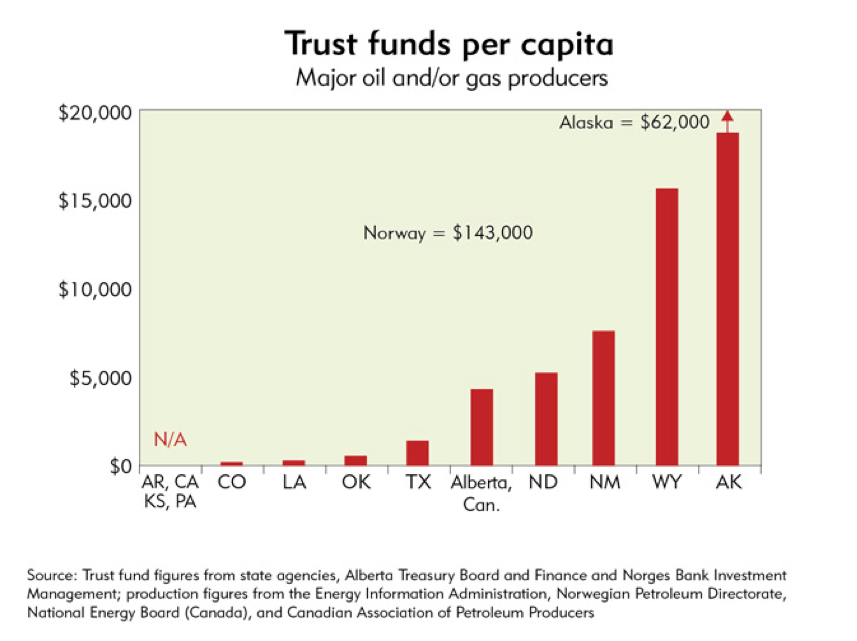

We could learn lessons from looking abroad to our British allies (or to our own states) to see the potential gains from establishing a permanent trust. Doing so would allow for stable, permanent, and ever rising payments to states and local governments without the risking fiscal dependence or creating new liabilities for taxpayer and federal lands.