- Payments made to compensate for the non-taxable status of federal lands, including National Wildlife Refuge Revenue Sharing payments (RRS), are important to the fiscal health of county governments, especially in rural counties.

- The Administration has proposed drastic reductions in RRS payments. The proposal is in response to the rising cost of payments to relatively wealthy counties where land values rapidly are increasing.

- For rural counties this proposal could lead to economic hardship, resentment against federal lands, and opposition to the wildlife refuge system and any refuge expansion plans.

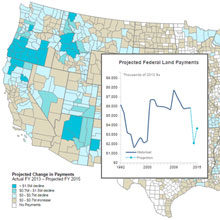

- This report and interactive map show how reforms could yield fair and predictable compensation to rural county governments without increasing overall costs and supporting the conservation mission of wildlife refuges.

The interactive map looks at existing and potential future Refuge Revenue Sharing (RRS) payments to counties. The first tab compares the status quo (the most recent 2015 appropriated payments) to Headwaters Economics proposed “Single PILT” reform. The second tab compares the USFWS proposal to the Headwaters Economics “Single PILT” reform.

The full research paper and associated spreadsheet also provide county-level details on the impacts of the reform proposal.

Background on Wildlife Refuge Payments

The federal government uses various payments mechanisms, known broadly as “county payments,” to compensate local governments for the tax-exempt status of federal lands within their boundaries. Among federal lands that are tax-exempt and for which county payment mechanisms exist are the national wildlife refuges managed by the U.S. Fish and Wildlife Service (USFWS).

The current Administration has proposed eliminating appropriations needed to pay the majority of authorized RRS payments. The Administration argues that economic benefits from visitors to national wildlife refuges, and the resulting tax revenue and economic activity, provide sufficient compensation to communities. The Administration also is concerned that the rising cost of RRS payments—based largely on the appraised value of refuge lands which has risen sharply in the last decade—are prohibitive.

These arguments may hold true for fast-growing urban areas, but they are not valid for rural, isolated counties with little or no economic growth.

The elimination of RRS payments in rural counties could lead to economic hardship, resentment against the presence of federal lands, and opposition to the conservation mission of the wildlife refuge system, including opposition to refuge expansion plans.

How Reforms Can Benefit Rural Counties

Our research paper offers details on a way to reform county payments based on changes to the PILT formula. This reform, the Single PILT Payment reform option, would:

- Eliminate RRS payments in their entirety and make several reforms to the PILT formula. The reformed PILT formula would be the single basis for compensation for national wildlife refuge lands;

- Change the PILT formula in ways that proportionately benefit rural counties more than urban ones, reversing recent trends in compensation as RRS appropriations have fallen;

- Increase payments to rural and relatively poor counties and reduce payments to relatively wealthy counties without raising the overall cost of compensation;

- And, broaden political support for wildlife refuge expansions and land management activities that support the conservation mission of the refuge system.