We recently wrote a paper detailing policy options for USFWS Refuge Revenue Sharing payments. These wildlife refuge payments compensate counties for non-taxable federal lands.

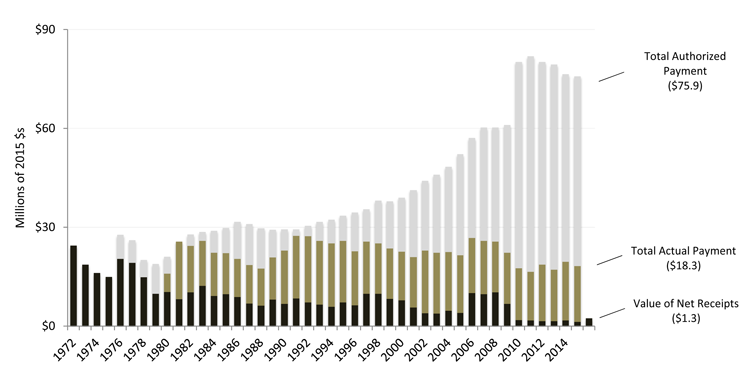

For several decades, funding battles in Congress have limited actual payments to counties (appropriations) to much less than the total amount authorized by legislation (see figure below).

National Wildlife Refuge Revenue Sharing Payments:

Authorized and Appropriated Payments, FY 1972-FY 2015

In addition, the existing payment formula has a quirk that authorizes continually higher payments largely for wealthy communities. This has eroded support from the Obama Administration for continuing appropriations.

Instead, the Administration has proposed making payments to counties based on the value of net receipts. Ending appropriations would have lowered payments from $18.3 million to $1.3 million in the last year (see the figure above).

Lower county payments will reduce revenue for local services (including schools) critical to leveraging the economic opportunities Refuges offer, particularly in rural communities. This will in turn erode local support for the conservation missions of National Wildlife Refuges (particularly refuge expansions).

For example, the payment to Harney County, Oregon, for the Malheur Wildlife Refuge was $75,951. Without appropriations, it would have been $1,492.

Our refuge payment reform paper and related research post offer a variety of proposals on how to reform, rather than eliminate payments.

Research includes the idea of combining several federal county payment programs into a single payment based on an updated formula to address cost concerns, establishing a natural resources trust, or rethinking creative revenue sources such as basing payments on the value of ecosystem services maintained on those federal lands.