Federal land payments to counties and states—or “county payments”—provide compensation for non-taxable federal land. Headwaters Economics studies the fiscal, economic, and policy issues related to county payments.

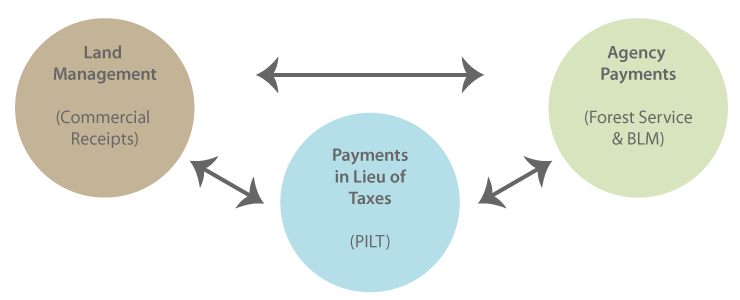

Policy reform proposals should address the how PILT, agency payments, and land management can work together to provide stable and predictable compensation to counties, create job opportunities in line with today’s economy, and improve forest health.

Single Payment

We propose a single payment solution (PDF) that would utilize PILT as the primary way to compensate counties for non-taxable land.

The county payments interactive shows how PILT could be reformed to ensure payments are delivered to counties based on the amount of acres of federal land; and to include incentives and performance criteria that link payments to economic opportunities and use payments most effectively and efficiently.

A single payment would require permanent mandatory federal appropriations, as is currently the case with PILT. However, proposed reforms would ensure that rural counties most dependent on county payments would maintain sustainable payment levels, even if future appropriations decline. The single payment could also be combined with a Natural Resources Trust to eliminate the need for permanent congressional assistance.

The single payment reform idea is explored in detail in our paper on reforming wildlife refuge payments.

The idea originally was proposed based on work with the Clearwater Basin Collaborative in Central Idaho. Headwaters Economics testified (PDF) before the U.S. Senate Energy and Natural Resources Committee on this topic and 2014 legislation from U.S. Senator Walsh drew on the same concept.

Natural Resources Trust

The U.S. federal government is conspicuous in having tremendous resource wealth but no permanent trust fund of any kind to manage these revenues. By comparison, trusts are utilized by nearly every U.S. state and other nations with significant natural resource wealth. For example, Alaska, Montana, North Dakota, Texas, and Wyoming all have significant trust funds, and Norway’s massive sovereign wealth fund is valued at more than $850 billion.

Our research paper and testimony before the United States Senate (2017) explain how such a Trust could work to provide permanent funding for county payments by using the proceeds of timber, recreation, mineral, and land use receipts to benefit states and counties adjacent to federal public lands. A Trust could provide permanent funding that would ensure stable and fair payments to counties and eliminate the need for congressional appropriations over time.

White Paper: Eight Reform Ideas

Our 2010 white paper considers ideas for the reform of county payments, explore the pros and cons of each, and evaluate whether each idea will provide stable and predictable compensation to counties, create job opportunities in line with today’s economy, and improve forest health:

- Let SRS expire and return to commodity revenue sharing, where county payments are tied to timber harvest levels and other resource extraction on public lands.

- Reauthorize SRS with no substantive changes.

- Let SRS expire and return to a revenue sharing system based on an expanded definition of “gross receipts” that counts the value of increases in forest health, such as watershed restoration and wildlife habitat improvements.

- Retain SRS payments and change the distribution formula to give proportionately higher payments to counties based on:

- Economic need and development potential.

- Control of wildfire costs by curtaining home-building on fire-prone lands.

- Increases in the value of forest health by public lands.

- The proportion of federal lands in protected status.

- Replace SRS, commodity revenue sharing, and PILT with a tax equivalency program, paying counties the equivalent of what they would be paid in taxes if the land were privately owned.

Headwaters Economics presents the policy options for consideration and discussion in the spirit of determining how to best provide counties with stable and predictable compensation while reinforcing today’s economic and land-health goals. We do not advocate for one idea over another and it is possible that several ideas could be implemented concurrently.

Analysis of Other Proposals

Headwaters Economics analyzes the potential impacts of proposals related to PILT, agency payments, and forest management suggested by Congress and the Administration. We do not weigh in on forest health and timber management issues directly. Instead, we are interested in research on the fiscal and economic development dimensions of federal land management policy, fire suppression and fire fighting cost and budgeting issues, and collaboration related to public lands. Some resources include:

Headwaters Economics has analyzed the potential impacts of recent proposals suggested in the House, Senate, and by the President.

History and Context

Timber Cut, Sold, and Gross Receipts

These two interactive maps show the commercial activities on National Forests such as the timber economy–gross receipts, timber harvest sales, and timber cuts.

Research Your County or Region

Headwaters Economics created the Economic Profile System (EPS) in cooperation with the Bureau of Land Management and the U.S. Forest Service. This free tool includes a “Payments from Federal Lands” report that provides a detailed history and analysis of payment data for PILT, the Forest Service, BLM, U.S. Fish and Wildlife Service, Federal Mineral Revenue Sharing from the Office of Natural Resources Revenue.

Users can run custom reports for any county, collection of counties, or states. The reports also include detailed descriptions of each program and links to data sources and methods.

Summary of All County Payments Research

This summary contains a brief description and links to all Headwaters Economics research on county payments.