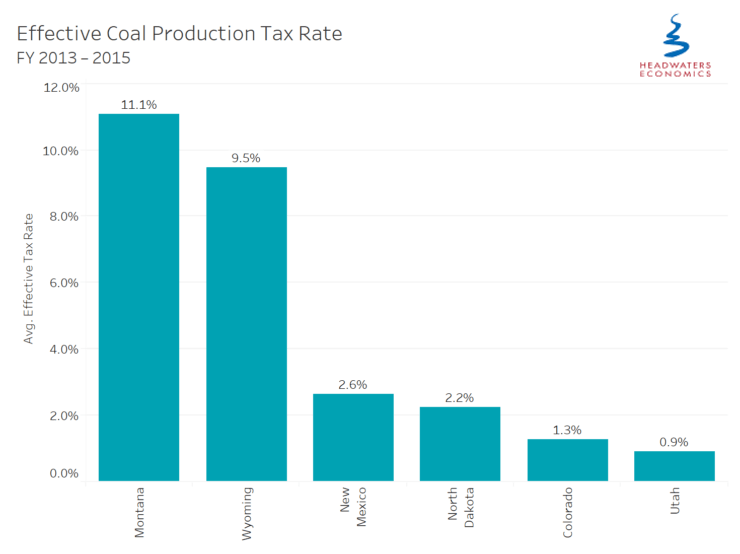

- The combined effective tax rate on coal production varies considerably in the six states studied—Colorado, Montana, New Mexico, North Dakota, Utah, and Wyoming—ranging from less than 1 percent in Utah to more than 11 percent in Montana.

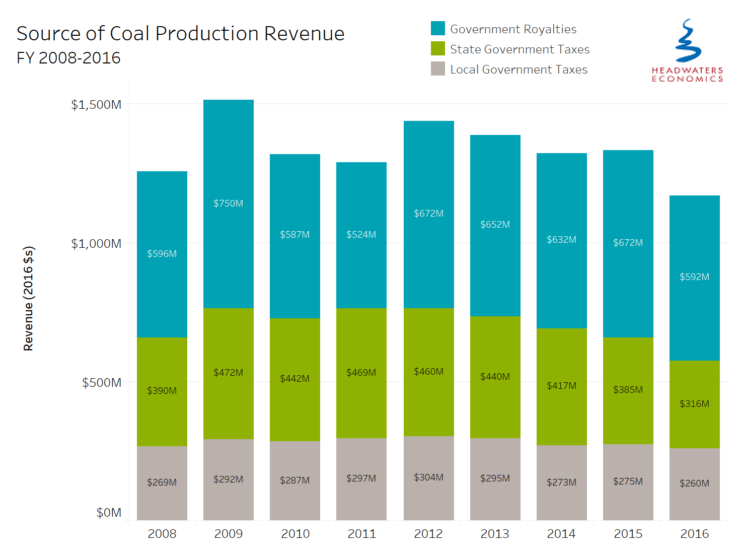

- State and federal government royalties from coal generate more revenue than state and local production taxes combined.

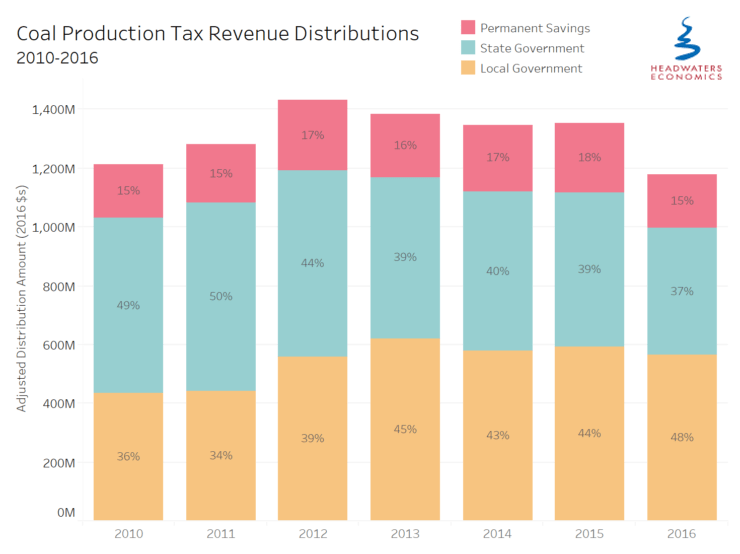

- More than half of all coal production revenue accrues to local governments through local taxes or through state distributions and grant programs. All states save revenue earned from leasing coal on state-owned land in a permanent trust benefiting schools. Colorado, Montana, New Mexico, and Wyoming also save a portion of severance tax revenue in a permanent fund.

- Given the economic challenges associated with coal mining—including market volatility, community and environmental impacts, and policy uncertainty—four best practices for coal fiscal policy are recommended.

Coal-Related Challenges to Western States and Communities

Coal fiscal policies are important. Between 2009 and 2025, the U.S. will retire roughly one-fifth of its coal power plant fleet. These retirements will reduce deliveries from western coal mines by about 15 percent from 2016 levels. The continued shift away from coal and to natural gas and renewable energy sources is causing fiscal challenges in coal-producing states.

For example, recent budget shortfalls in Wyoming, Montana, and New Mexico are at least partially caused by declining coal revenue. Local communities where coal mines and coal fired power plants are located will experience significant budget challenges when these facilities close or slow production.

Findings: Coal Fiscal Policies for Western States

The combined effective tax rate on coal production varies considerably in six states studied—Colorado, Montana, New Mexico, North Dakota, Utah, and Wyoming—ranging from a low of less than 1 percent in Utah to a high of more than 11 percent in Montana.

In addition, state and federal royalties from coal are tremendously important for states, generating more revenue than state and local production taxes combined.

How states spend coal-related revenues also varies considerably. Overall, nearly half of all coal production revenue in 2016 accrued to local governments through local taxes or through state distributions and grant programs funded by coal production revenue.

In addition, all states save some portion of revenue earned from leasing coal on state-owned land in a permanent trust fund that benefits public schools. Colorado, Montana, New Mexico, and Wyoming also save a portion of severance tax revenue in a permanent fund.

Next Steps for Coal Fiscal Policies

This review of coal fiscal policies among western states and local governments can contribute to a better assessment of the exposure of western states and local communities to fiscal and economic risks as the energy transition continues. It is intended to shed light on best practices related to coal fiscal policy and explore the role of fiscal policy in economic development, energy markets, and conservation.

Previous research and the experience of coal-producing regions show that two general fiscal approaches are possible, with different outcomes.

First, severance taxes and royalty payments reinvested into communities through long-term savings, infrastructure, and economic development activities can leverage resource wealth into a diversified economy, initiating a virtuous cycle of growth.

Alternatively, if resource wealth is instead extracted and removed from mining regions or used primarily to offset other sources of tax revenue, local and regional economies can become too dependent on extractive activities and face budget challenges when coal revenue declines during market downturns or when coal-fired power plants are closed.

Best Practices

Given the economic challenges associated with coal mining, including volatility, community and environmental impacts, and policy uncertainty, smart coal fiscal policy has these elements:

• Tax coal resources directly and avoid incentives and deductions that reduce the effective tax rate.

• Minimize spending of coal revenue on annual operating budgets and using coal revenue to lower other sources of tax revenue that increase dependence on continued annual production.

• Invest coal revenue in long-term infrastructure, economic development, and environmental reclamation priorities and in permanent savings funds that stabilize revenue and contribute to economic diversification.

• Remove limits on local government taxation, spending, and saving authority specifically related to coal production revenue to allow local governments to avoid over-reliance on annual coal revenue.

Smart fiscal policy will increase in importance as the energy transition continues to reduce demand for coal from western states. Fiscal policies should be designed to stabilize and diversify budgets and economies in coal producing states and communities to help insure long-term prosperity.

Detailed Data

In addition to a description of methods and analysis, the full report contains two detailed appendixes with production revenue and distribution by state.