- How these payments continue may be the most important policy decision affecting county budgets, economic opportunity, and how public lands are managed.

- Headwaters Economics analyzed various potential reforms to better understand the impacts on counties and citizens, especially in rural communities.

- Reforms and policy options for county payments should be evaluated by whether they provide stable and predictable compensation to counties, create job opportunities in line with today’s economy, and improve forest health.

This post contains a summary of the policy proposals, analysis, research, history and context, and interactive tools created by Headwaters Economics concerning federal land payments to counties and states, including SRS and PILT (often called county payments).

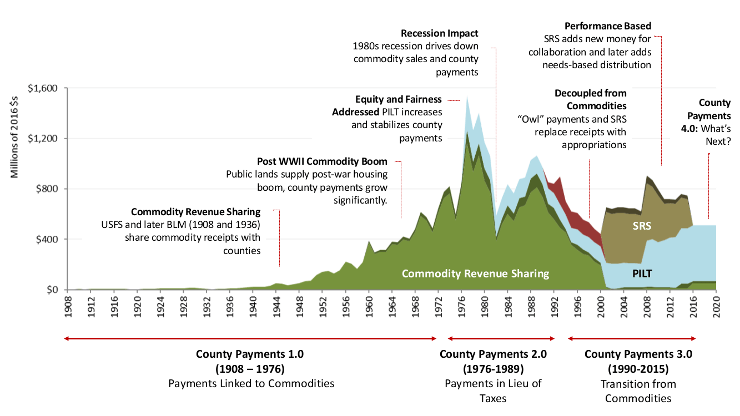

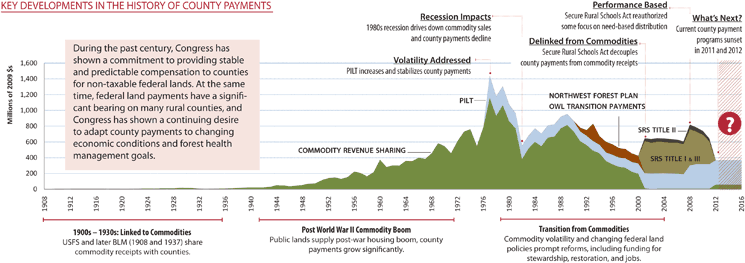

For 100 years, Congress repeatedly has reformed county payments—each change reflecting new economic conditions and how we value public lands—while keeping a commitment to counties.

Policy Reform Ideas

Policy reform proposals should address the how PILT, agency payments, and land management can work together to provide stable and predictable compensation to counties, create job opportunities in line with today’s economy, and improve forest health.

Single Payment

We propose a single payment solution (PDF) that would utilize PILT as the primary way to compensate counties for non-taxable land.

The county payments interactive shows how PILT could be reformed to ensure payments are delivered to counties based on the amount of acres of federal land; and to include incentives and performance criteria that link payments to economic opportunities and use payments most effectively and efficiently.

Using an Economic Performance Index to Reform PILT

Index helps target future PILT payments to where they will have the most economic benefit while reducing needs for future appropriations.

A single payment would require permanent mandatory federal appropriations, as is currently the case with PILT. However, proposed reforms would ensure that rural counties most dependent on county payments would maintain sustainable payment levels, even if future appropriations decline. The single payment could also be combined with a Natural Resources Trust to eliminate the need for permanent congressional assistance.

The single payment reform idea is explored in detail in our paper on reforming wildlife refuge payments.

The idea originally was proposed based on work with the Clearwater Basin Collaborative in Central Idaho. Headwaters Economics testified (PDF) before the U.S. Senate Energy and Natural Resources Committee on this topic and 2014 legislation from U.S. Senator Walsh drew on the same concept.

Natural Resources Trust

The U.S. federal government is conspicuous in having tremendous resource wealth but no permanent trust fund of any kind to manage these revenues. By comparison, trusts are utilized by nearly every U.S. state and other nations with significant natural resource wealth. For example, Alaska, Montana, North Dakota, Texas, and Wyoming all have significant trust funds, and Norway’s massive sovereign wealth fund is valued at more than $850 billion.

Our research paper and testimony before the United States Senate (2017) explain how such a Trust could work to provide permanent funding for county payments by using the proceeds of timber, recreation, mineral, and land use receipts to benefit states and counties adjacent to federal public lands. A Trust could provide permanent funding that would ensure stable and fair payments to counties and eliminate the need for congressional appropriations over time.

White Paper: Eight Reform Ideas

Our 2010 white paper considers ideas for the reform of county payments, explore the pros and cons of each, and evaluate whether each idea will provide stable and predictable compensation to counties, create job opportunities in line with today’s economy, and improve forest health:

- Let SRS expire and return to commodity revenue sharing, where county payments are tied to timber harvest levels and other resource extraction on public lands.

- Reauthorize SRS with no substantive changes.

- Let SRS expire and return to a revenue sharing system based on an expanded definition of “gross receipts” that counts the value of increases in forest health, such as watershed restoration and wildlife habitat improvements.

- Retain SRS payments and change the distribution formula to give proportionately higher payments to counties based on:

- Economic need and development potential.

- Control of wildfire costs by curtaining home-building on fire-prone lands.

- Increases in the value of forest health by public lands.

- The proportion of federal lands in protected status.

- Replace SRS, commodity revenue sharing, and PILT with a tax equivalency program, paying counties the equivalent of what they would be paid in taxes if the land were privately owned.

Headwaters Economics presents the policy options for consideration and discussion in the spirit of determining how to best provide counties with stable and predictable compensation while reinforcing today’s economic and land-health goals. We do not advocate for one idea over another and it is possible that several ideas could be implemented concurrently.

Analysis of Other Proposals

Headwaters Economics analyzes the potential impacts of proposals related to PILT, agency payments, and forest management suggested by Congress and the Administration. We do not weigh in on forest health and timber management issues directly. Instead, we are interested in research on the fiscal and economic development dimensions of federal land management policy, fire suppression and fire fighting cost and budgeting issues, and collaboration related to public lands. Some resources include:

Headwaters Economics has analyzed the potential impacts of recent proposals suggested in the House, Senate, and by the President.

- December 2014, analysis of county payments without SRS (explanation and spreadsheet)

- January 2014, comparison of O&C proposals and the Senate bill

- September 2013, House bill analysis (national) and spreadsheet (USFS data)

- October 2011, Senate bill analysis

- July 2011, President’s proposal analysis

Interactive: County Payments History, Context, and Policy

This intreractive provides several views of federal land payments for every county and state. It includes:

- A trend line of payments history going back to 1992, along with a breakdown of the payments received through specific programs;

- Analysis of the percent of county budgets from federal land payments;

- A projection of the change in county payments if the Secure Rural Schools Act (SRS) is not reauthorized;

- And, a map that shows the change in payments if if a single payment PILT reform is adopted.

Timber Sales, Receipts, and Interactive Maps

These interactive maps show the commercial activities on National Forests such as the timber economy–gross receipts, timber harvest sales, and timber cuts.

- Gross Receipts from Commercial Activities at National Forest, State, and USFS Region Levels, FY 1986-2017

- Timber Sales and Timber Cuts, FY 1980-2018

Research Your County or Region

Headwaters Economics created the Economic Profile System (EPS) in cooperation with the Bureau of Land Management and the U.S. Forest Service. This free tool includes a “Payments from Federal Lands” report that provides a detailed history and analysis of payment data for PILT, the Forest Service, BLM, U.S. Fish and Wildlife Service, Federal Mineral Revenue Sharing from the Office of Natural Resources Revenue.

Users can run custom reports for any county, collection of counties, or states. The reports also include detailed descriptions of each program and links to data sources and methods.

Background and Timeline

The two largest county payment programs–the Secure Rural Schools and Community Self-Determination Act (SRS) and Payments in Lieu of Taxes (PILT)–are expiring. County governments are compensated for the tax-exempt status of federal public lands within their boundaries, and these payments often constitute a significant portion of county and school budgets, particularly in rural counties with extensive public land ownership.

The way payments are funded and distributed also affects how public lands are managed, in turn influencing the kind of economic opportunities available to counties. Congress and the Administration are looking at potential reforms, and Headwaters Economics has prepared a white paper offering eight reform options as well as analysis of several major proposals in the House, Senate, and from the President.

During the past 100 years, Congress has repeatedly reformed federal land payments to counties, with each change reflecting new economic conditions and changing values of public lands—and a renewed commitment to counties. How this commitment is continued may be the most important policy decision affecting county budgets, economic opportunity, and forest health in public land counties across the country.

Payment programs have been flexible,

adapting to changing economic conditions and public values

Large version (PDF): Historical Timeline of Federal Land Payments