- Establishing an endowment by creating a permanent Trust would provide permanent, predictable, and increasing payments to federal land counties.

- The current system—revenue-sharing payments and discretionary appropriations from Congress—has failed to provide predictable and fair compensation to counties.

- This failure has exacerbated fiscal crises in rural communities and left them unprepared to meet the economic challenges and opportunities facing federal land counties in the 21st-century economy.

History of County Payments

This paper, published by the Humboldt Journal of Social Relations, discusses long-term problems with the county payment programs and proposes building an endowment for federal public land counties by creating a permanent Trust.

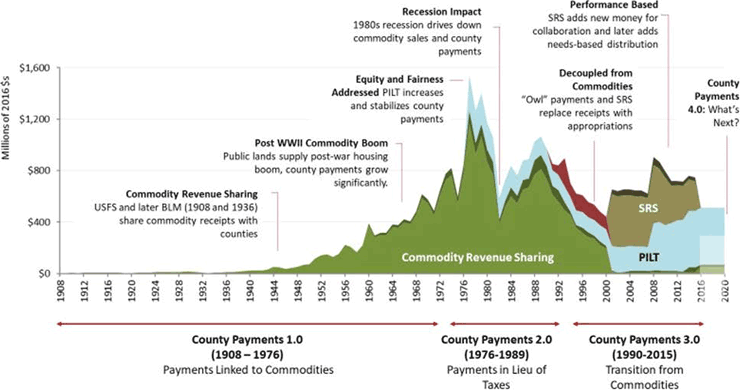

Federal land management agencies, including the U.S. Forest Service and Bureau of Land Management (BLM), make payments to local governments to compensate for the non-taxable status of federal public lands. The original “county payments” program began in 1908 and paid an estimated $4.9 million (in 2015 dollars) to local governments based the value of commercial activities on federal lands, primarily timber harvesting (County Payments 1.0).

The original revenue sharing policy did not anticipate the major changes in the volume and types of activities on federal lands–and federal lands changing contribution to rural economies—that have evolved over the past century leading to unequal compensation among counties, uncertain payments from year to year.

As the timeline below shows, Congress added programs to address the shortcomings of revenue sharing payments–including fairness and predictability–by adding PILT in 1976 (County Payments 2.0); and the changing economy and land management priorities with a variety of “transition payments” between 1990 and 2015 to address the changing economy and land management priorities (County Payments 3.0).

By 2018, county payments were made to nearly 2,000 local governments in 52 U.S. states and territories totaling more than $750 million largely from multiple county payment programs—continued revenue sharing payments, Payments in Lieu of Taxes (PILT), and the Secure Rural Schools and Community Self-Determination Act (SRS) and National Wildlife Refuge Revenue Sharing Payments (RRS).

County Payments Are Under Threat

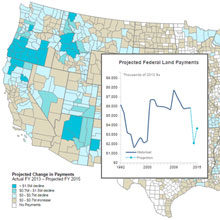

More recently, the President’s FY 2019 proposed budget would not extend SRS—ending transition payments—and would limit appropriations for PILT. If this budget proposal is accepted by Congress, overall county payments would decline by $304 million (39 percent) compared to FY 2015 (the last year SRS was paid).

Some rural western counties would see their payments fall by as much as 97 percent. The proposal also would return the inequity, uncertainty, and perverse incentives inherent to revenue sharing payments that transition payments sought to address.

Why Are County Payments Important?

County payments make up a significant share of total governmental revenue in many rural communities and therefore play a leading role in economic development and support critical services and infrastructure in public land counties.

Over time, declining revenue and payment uncertainty has limited the current county payment programs ability to address the many fiscal and economic challenges facing public land counties.

Overall, the United States economy is growing, but jobs and businesses are increasingly concentrated in a small number metropolitan counties; and many non-metro areas, including public land counties, are not participating in growth. In part, new high wage services jobs are clustering in cities that have educated workers, access to global markets, and proximity to similar companies and ideas.

In addition, structural changes in mature manufacturing and goods producing sectors—including automation and productivity gains that have resulted in jobs losses–have hit non-metro counties more acutely.

Public lands provide economic opportunities, including resource extraction, recreation, and amenity values. Capitalizing on these opportunities depends in part on the availability of critical rural institutions, such as education, infrastructure, health and social services, and other public amenities provided by local governments.

County governments are playing an increasing role in economic development, public-private partnerships, and services. These changes increase the importance of reforming county payments to reverse the trend of declining payments and ensure fairness and predictability.

Policy Solution: Endowing Federal Public Land Counties

Headwaters Economics has studied a variety of solutions, including a proposal described here to form a permanent natural resources trust—county payments 4.0. A permanent trust has several advantages in concept.

First, it still utilizes receipts to fund county payments, but stabilizes these revenues over time to guarantee predictable and increasing payments year over year.

Second, the Trust would not require discretionary appropriations from Congress after the endowment grows to a size sufficient to meet payment obligations, ending uncertainty for counties and save taxpayer dollars.

Third, decoupling county payments from annual commercial receipts would allow forest management reform to move forward with a focus on management strategies intended to restore forest health and on economic development strategies sensitive to the varied needs of different types of public land counties.

How a Permanent Trust Would Work

Revenue

The Trust would be funded with receipts generated from the management of public land already dedicated to county payments, including the Forest Service 25% Fund receipts and BLM O&C 50% Revenue Sharing receipts and National Wildlife Refuge Revenue Sharing receipts.

Congress also could make discretionary appropriations from other revenue sources to capitalize the Trust more quickly. For example, there is precedent for allocating revenue from tariff or settlement revenue related to Canadian softwood imports to the U.S. into a permanent fund that benefits public land counties.

Establishing the Trust

Receipts would be transferred to a congressionally-chartered not-for-profit organization who would establish the Trust outside the federal Treasury to ensure the Trust is held in perpetuity for the benefit of public land counties (for example, the National Forest Foundation or the U.S. Endowment for Forestry and Communities).

Investing Funds to Earn Income

The principal balance of the Trust would be invested to earn income. The investment strategy would seek to achieve a five percent real rate of return, and would distribute no more than four and a half percent of the ending fund balance (or total market value of the Trust) in each fiscal year.

Limiting distributions below the average real rate of return on the investment will inflation-proof the Trust and ensure it will provide stable and predictable payments in perpetuity.

Replacing Appropriations

Distributions from the Trust would pay for a permanent authorization of SRS and RRS payments, including direct payments to eligible counties and schools, and grants and loans for economic development and land stewardship. Legislation establishing the Trust also would permanently authorized SRS and RRS payments.

The cost of appropriations to fund these programs declines annually until the Trust grows to a sufficient size that appropriations are no longer necessary. After than point, county payments would increase year over year.