This report reviews how states and communities are responding to the growing infrastructure and services needs of the Bakken boom:

- How high global oil prices and new technology have brought a frenzy of activity to North Dakota.

- How unconventional oil extraction creates a “treadmill” of drilling activity that increases infrastructure demands on nearby communities.

- Whether North Dakota’s fiscal policy is adequately prepared to meet the demands of unconventional energy development.

- Comparitive fiscal policies in North Dakota to Colorado, Montana, and Wyoming.

Headwaters Economics also recently completed a supplemental briefing paperthat looks at the impact of state tax subsidies for oil production, what’s gained or lost, and lessons for federal policy. The North Dakota report was prepared in cooperation with Stanford University’s Bill Lane Center for the American West as part of a larger study: “Are Western Communities Getting a Fair Return on Energy Development?”.

Oil Boom | Fiscal Policy | Conclusions

Introduction

As oil production from the Bakken formation continues to set records in North Dakota, the sheer pace and scale of the boom is still unfolding. The intensity of industrial activity in western North Dakota translates into mounting concerns about the ability of local and state government to respond to growing infrastructure needs and service demands. After a recent tour of the region, North Dakota state officials announced plans for direct assistance to local governments, along with a promise to revisit how oil tax revenues are shared between the state and local governments.1 Meanwhile, citizens and local leaders in eastern Montana — where development of the Bakken formation is expected to occur next — are already reporting overwhelming impacts from the activity in North Dakota.2

This report analyzes North Dakota’s fiscal policy in terms of how well the state collects and distributes fossil fuel revenue and how the state is capturing wealth to ensure long-term economic benefit. The report discusses how the specific development strategies for an unconventional oil resource change the nature and longevity of drilling impacts and compares North Dakota’s policy to three peer energy-producing states in the West: Colorado, Montana, and Wyoming.

Unlike conventional oil extraction, which is premised on “sticking a straw in the ground” and watching valuable resources flow out, unconventional oil resources — like those found in the Bakken — involve a much more complicated extraction effort. In addition, after an initial rush of production, the flow out of unconventional wells tends to decline quickly: a typical Bakken horizontal oil well will produce only 55 percent of oil in the second year of production compared to the first — a 45 percent annual decline. Unlike previous periods of oil development in the West — which were marked by an initial disruptive drilling phase followed by a long, relatively quiet production phase — development in the Bakken will be characterized by an ongoing cycle of drilling, fracking, and often re-fracking of producing wells.

The “treadmill” of drilling and fracking activity suggests that impacts will be heightened and more continuous throughout the life of the Bakken play (as long as high oil prices support this expensive form of energy production). Intensive oil extraction creates the need for expensive improvements to road, water, and sewer systems and increases demand for public services such as police, fire, and emergency response, social services, and — significantly — housing.

Fiscal policy — the way state and local governments tax oil production and distribute the proceeds — will be central to helping states adapt to the new unconventional resource plays and to ensuring that communities benefit from oil development.

In previous research, Headwaters Economics has articulated three requirements of sustainable fiscal policy relative to oil and natural gas:

- Fossil fuel extraction pays its way through effective impact mitigation;

- Fossil fuel extraction supports economic diversification and resilience; and

- Fossil fuel extraction leaves a lasting legacy in the form of a permanent fund.

These goals are described in more detail in Appendix A.

As we have documented in previous studies,3 existing fiscal and planning tools have had limited efficacy during recent energy booms in achieving these goals. This report indicates that the fiscal policies on the books in North Dakota and other states may be especially ill suited to unconventional oil plays. North Dakota appears to be learning on the job, but a more consistent approach in all states that are facing future unconventional energy plays will need to replace the current, often ad hoc assistance to oil-impacted communities.

In this report, we pay particular attention to the amount of revenue collected, the timing of revenue collections, the portion of revenue directed to local governments that are impacted by industrial activity and rapid population growth, and the share of revenue invested into permanent funds for long-term economic and fiscal benefit from the one-time depletion of non-renewable resources.

Oil Boom | Fiscal Policy | Conclusions

Summary Findings

- An unconventional oil well in shale generates an initial rush of oil that subsequently declines quickly. Production from Bakken unconventional oil wells declines by nearly half in the second year (45%), meaning more wells need to be drilled to produce oil from unconventional shale plays compared to more conventional oil. This has implications both for the impacts of development and for the structure of revenue policies.

- Industrial and community impacts from development of the Bakken are greater and more continuous than impacts from development of conventional oil fields. The “treadmill” of drilling and fracking activity means employment opportunities will be greater, but will also impose heightened and more continuous industrial impacts on rural infrastructure and stress on community services.

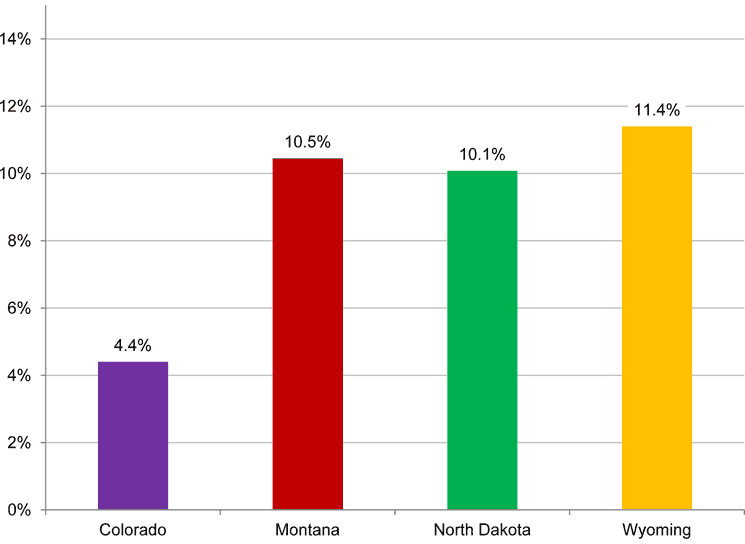

- North Dakota’s effective tax rate is average compared to other energy-producing states in the West, with room to increase. In fiscal year 2010, the state’s effective tax rate on oil and natural gas of 10.1 percent ranked behind Wyoming (11.4%) and Montana (10.5%), and ahead of Colorado (4.4%). Higher effective tax rates collect more revenue from extraction with no effect on prices and little effect on industry investment or production.

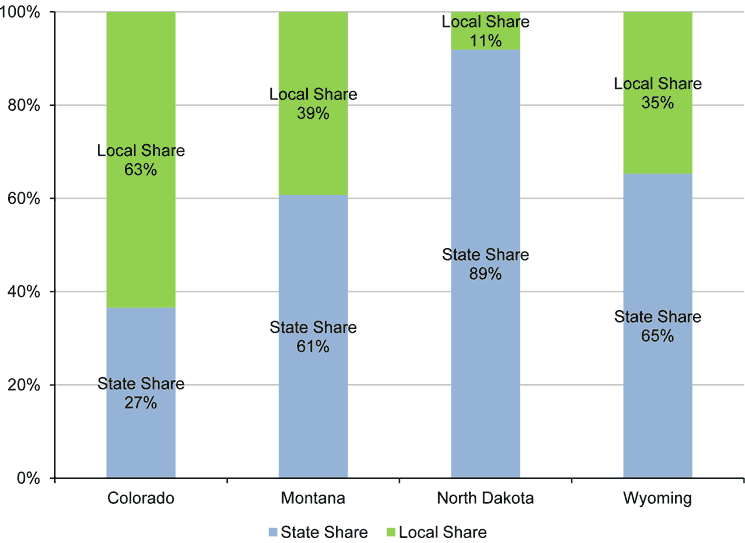

- North Dakota stands out among its peers for providing the least direct funding for oil-impacted communities. Local North Dakota governments received directly 8 percent of total state revenue from oil and natural gas in FY 2011; this amount is estimated to rise to 11.2 percent in FY 2012-2013, since changes were made to the distribution formula. In addition North Dakota has contributed $885 million more in one-time infrastructure assistance for the coming fiscal year. By comparison, local governments in Colorado receive 63 percent directly; in Montana, 39 percent; and in Wyoming, 35 percent. Such transfers fill an important gap, but as the experiences of Wyoming in the natural gas boom of 2003-2008 suggest, leaving impact assistance to the discretion of state legislatures is not a responsible approach to managing an energy boom.4

- States can no longer rely on lasting production and tax revenue from unconventional oil plays after drilling activity slows. The steep production decline curve for individual wells means that total field production will drop steeply when drilling activity slows either in response to low prices (below $60 a barrel in the Bakken), or when the resource is exhausted. States may need additional revenue to mitigate impacts as they occur and investing in permanent funds will be more important to ensuring lasting fiscal benefits.

II. A Snapshot of the North Dakota Oil Boom

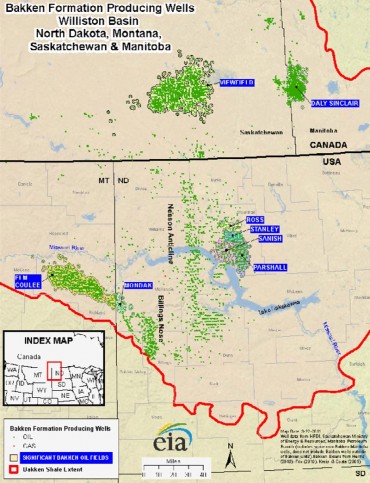

Located mainly under portions of Montana, North Dakota, and Saskatchewan, the Bakken formation — a geological layer running horizontally below the surface of the earth — covers more than 200,000 square miles.

In 2008, the U.S. Geological Survey estimated the amount of technically recoverable oil in the Bakken at between 3.0 to 4.3 billion barrels5 (the agency will update this estimate in 20126 and many believe the 2008 estimate to be low7 ). More optimistic estimates range as high as 24 billion barrels.8 The U.S. Energy Information Administration put total proven oil reserves at 22.3 billion barrels in December 2009.9

The application of new horizontal drilling and fracking technology, coinciding with high prices in the last decade, has made drilling in the Bakken economically viable. Production began in earnest in Montana’s Elm Coulee field, and quickly moved into North Dakota, where it is now centered.

Despite the expansive reach of the Bakken formation, its depth, thickness, and maturity (the amount of oil in the source rock) varies throughout the area.

The heterogeneous nature of the resource means future exploration and production is uncertain and will likely skip between hot spots rather than march uniformly across the full expanse of the shale. Many people expect rigs will eventually cross back into Montana as existing plays are fully produced and as new areas are found. Technology also continues to lower costs and increase oil recovery, which will make plays that are marginal today economic in the future.

Production Trends

North Dakota’s oil production increased from 2.5 million barrels per month in 2004 to more than 16.5 million barrels per month by the end of 2011, more than a six-fold increase.10 The state recently passed California as the third-largest oil-producing state in the nation, behind Texas and Alaska.11

In September 2011, North Dakota’s oil production accounted for about 8 percent of total national production.12 The average ratio of domestic production of petroleum products (including crude oil) to consumption in 2011 was 42 percent.13

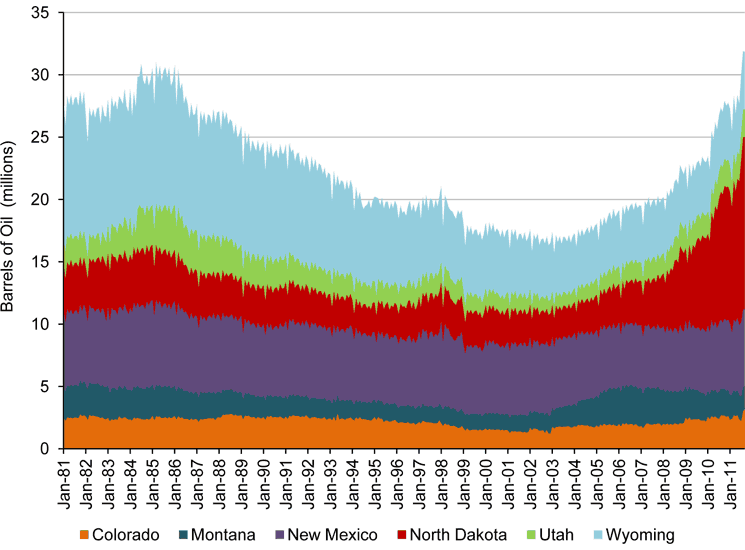

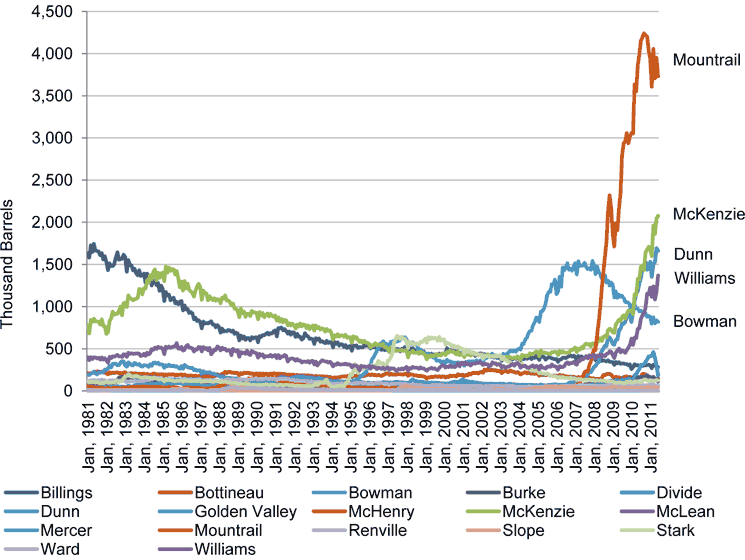

Monthly Oil Production in Colorado, Montana, New Mexico, North Dakota, Utah, and Wyoming, January 1981 to April 201114

By comparison, Wyoming’s production — based for the past several decades on conventional oil fields — has declined from more than 10 million barrels monthly in the 1980s to around four million barrels monthly today. North Dakota’s rapid rise is helping to make up for long-term declines in the Interior West’s and the nation’s oil production. Total monthly production surpassed 1980s production levels for the first time in August 2011.15

The industry’s success at unlocking unconventional oil in the Bakken has generated excitement in the Interior West about additional shale oil plays, notably the Niobrara, accessible in both Colorado and Wyoming, and the “Alberta Bakken” formation along the Rocky Mountain Front in Montana.16

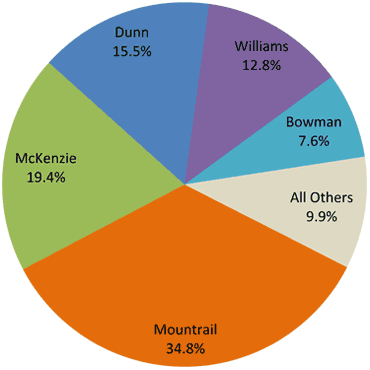

Production trends across counties illustrate the uneven nature of the Bakken. Production is concentrated in those areas where the resource is mature and most accessible and where existing technology is best suited to the resource play. Currently, 90 percent of North Dakota production is located in five counties: Bowman, Dunn, McKenzie, Mountrail, and Williams. Mountrail alone accounted for 35 percent of total state production in June of 2011.

Monthly Oil Production in the Seventeen North Dakota Oil Counties,

January 1981 to June 201117

Share of Total Oil Production in the Seventeen North Dakota Oil Counties, June 201118

Drilling Activity

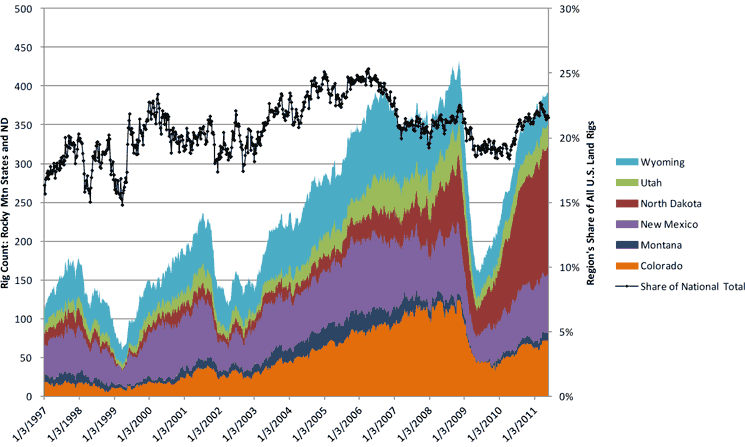

National drilling rig counts are an important measure of trends in domestic fossil fuel energy development activity. Because a majority of oil and gas industry jobs are associated with the drilling phase, drilling activity (as measured by rig counts) serves as a good proxy for employment trends.

In the year 2011, drilling in North Dakota exceeded the levels of activity associated with the Utah- Colorado natural gas boom of 2005-2008.19 For example, in 2008, counties in the Uinta‐Piceance Basin led the rankings for busiest year of drilling activity (during the period 2001 to 2011) with 5,263 total rig weeks taking place in three counties in the Uinta‐Piceance Basin: Garfield County, Colorado (3,181), Rio Blanco County, Colorado (624); and Uintah County, Utah (1,458). A rig week is the presence of one drilling rig for at least one week in the county.

In 2011, drilling in North Dakota counties resulted in the following rig weeks: McKenzie (1,882); Mountrail (1,427); Williams (1,352); Dunn (1169); and Divide (366) — a total of 6,196 rig weeks for these five counties.

The figure below shows that the rig count in North Dakota has expanded rapidly after the recession when oil prices recovered from lows beneath $30 per barrel to well over $100 per barrel in 2011. The movement of rigs from state to state reflects the mobility of the industry, and the ease at which rigs can switch from drilling for unconventional natural gas to unconventional oil. Counties experience these rapid changes as booms and busts that bring swift accelerations and decelerations in population growth, employment, and revenue.

Headwaters Economics produced an interactive timeline of drilling activity by county from 2001 to 2011 that lets users explore changes in drilling activity by county in six Western states, Montana, North Dakota, Wyoming, Utah, Colorado, and New Mexico.

Rig Activity (weekly, 1/3/97-5/27/11) in Colorado, Montana, New Mexico, North Dakota, Utah, and Wyoming, 1997 to 2011

Bakken Well Decline Curves

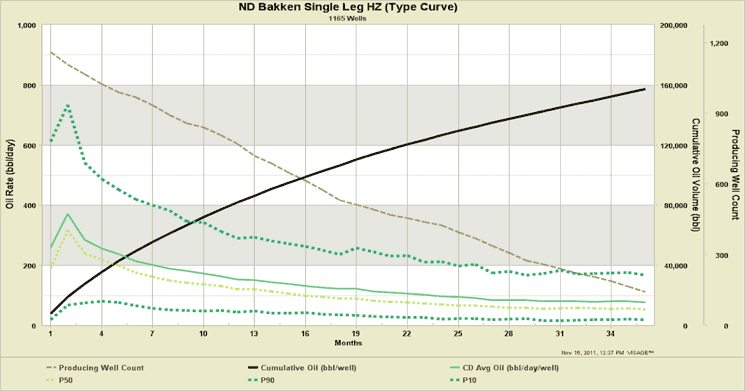

Drilling and fracking an unconventional oil well in shale generates an initial rush of oil that subsequently declines quickly. The decline is not linear, however, and most wells will eventually stabilize and continue to produce for 30 years or more, albeit at volumes much lower than those achieved in the first year of production.

The decline curve for Bakken oil wells, described by one industry analyst as “horrific,”20 compares unfavorably to declines experienced in conventional oil wells and oil fields. For example, Continental Resources estimates that 48,000 wells will need to be drilled over several decades to extract up to 24 billion barrels of oil from the Bakken (half a million barrels per well). The North Dakota Industrial Commission estimates that 33,000 wells will be drilled in the next 15 to 25 years, with 5,000 of these coming in the next two years as companies rush to secure leases at low prices.21 Alaska’s Prudhoe Bay had produced nearly 11 billion barrels of oil from just 1,114 wells by 2006 (nearly 10 million barrels per well).22 A detailed description of the decline curve is offered in the box on page 8.

The steep production decline for individual Bakken wells requires that more wells be drilled to extract all the recoverable oil from the Bakken. In order to maintain production, a typical well will be re-fracked, perhaps multiple times.

Some skeptics are concerned that the “treadmill” of drilling activity required to maintain production will eventually — and perhaps sooner rather than later — flatten total production from the Bakken.23 One estimate suggests 700 Bakken wells must be drilled annually just to offset declines from Alaska’s North Slope fields. A shaper concern is that if prices fall and drilling becomes uneconomical (a 2008 estimate suggests $60 per barrel is the price point at which the average well becomes unprofitable24 ), production will drop off steeply.

More to the point for North Dakota’s communities in the Bakken, the continuous drilling and fracking activity will deepen and extend social and industrial impacts. While this study does not attempt to quantify these impacts, anecdotal evidence highlights considerable concerns in western North Dakota that are spilling into Montana.25 This report examines tax policy because it has direct bearing on how communities can facilitate and mitigate the very different kinds of drilling activity, community impact, and revenue profiles associated with unconventional oil plays. Many states fiscal policy was reformed in the late 1990 sand early 2000s to meet both industry and community needs based on low oil prices and understanding of conventional plays, and may need to be updated.

The figure below shows the production curve, or type curve, for an average Bakken horizontal oil well. The black curve labeled “Cumulative Oil (bbl/well) shows that the average well produced 157,222 barrels of oil over the first 36 months of production. The solid green curve labeled “CD Avg Oil (bbl/day/well) shows that, at peak, the average well produced an average rate of 372 barrels per day in the second month, declining to a low of 78 barrels per day in the 36thmonth.Based on these data, the typical Bakken well will produce only 55 percent of what it produced in the first year, a 45 percent decline. The decline rate slows to 32 percent in the third year. After three years average daily production of 78 barrels is only 21 percent of the peak average daily production of 372 barrels achieved in the second month of production.The curves labeled P10, P50, and P90 illustrate the production type curve for the 10th percentile well, the median well, and the 90th percentile well in the sample respectively. Each curve is based on a sample of wells (producing well count) in each month of production. The sample size declines over time because there are fewer wells in the sample that have been producing for the full 36 months than there are wells that have been producing for at least one month.

Typical Profile of a Bakken Horizontal Unconventional Oil Well

Source data from geoLOGIC Data Center.

Calculation and visualization from VISAGE.

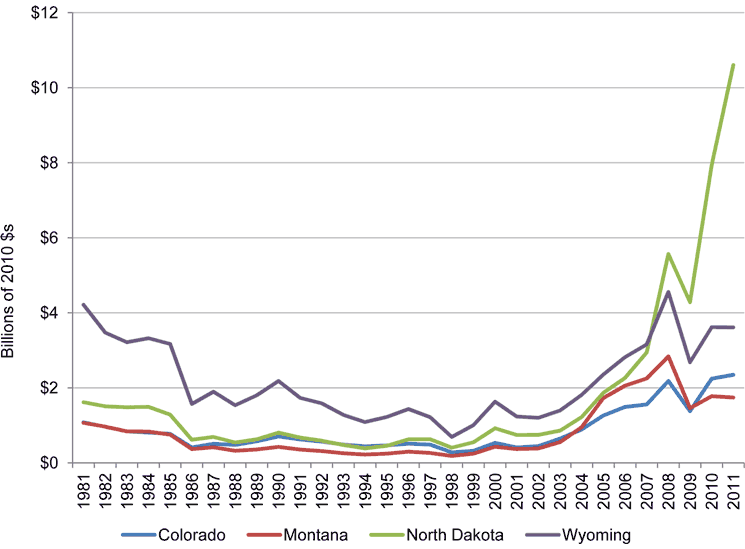

Production Value Trends

Cumulatively, the four producing states generated $18.3 billion worth of oil in 2011. North Dakota leads the states with $10.6 billion of production value, with Wyoming in a distant second ($3.6 billion) followed by Colorado ($2.3 billion) and Montana ($1.4 billion).

Crude Oil Production Value in Colorado, Montana, North Dakota, and Wyoming

In the next section, we turn our attention to fiscal policy — how the states of Colorado, Montana, North Dakota, and Wyoming tax oil production, and how they distribute the revenue between state and local governments. Specifically, we profile how North Dakota’s fiscal policy is set up to help oil-impacted counties deal with growing infrastructure and services demands and diversify their economies. We then compare North Dakota to three energy-producing peer states: Colorado, Montana, and Wyoming.

III. Four‐State Fiscal Policy Comparison

“A few years ago, our board set a goal that Mountrail County would be a better place to live and work as this oil play works itself out over the next 30 years.”26

—Dave Hynek, Mountrail County Commissioner

Fiscal Policy Context

The wealth being generated in the Bakken is staggering, more than $10 billion in North Dakota in 2011, and still growing rapidly. The pace and scale of development is transforming western North Dakota’s communities, for better and for worse.

In this section we profile the state’s fiscal policy relative to that of Colorado, Montana, and Wyoming. As mentioned in the introduction, there are three features of sustainable fiscal policy relative to oil and natural gas:

- Fossil fuel extraction pays its way through effective impact mitigation;

- Fossil fuel extraction supports economic diversification and resilience; and

- Fossil fuel extraction leaves a lasting legacy in the form of a permanent fund.

These goals are described in more detail in Appendix A. We are interested in how well North Dakota and its peer energy-producing states of Colorado, Montana, and Wyoming collect and distribute revenue in order to mitigate industrial and population impacts of the boom in the necessary timeframe and to the appropriate areas, and how these states capture wealth to ensure long-term economic benefit. In short, we want to understand the role fiscal policy plays in making western North Dakota and other Western communities better places to live as a result of unconventional oil development in the Bakken and elsewhere.

As the pace and scale of the boom continues to unfold, the North Dakota state legislature and Governor

Jack Dalrymple have made significant changes to the state’s spending and distribution policy and

continue to do so. The 2011 legislature reformed revenue distribution policy, shifting a larger share of tax revenue to oil-impacted counties. A special legislative session in late 2011 also made a significant commitment of more than $800 million in transportation, water, and housing assistance and incentives.27

Most recently, the governor completed a tour of oil-impacted communities, which resulted in new commitments of assistance and sent a signal that distribution formulas may again be revisited.28

The profiles below illustrate that each state has a different set of tax rates, tax incentives, or spending priorities relative to oil and natural gas extraction. Each does some things well and also has room for improvement to ensure that oil-impacted communities benefit from the activity.

Effective Tax Rates

An effective tax rate is the best way to compare the amount of revenue each state receives relative to others. The effective tax rate measures actual taxes paid based on gross production value, taking into account different tax structures, tax rates, deductions, and incentives.

Oil and Natural Gas Effective Tax Rate for Production, Property, and Sales Taxes, FY 2010

| State | Production Taxes | Property Taxes | Sales Taxes | Total Tax Revenue | Oil and Natural Gas Production Value | Effective Tax Rate |

|---|---|---|---|---|---|---|

| Colorado | $64,982,616 | $284,315,832 | $25,154,632 | $374,453,080 | $6,785,746,679 | 4.4% |

| Montana | $210,335,320 | $210,335,320 | $2,012,566,089 | 10.5% | ||

| North Dakota | $594,422,795 | $73,675,294 | $668,098,089 | $6,629,885,189 | 10.1% | |

| Wyoming | $174,006,343 | $155,935,575 | $27,722,728 | $357,664,646 | $3,618,357,300 | 11.4% |

North Dakota’s effective tax rate of 10.1 percent in FY 2010 was similar to Wyoming (11.4 %) and Montana (10.5%), and more than twice Colorado’s (4.4%).

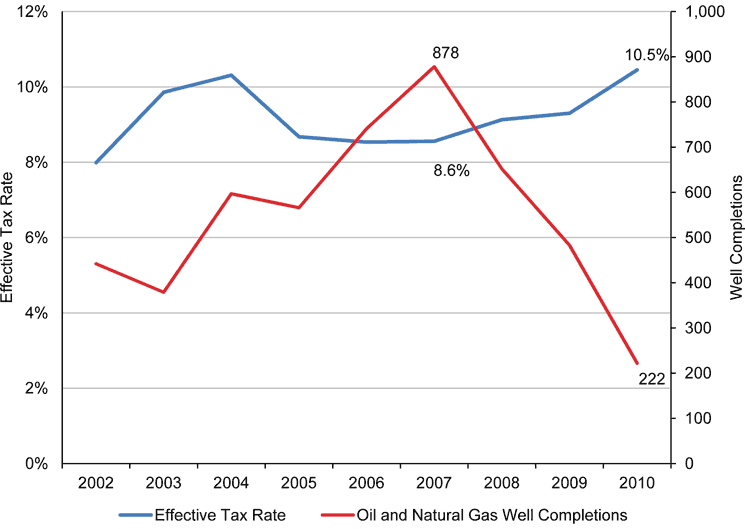

Over time, North Dakota’s effective tax rate has varied, with FY 2010 effective tax rate of 10.1 percent being the highest. The average effective tax rate in North Dakota from FY 2002 to FY 2008 was 8.7 percent. The current effective tax rate is high because high oil prices remove the state’s incentive tax rate for new production, and stripper wells that pay a lower tax rate make up a smaller percentage of total production as most production is coming from new wells in the first several years of production (at relatively high production rates). North Dakota’s effective tax rate will decline if prices drop and the incentive tax rate for new production becomes available.

Montana’s effective tax rate also varies over time due to the state’s drilling incentive, which reduces the production tax rate to 0.5 percent for the first 18 months of production from newly completed horizontal wells. During periods of rapid drilling activity, as in FY 2006 when they Elm Coulee field was being developed, the state’s effective tax rate dropped to 8.5 percent. By FY 2010 after the Elm Coulee field had played out, it has risen to 10.5 percent.

Montana Well Completions and Effective Tax Rate, FY 2002-2010

Colorado’s effective tax rate was most volatile over the period, although it remained the lowest of the four states. Colorado has a unique incentive that allows producers to write off local property taxes paid from their state severance tax liability. Because of the lag between when property taxes and severances taxes are levied against the same period of production (between one and two years difference), the value of the incentive changes dramatically, affecting the state’s effective tax rate. The recent recession and dramatic changes in energy prices caused Colorado’s effective tax rate to swing from a high of 8.5 percent in FY2009 to a low as 4.4 percent the next year.

By comparison, Wyoming’s effective tax rate is most stable over time, varying from a low of 10 percent in FY 2008 to a high of 12.1 percent in FY 2006.

Effective tax rate comparisons are useful to compare the resources available in the different states and to assess how the amount of revenue collected helps to achieve fiscal policy goals. Also, there is evidence that tax rates have little effect on overall production of oil and natural gas,29 so lower effective tax rates essentially leave money on the table (or transfer wealth from states to the federal government as state production taxes can be deducted from federal corporate income tax liability).

For example, Montana’s 18-month tax holiday has not resulted in companies abandoning North Dakota’s higher taxes to drill in the Treasure State. Oil and gas extractive activities track world market price closely. Development occurs when and where resources are prime, which is a function of geology, technology, and price. In February 2012, 185 drilling rigs were working in North Dakota, compared to 18 in Montana,30 suggesting that comparative tax rates have no correlation with investment decisions and ultimately, the production of oil and natural gas.

Timing of Revenue Collection

A common problem in mitigating the impacts of energy development on communities is the lag between when development occurs and when revenue is available for impact mitigation. Fiscal policies affect the timing of revenue collection and ultimately when resources are available for local governments to pay for infrastructure and services. The lag can be exacerbated by the lead-time required to plan, design, and construct capital facilities needed to accommodate industrial development and population growth.31

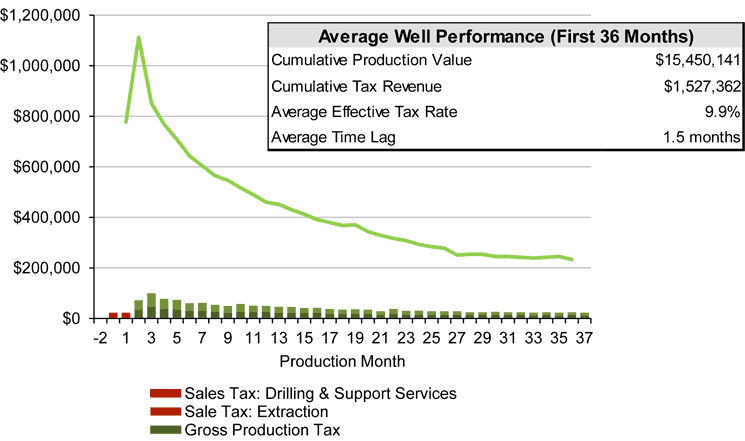

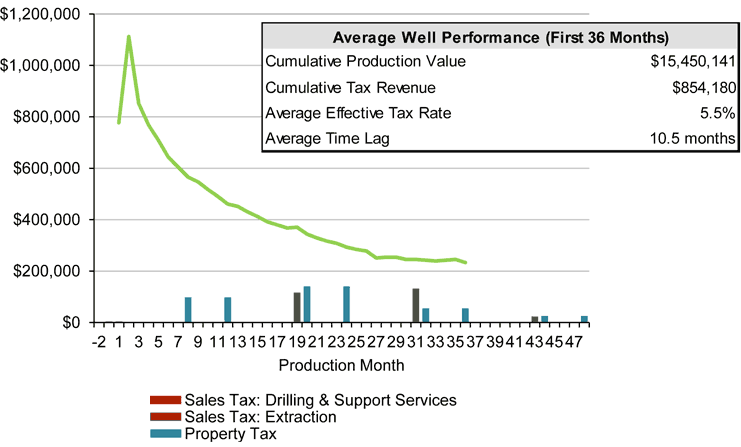

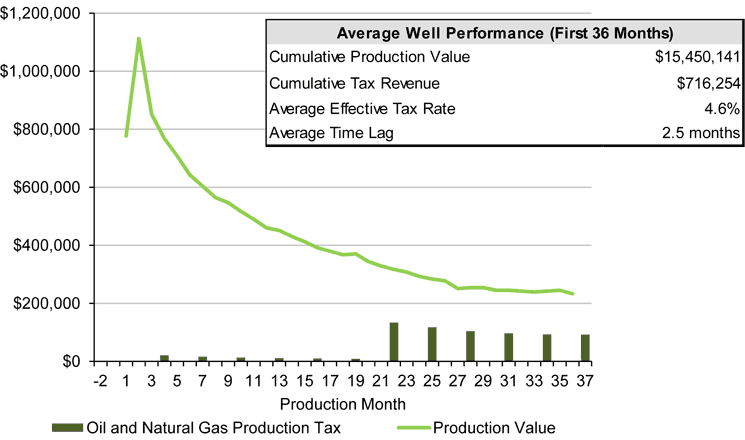

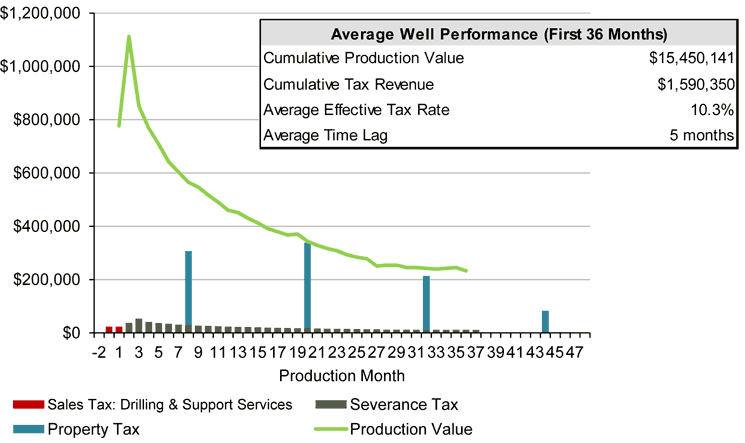

In this section, we utilize the average Bakken horizontal oil well production curve described earlier to test and compare tax policies in Colorado, Montana, North Dakota, and Wyoming. We compare the types of taxes levied, the effective tax rate, and the timing of tax collections relative to when drilling and production occurs.

First, we estimated the total production value and the timing of production value for a typical Bakken oil well by applying a constant price of $98 per barrel32 to the production curve illustrated in the box on page 8XXXXXXX.33 The following four figures illustrate that the average Bakken horizontal oil well will produce $15.45 million in cumulative production value, peaking at $1.1 million in the second month and declining to $233,142 in the 36th month of production.

Tax Revenue Generated from an Average Bakken Horizontal Oil Well in North Dakota

Tax Revenue Generated from an Average Bakken Horizontal Oil Well in Colorado

Tax Revenue Generated from an Average Bakken Horizontal Oil Well in Montana

Tax Revenue Generated from an Average Bakken Horizontal Oil Well in Wyoming

North Dakota captures revenue relatively early in the drilling and initial production phase. In North Dakota, a sales tax collects revenue from drilling and support services and two production taxes levied monthly ensure a short lag between production and revenue collections. North Dakota’s average effective tax rate is higher over the first 36 months of production at 9.9 percent ($1.5 million in cumulative tax revenue) compared to Montana’s average effective tax rate of 4.6 percent ($716,254 in cumulative tax revenue) over the same period.

Wyoming performs best, capturing an effective tax rate of 10.3 percent over the first 36 months, while

Colorado’s effective tax rate is 5.5 percent in the first three years.

Montana performs so poorly because the state has no sales tax on drilling and support services, and grants an 18-month holiday on production from new horizontal wells. The tax holiday delays significant revenue collection from new production until nearly two years after drilling has impacted infrastructure and services.

Revenue Distribution

North Dakota earmarks the smallest amount of total oil revenue for local governments, either through local tax collections, direct distributions, or dedicated energy impact grants. In North Dakota in FY 2011, only 7.9 percent of revenue was distributed directly to local governments. Changes made in the 2011 legislative session will increase the state’s mandated direct contributions to 11.2 percent of total projected revenue. By comparison, in FY 2011, local governments in Colorado received 63 percent directly; in Montana, 39 percent; and in Wyoming, 35 percent.

Direct Distributions of Oil and Natural Gas Tax and Royalty Revenue to State, Local, and Tribal Governments, FY 2011 (North Dakota is Estimate for FY 2012 to Reflect Current Distribution Policy)

Even with its comparative advantage in capturing more revenue more quickly from oil wells, North Dakota’s local governments are experiencing difficulties in keeping pace with service and infrastructure needs. Local governments collect a sales tax on oil and natural gas drilling and support services, and the state distribution of gross production tax is front-loaded to cities and counties.

However, total distributions to local governments are limited by a distribution formula that shifts money from local governments to the state as total revenue collections rise, ensuring that the state, and not the directly impacted cities and counties benefits from windfall tax revenues generated by high prices and production.

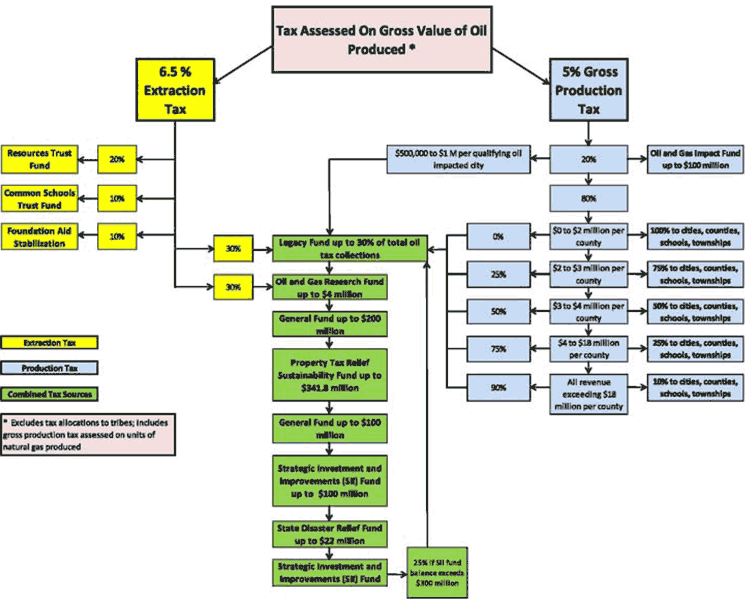

The distribution chart below shows how production tax revenue is initially directed to cities, counties, schools and townships. Twenty percent of the tax is directed to counties and to the Oil and Gas Impact Fund, but these distributions are capped. After the cap is met for each eligible county and for the Impact Fund, the rest of the revenue is deposited into a variety of state funds. Eighty percent of the production tax is shared between the state and local governments based on a formula that initially directs 100 percent of the revenue to local governments, but only for the first $2 million in revenue. After the 80 percent share of the production tax exceeds $18 million, the state retains 90 percent of additional revenue, and local governments receive only 10 percent.

State of North Dakota: Revenue Highlights:

Oil Extraction and Production Tax Allocations, 2011-2013 Biennium

By comparison, Colorado distributes half of state severance taxes and 40 percent of non-bonus federal mineral royalties directly to local governments, including counties, cities, and school districts, with no caps or progressive formulas restricting how much local governments can receive. The distributions are directly based on criteria that include the proportion of oil and natural gas employees residing in each county, and the proportion of permits and oil and natural gas production in each county.34 Funds are also distributed through an impact grants program.

In addition, Colorado communities retain local property taxes levied against the production value of oil and natural gas, and local sales taxes on oil and natural gas drilling activity and support services. In sum, counties receive nearly two-thirds of all revenue collected from oil and natural gas production in Colorado compared to only 11 percent in North Dakota.

Montana has a single production tax on oil and natural gas and shares about half of the proceeds with local governments in lieu of local property taxes. Montana collects less revenue and in a less timely manner than its neighbor state, so it may have even greater difficulties responding to impacts of oil development when rigs eventually cross the border.

Wyoming has relatively poor distributions from the state severance tax to local governments, but local governments collect property taxes on production. This works well for counties that have significant production value to tax. Nearby cities that need to expand infrastructure and extend services often have little or no production to tax within their jurisdiction and little direct assistance from the state. As a result, the distribution of state revenue to assist oil-impacted communities can be ad hoc and often politicized.35

North Dakota’s low direct distribution threshold replicates the situation Wyoming communities face. In total, the governor’s office and state legislature is directing $1.2 billion to energy-impacted counties in

2012 and 2013, about 59 percent of total projected oil revenue of $2 billion over the same period. Most of these dollars, $850 million, will be in the form of one-time transportation, water, and housing grants and tax incentives.

While these transfers are significant, communities do not receive the certainty from a biennial appropriations process that they would from a system of direct distributions based on clear impact metrics and a tax policy that recognizes the unique needs of oil-impacted communities. If Continental Resources’ projection that 48,000 wells will be required to extract all the Bakken’s oil is correct, the impact on communities will continue for 15 to 25 years. Communities will have to rely on consistently high prices and unwavering political support, possibly for decades to come, to avoid both commodity and fiscal boom and bust.

Permanent Fund Savings

One of the purposes of a severance tax is to ensure that communities and the state benefit from the depletion of non-renewable resources. The typical mechanisms for replacing this wealth is through direct investments in economic development and investments in a permanent fund that ensure lasting fiscal benefits.

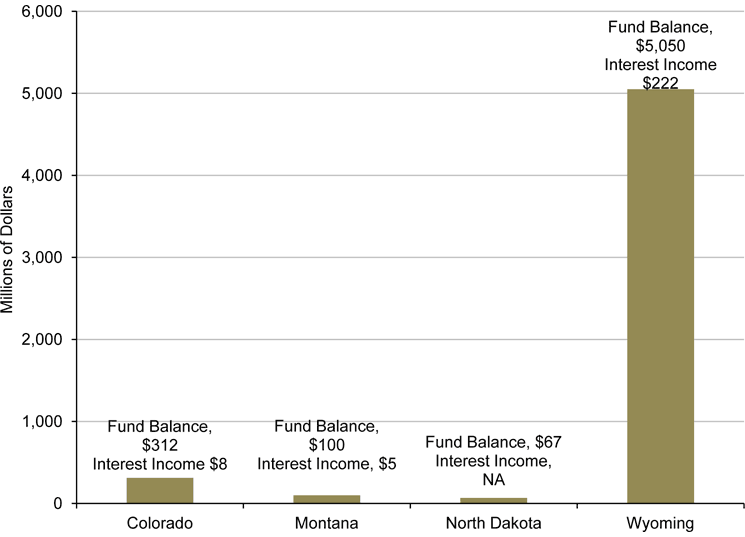

Permanent funds are used for a variety of purposes in energy producing states. Most often, interest income is directed to the general fund to support basic ongoing state government services. It might also be used for tax relief, infrastructure projects, rainy day funds, and reclamation of natural resource damages resulting from resource extraction. The figure below shows the current size of permanent fund balances in Colorado, Montana, North Dakota, and Wyoming.

Permanent Fund Year-End Balance and Annual Income Distributions, FY 2011

North Dakota only created its permanent fund in 2011, and the first deposit was made in September of that year. The balance as of October was $67 million. The Legacy Fund will make its first distributions in FY 2017. Despite the newness of the fund, and as a result the small current balance, its creation is a step in the right direction.

Wyoming has the largest permanent fund with a principal balance of more than $5 billion at the end of FY 2012. The fund distributed $222 million to the state’s general fund in FY 2011. Voters created the Permanent Wyoming Mineral Trust Fund (PWMTF) in 1974. The state has directed a set percent of severance tax revenue to the fund each year, and the legislature has made additional discretionary deposits in years with high severance tax revenue. Notably, during the natural gas boom the PWMTF fund balance more than doubled from $1.6 billion in FY 2000 to $4.3 billion in FY 2009. Over the period, the legislature directed about 40 percent of total severance tax collections to the fund with a combination of statutory and discretionary distributions.36

Montana invests no new oil and natural gas revenue into a permanent fund, but maintains a $100 million balance in the Resource Indemnity Trust. The fund is capped at $100 million by state statute and its purpose is funding restoration projects across the state. If and when drilling rigs come across the border, Montana lawmakers should consider increasing and freeing up this funding to ensure resources are available to mitigate the still uncertain environmental impacts of drilling and fracking, and to provide resources for restoration. Improvements to the state’s environmental qualities are a means to link energy development to long-term prosperity, because these amenities are competitive economic advantages in today’s service-based economy.

Colorado has $312 million in the Colorado Water Conservation Board Severance Tax Trust Fund that provides financing for water storage and supply projects in the state. The legislature has routinely raided the fund in the last few years to make up for revenue shortfalls resulting from the recession. Over the last three years, the legislature has diverted $129 million from the fund, or about 41 percent of the current fund balance.

IV. Conclusion

North Dakota’s fiscal policy faces many of the same challenges as other energy-producing states. To date, North Dakota has avoided many of the worst mistakes made by its peers, but the state’s policy retains flaws, primarily the relatively small direct revenue distributions to oil-impacted communities.

Development of the Bakken presents greater challenges for communities than development of conventional oil fields. More wells and more activity mean heightened and continuous impacts on rural infrastructure such as roads and water resources, and increased stress on public safety, housing, and other community services from rapid population growth.

North Dakota should pay particular attention to key aspects of its fiscal policy to ensure that communities in the oil patch have the resources they need in the timeframe and amount necessary to mitigate impacts. Revenue from oil production always lags behind the impacts of drilling. Tying community prospects to biennial appropriations processes, even if significant resources are forthcoming, is ad hoc and can

increase the gap between on-the-ground impacts and mitigation resources. Distribution formulas should be revisited to increase the amount of money retained directly by communities.

Still more work will be required to help communities meet the more ambitious but reasonable goal that the oil wealth leaving the state not only mitigates impacts, but also diversifies the state’s economy and makes western North Dakota a better place to live. Achieving this goal will require many approaches, but fiscal policy will be important in growing and protecting a permanent fund, and investing in education, restoration to improve natural amenities, transportation and communications infrastructure, and other economic development strategies that will help the region compete in a post-oil economy.

V. Appendix A: Goals and Challenges of Sustainable Fiscal Policy

This brief examines fiscal policy — how state and local governments tax oil extraction and spend the proceeds — in four energy-producing Western states: Colorado, Montana, North Dakota, and Wyoming.

We assess North Dakota’s fiscal policy relative to its peers based on three basic goals, and how well each state manages several challenges inherent to taxing oil and natural gas:

Goal One: Fossil fuel extraction pays its way through effective impact mitigation.

The impacts of oil extraction on communities stem from rapid industrialization and population growth, often in rural areas, and from potential environmental impacts. These impacts should be well analyzed and revenue should be sufficient in time and amount to prepare for and manage change.

Goal Two: Fossil fuel extraction supports economic diversification and resilience.

Upward pressures on infrastructure and housing costs, wages, and rising community impacts can dampen economic growth in sectors outside the oil and natural gas industry, leading to specialization and slower long-term growth. Fiscal policy should provide opportunities to support and diversify sectors outside the oil and natural gas industries.

Goal Three: Fossil fuel extraction leaves a lasting legacy in the form of a permanent fund.

Extracting oil represents a one-time opportunity to capture wealth from the depletion of non-renewable resources. Severance taxes are designed to capture value as resources are severed, or removed, from the ground. Investing a portion of oil revenue into a permanent fund will provide lasting fiscal benefits that can help achieve the first two goals of sustainable fiscal policy.

Challenges to Sustainable Fiscal Policy

States face several challenges inherent to achieving fiscal policy goals that are specific to oil extraction activity and the associated impacts.

Timing of Revenue: Oil extraction and the associated industrial activity and population growth impose significant impacts on communities during the exploration and drilling phase of production, while the bulk of revenue derived from oil extraction comes only after production has begun. Resources are often not available in the time necessary to mitigate impacts and facilitate production.

Uneven Distribution: Production taxes often benefit local governments where production occurs, such as unincorporated county areas, but impacts on infrastructure and services may be located in nearby cities and towns, creating unevenness in the location of impacts and revenue availability.

Revenue Volatility: Oil prices, and therefore tax revenue, is tremendously volatile, which makes it difficult to plan for ongoing public services including schools, emergency services, and road and bridge operations.

Revenue Amount: Effective tax rates vary considerably from state to state, resulting in different levels of revenue that is available to achieve tax policy goals. States often set tax rates in order to compete with their neighbors for industry activity, but oil and natural gas taxes are relatively inelastic, meaning different tax rates have little effect on the level of production in a state.

VI. Endnotes

- 1. Donovan, Lauren. February 21, 2012. Officials announce plan to mitigate oil impact in western North Dakota, Bismarck Tribune. ↑

- 2. Brown, Matthew, March 2, 2012. Bakken oil boom, teacher kidnapping alter Sidney forever. ↑

- 3. Headwaters Economics. 2011. Fossil Fuel Extraction and Western Economies; Headwaters Economics. 2009. Impacts of Energy Development in Colorado, with a Focus on Mesa and Garfield Counties; Headwaters Economics, 2008. Energy Revenue in the Intermountain West. All of these reports are available at: Headwaters Economics: Energy/Western. ↑

- 4. Headwaters Economics. 2009. Impacts of Energy Development in Wyoming, with a Case Study of Sweetwater County. ↑

- 5. U.S. Department of the Interior, U. S. Geological Survey. Press Release. 3 to 4.3 Billion Barrels of Technically Recoverable Oil Assessed in North Dakota and Montana’s Bakken Formation–25 Times More Than 1995 Estimate.” April 10, 2008. ↑

- 6. U.S. Department of the Interior Press Release Bakken Formation Oil Assessment in North Dakota, Montana will be updated by U.S. Geological Survey. May 19, 2011. In the release announcing the update, Secretary of the Interior Ken Salazar states “with wells drilled in the Bakken during the past three years, there is significant new geological information. With ever-advancing production technologies, this could mean more oil could potentially be recovered in the formation.” ↑

- 7. LeFever, J and L Helms. 2006. Bakken Formation Reserve Estimates. North Dakota Geological Survey, Oil and Gas Division. ↑

- 8. Fox, Michelle. Aug 24, 2011. CEO: 24 Billion Barrels of Oil in Bakken Shale. CNBC. ↑

- 9. U.S. Energy Information Administration (EIA), U.S. Government, U.S. Dept. of Energy. Total U.S. Proved Reserves of Crude Oil 1979-2009. ↑

- 10. Helmes, Lynn. February 10, 2012 Director’s Cut. North Dakota Industrial Commission, Department of Mineral Resources. ↑

- 11. U.S. Energy Information Agency. Field Production of Crude Oil (Thousand Barrels) by Area. ↑

- 12. Ibid. ↑

- 13. U.S. Energy Information Agency. Petroleum Overview, Table 3.1. Monthly Energy Review February, 2012. ↑

- 14. U.S. Energy Information Agency. Field Production of Crude Oil (Thousand Barrels) by Area. ↑

- 15. Ibid. ↑

- 16. See for example Colorado Department of Natural Resources, Geological Survey, Rock Talk. Colorado’s New Oil Boom — the Niobrara. Vol 13, No. 1. Spring 2011. ↑

- 17. North Dakota Association of Oil and Gas Counties includes 17 Oil County members: Billings, Bottineau, Bowman, Burke, Divide, Dunn, Golden Valley, McHenry, McKenzie, Mclean, Mercer, Mountrail, Renville, Slope, Stark, Ward, and Williams. North Dakota Industrial Commission, Department of Mineral Resources, Oil and Gas Division. General Statistics: ND Historical Barrels of Oil Produced by County. Updated September 9, 2011. ↑

- 18. Ibid. ↑

- 19. Headwaters Economics. 2012. County-Level Drilling Activity, 2001-2011. ↑

- 20. Million Dollar Way Blog (All Bakken All the Time) FAQ. Accessed February 28, 2012. ↑

- 21. North Dakota Industrial Commission, Oil and Gas Division. Presentation to North Dakota Oil Gas and Coal Producing Counties, October 6, 2011. ↑

- 22. BP Prudhoe Bay Fact Sheet, August 2006. ↑

- 23. Andreoli, Derik. December 12, 2011. The Bakken Boom – A Modern-Day Gold Rush. The Oil Drum; Berman, A.E. 2012. After The Gold Rush: A Perspective on Future U.S. Natural Gas Supply and Price. The Oil Drum. ↑

- 24. World Oil Online, High Oil Prices Spur Bakken Activity. May 2010. ↑

- 25. See for example, North Dakota’s Bakken: a Holy Hell. 2011. NorthDecoder.com. ↑

- 26. Omdahl, Lloyd. January 23, 2012. Oil boom breeds unexpected consequences. Guest Opinion, Williston Herald. ↑

- 27. North Dakota Office of the Governor. November 2011. Special Legislative Session Highlights.↑

- 28. North Dakota Department of Commerce. North Dakota Tour Findings and State Response from 2012 Western Infrastructure Development Meetings. February 21, 2012. ↑

- 29. For a review of the relationship between tax rates and state production, see Headwaters Economics report Fossil Fuel Extraction and Western Economies. See also: S. Gerking, W. Morgan, M. Kunce, and J. Kerkvliet, Mineral Tax Incentives, Mineral Production and the Wyoming Economy, report prepared for the Mineral Tax Incentives Subcommittee, Wyoming State Legislature, 2000, and, M. Kunce, S. Gerking, W. Morgan, and R. Maddux, State Taxation, Exploration, and Production in the U.S. Oil Industry, report prepared for the Wyoming State Legislature, 2001. ↑

- 30. Baker Hughes, North American Rotary Rig Count by State, February 2012 Average. ↑

- 31. Headwaters Economics. 2009. Impacts of Energy Development in Colorado, with a Focus on Mesa and Garfield Counties. ↑

- 32. Energy Information Administration Short Term Energy Outlook, December 2011, projects an average 2012 West Texas Intermediate crude oil price of $98. ↑

- 33. geoLOGIC Data Center and North Dakota Office of State Tax Commissioner. Data analysis by VISAGE and Headwaters Economics. ↑

- 34. State of Colorado Department of Local Affairs. Federal mineral lease and state severance tax direct distribution program guidelines, June 2011. ↑

- 35. Headwaters Economics. 2009. Impacts of Energy Development in Wyoming, with a Case Study of Sweetwater County. ↑

- 36. Western, Samuel. February 21, 2012. Robust but Unbalanced: Wyoming’s Permanent Mineral Trust Fund can’t entirely protect the budget from volatile commodity prices. WyoFile. ↑