Rob Godby, PhD, currently serves as the Director of the University of Wyoming’s Center for Energy Economics and Public Policy, and is also an Associate Professor in the Economics Department at UW. His research areas include natural resource, energy, and environmental economics and policy, industrial organization and macroeconomic policy. He authored the books The European Financial Crisis: Debt, Growth and Economic Policy (2013) and A Greek Tragedy and a European Odyssey: The Politics and Economics of the Euro-crisis with Stephanie Anderson (2016). Rob has also authored or co-authored many professional journal articles and has prepared several studies for agencies of the Wyoming government on energy, economic development, labor market and education policy. His comments also often appear in the international, national, and local media. Rob’s passions outside of work include sportscar and bicycle racing, both of which he has participated in rather unsuccessfully.

Roger Coupal is a community development specialist at the University of Wyoming. His Extension, research and teaching programs are concerned with natural resource policy and community development. Roger’s objective is to provide educational opportunities and information for students, community groups, and public officials engaged in policy issues that reside in the nexus of community development and natural resource policy.

Mark Haggerty moved to Bozeman, Montana, in 1993 and has worked across the state and the West as a researcher, teacher, community organizer, and facilitator. At Headwaters Economics for the past 10 years, Mark has worked to understand why some communities do better than others, and to communicate key lessons and policy ideas to people working to make their own states, counties, and towns more livable and sustainable. Mark’s expertise is in fiscal policy, rural economic development, and community planning. He has served on local planning boards, worked with county commissioners and state legislators across the West, and testified in Congress at the request of both Republicans and Democrats. Mark holds a BA in Economics and MA in Geography from the University of Colorado.

As demonstrated by the body of papers in this collection, public lands can be a tremendous benefit to local communities and regional economies. In this essay, we draw attention to how policy decisions—fiscal policies in particular—affect the ways in which communities benefit economically from public lands. We consider two case studies—federal timber harvests in Oregon and federal leasing of fossil fuels in Wyoming—to illustrate how federal land fiscal policy has undermined the economic benefits of public lands. In each of these cases, billions of dollars in resources were extracted from public lands with a portion (between a quarter and a half of federal revenue) returned to state and local governments where public lands are located. These payments were largely used to lower less popular local taxes, increasing dependence on continued federal payments and encouraging a narrow view of how public lands create value. In the cases of Oregon and Wyoming, federal revenue sharing eroded long-term economic opportunities. These dynamics are not inherent to public lands but are the result of fiscal policy choices. Reforms to federal land fiscal policy that would substantially increase the economic benefits of public lands are possible.

What is Federal Land Fiscal Policy?

Federal land management agencies make payments to state and local governments through a variety of programs to compensate for the nontaxable status of federal lands. The first payments made in 1908 were revenue-sharing agreements that delivered 25% of the value of commodities extracted from the newly established national forest lands to local governments. (Payments equal to 10% of commercial receipts were shared with local governments beginning in 1906, but the Act of 1908 is still in effect today and is generally cited as the original U.S. Forest Service compensation program.) Gifford Pinchot and Teddy Roosevelt argued that revenue-sharing provided adequate compensation for tax-exempt lands and was synergistic with the conservationist goals of management efficiency and the development of the West. The same basic revenue-sharing model was later adopted by the BLM and the U.S. Fish and Wildlife Service. The Mineral Leasing Act of 1920 formalized the largest such program by sharing half of federal revenue from leasing of fossil fuels and other mineral resources with states, requiring only that states use the revenue within broad guidelines to mitigate impacts related to extraction on public lands.

For decades these policies remained relatively modest. U.S. Forest Service payments averaged about $10 million annually between 1910 and 1940 (in 2017 dollars). That changed after World War II when timber harvests from public lands grew exponentially to supply the postwar housing boom. Suddenly, communities and states began receiving substantial funds from federal land management. The highest timber payment from the Forest Service to local governments exceeded $1.2 billion in 1977 (in 2017 dollars). Fossil fuel royalties also dramatically increased in this period with the expansion of oil production and the development of major coal leases in the West.

The rise in the value of revenue-sharing payments was welcomed by state and local governments, but also created concerns in the U.S. Congress which initiated a series of reviews and reforms. The Public Land Law Review Commission’s report to Congress in 1970 documented that revenue-sharing provided unequal compensation because not all lands had the same revenue-generating potential; that payments were uncertain year to year (U.S. Forest Service receipts vary by 30% on average) making it difficult for counties and school districts to plan long-term budgets; and that revenue-sharing encouraged local governments and managers to view public lands narrowly for their revenue potential at the expense of other values.

Congress addressed these challenges with the addition of several new, appropriated payment programs, beginning with the Payments in Lieu of Taxes (PILT) program in 1976. PILT primarily addressed equity and predictability concerns by guaranteeing all counties a minimum per-acre payment. A second period of reforms responded to declining timber harvest levels and receipts from public lands brought on by industrial restructuring and emerging environmental concerns. Beginning in 1989, the BLM guaranteed O&C counties payments that were equal to at least 85% of historic revenue-sharing payments. (“O&C” refers to the Oregon and California land grants that were revested to the U.S. government and are managed by the Bureau of Land Management primarily for timber production. The O&C lands are located in 18 counties in western Oregon.) These “transition payments” were formalized in the Northwest Forest Plan in 1993 and extended nationwide with passage of the Secure Rural Schools and Community Self Determination Act in 2000 (known simply as SRS).

More recent structural changes in the U.S. economy toward services occupations have revealed another challenge. Because payments from SRS, PILT, and mineral revenues can make up a substantial portion of local and state government budgets, federal payments were often utilized to cut less popular property and income taxes. These decisions result in fiscal over-reliance on extractive activities taking place on public lands—and on uncertain appropriations from Congress. Essentially, budget decisions from local to federal levels have so fundamentally narrowed the fiscal relationship between public lands and state and local governments that the economic benefits of public lands also are restricted. As the U.S. economy continues to change, communities reliant on public lands are less able to participate in economic growth.

Case studies in Oregon and Wyoming illustrate these dynamics, but also demonstrate that adverse outcomes are not inherent to resource extraction or to the presence of public lands in rural communities. The economic benefits of public lands are shaped by fiscal policy choices at the federal, state, and local level.

Case Study 1: In Oregon, Over-Reliance on Revenues from Timber, and a Proposed Solution

Since the end of the Great Recession in 2009, the U.S. economy is characterized by increasing geographic inequality as the nation’s major metropolitan areas pull away from the rest of the country because of their advantages—access to markets, access to capital, a large educated labor force, and the creative and innovative synergies created by agglomerations of like-minded companies and individuals. Meanwhile, rural areas are struggling because of distance to markets and labor-saving technologies. (These trends are explored in more detail by Julia Haggerty in this collection.)

In Oregon, growth is largely concentrated in the metropolitan Willamette Valley (nearly 60% of new jobs in Oregon are located in three counties around Portland). In the 1980s and 1990s, Oregon’s rural counties were affected by restructuring in the timber industry and changes in management priorities on federal land that reduced harvest levels. Timber-dependent communities experienced wrenching economic transition as mills consolidated and automated—reducing the need for workers—or closed altogether.

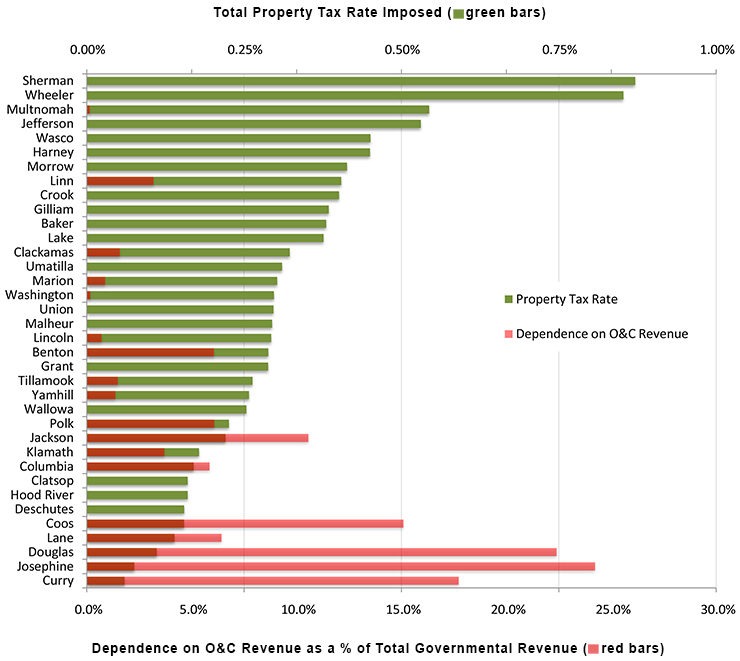

Billions of dollars were extracted from the region, but rather than build wealth and resilience in resource-rich communities, revenue was largely used to lower taxes, increasing dependence on continued extraction and resulting in fiscal crisis when revenue-sharing payments linked to high harvest volumes declined (Figure 1).

Figure 1: Oregon property tax levies compared to federal transfers of timber revenue.

Rural communities responded by spending down savings and reserves, cutting service provision, reducing staff, and foregoing infrastructure improvements. These counties couldn’t keep pace with increasing demands on local governments to take a more active role in economic development. Over time, these counties were unable to overcome their basic economic geography and slipped further behind peers that were more closely aligned with metropolitan economies or able to attract amenity migrants.

Dependence on federal transfer payments is not an inevitable outcome of participation in the timber economy but is driven, at least partially, by choices made by local, state, and federal governments. Locally, counties that received the largest timber payments maintained the lowest property tax rates. States, for their part, restrict the ability of local governments to manage volatile revenue via strict balanced budget requirements and taxation and expenditure limitations while offering declining levels of state assistance. Local and state policy choices contribute to the pressure placed on federal land managers to increase harvest levels as the solution to local fiscal stress, or to pressure Congress for bailouts when these strategies fail.

Congress has largely ignored—or failed to recognize—the impacts of uncertainty and volatility of payments on local economies, prioritizing its own discretionary spending authority (the power of the purse) over predictability and equity of payment programs. For some federal elected officials, the rhetorical link between local budgets and active management of public lands is seen as a powerful incentive for increasing harvests.

Current federal policy proposals seek to reform the dysfunction of federal land payment programs by creating a federal endowment fund to provide stable, increasing, and reliable payments (Forest Management for Rural Stability Act, S.3753 115 th Congress). The proposal would permanently authorize stable and predictable payments at 2017 payment amounts financed by the new endowment. Instead of sharing commercial receipts with local governments on an annual basis, these revenues would be deposited into the endowment, the principal of which would be invested to earn income. The endowment would begin to build wealth over time from the management of federal lands, creating predictability and permanence for counties and guaranteeing increasing payments over time.

Reforming federal land fiscal policy is a necessary but not sufficient condition for rural communities trying to leverage the economic benefits of public lands. Communities still need to work with agencies to manage lands in ways that benefit local economies. The endowment model, by removing an annual revenue requirement associated with direct revenue-sharing programs, increases the types of activities that can add value to rural economies (recreation and conservation activities, for example). Predictable and rising payments support the increasingly important role of local governments in economic development and planning activities and in supporting resilient rural institutions.

Case Study 2: In Wyoming, Dependence on Federal Energy Revenue Has Contributed to a “Mineral Tax Trap”

Wyoming is home to the world’s first national park and the first U.S. national monument. Over half of the state’s surface land is publicly owned and, including subsurface mineral rights, fully two-thirds of the state is federally administered.

These public lands contain significant mineral wealth and have become the backbone of the Wyoming economy. Nationally, Wyoming ranks first in coal production, and eighth in both oil and natural gas production. If Wyoming were a country, it would rank in the top 10 in the world for energy production. In 2016, extractive industries accounted for 20.3% of state GDP and 6.9% of state employment. A majority of Wyoming’s coal, oil, and natural gas are extracted from public lands.

Despite this incredible wealth, the state’s dependence on natural resources has created economic symptoms that suggest the classic resource curse as described in the academic literature is occurring in Wyoming: focus on resource extraction has resulted in a lack of economic diversity and slower growth. It has also caused a lack of state-revenue diversity.

Table 1 compares Wyoming sectoral employment shares to regional neighbors and the national economy. Differences in economic composition are stark. Natural resources in Wyoming have an employment share 3.5 times larger than the regional average, more than six times the national average, and more than 50% larger than the next-highest state in the table. By comparison, manufacturing’s share is less than half the regional average and only 40% of the national average, while employment shares in high-value sectors such as finance, professional and business services, and education and health trail from 28% to more than 50% below regional and national averages.

| Percent of Employment, 2017 | WY | NB | MT | NM | ND | CO | UT | ID | SD | State Region | U.S. |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Private | 76% | 83% | 82% | 78% | 83% | 84% | 84% | 83% | 83% | 83% | 85% |

| Services | 57% | 67% | 69% | 65% | 65% | 71% | 67% | 64% | 66% | 67% | 70% |

| Trade, Transport., Utilities | 19% | 20% | 20% | 17% | 22% | 18% | 19% | 19% | 21% | 19% | 19% |

| Information | 1% | 2% | 1% | 2% | 2% | 3% | 3% | 1% | 1% | 2% | 2% |

| Financial Activities | 4% | 7% | 5% | 4% | 6% | 6% | 6% | 4% | 7% | 6% | 6% |

| Professional and Business | 7% | 12% | 9% | 13% | 8% | 16% | 14% | 13% | 7% | 13% | 14% |

| Education and Health | 10% | 14% | 16% | 16% | 15% | 13% | 13% | 14% | 16% | 14% | 15% |

| Leisure and Hospitality | 14% | 9% | 14% | 12% | 10% | 13% | 10% | 11% | 11% | 11% | 11% |

| Other Services | 3% | 3% | 4% | 3% | 3% | 3% | 3% | 3% | 3% | 3% | 3% |

| Non-Services | 19% | 17% | 13% | 13% | 18% | 13% | 17% | 19% | 17% | 16% | 15% |

| Natural Resources and Mining | 8% | 2% | 3% | 4% | 5% | 2% | 1% | 4% | 2% | 2% | 1% |

| Construction | 7% | 5% | 6% | 6% | 7% | 6% | 7% | 6% | 5% | 6% | 5% |

| Manufacturing (Incl. Forest Prod.) | 4% | 10% | 4% | 3% | 6% | 6% | 9% | 9% | 10% | 7% | 9% |

| Government | 24% | 17% | 18% | 22% | 17% | 16% | 16% | 17% | 17% | 17% | 15% |

Educational attainment in the state also shows signs of the resource curse. While Wyoming’s share of population with a high school diploma is slightly higher than the regional and national average, proportions of the population having a bachelor’s degree lags behind all states in Table 2 and the national average, while the share of population with a graduate degree lags behind all but North Dakota, the second most energy-dependent state in the region. These outcomes are symptomatic of a less diverse, resource-dependent economy. The overall result has been a relative lack of growth in both personal income and population since 1980.

| WY | NB | MT | NM | ND | CO | UT | ID | SD | State Region | U.S. | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Population % Change, 1980-2016 | 24% | 20% | 30% | 60% | 13% | 85% | 102% | 73% | 23% | 59% | 41% |

| Pesonal Income % Change, 1980-2016 | 103% | 122% | 113% | 145% | 169% | 210% | 252% | 174% | 148% | 175% | 172% |

| Education | |||||||||||

| No high school degree | 8% | 9% | 7% | 15% | 8% | 9% | 8% | 10% | 9% | 10% | 13% |

| High school graduate | 92% | 91% | 93% | 85% | 92% | 91% | 92% | 90% | 91% | 90% | 87% |

| Associates degree | 11% | 10% | 9% | 8% | 13% | 8% | 10% | 9% | 11% | 9% | 8% |

| Bachelor’s degree or higher | 26% | 30% | 30% | 27% | 28% | 39% | 32% | 26% | 27% | 32% | 30% |

| Graduate or professional | 9% | 10% | 10% | 12% | 8% | 14% | 11% | 8% | 8% | 11% | 12% |

This dependency has also affected taxation choices that define Wyoming’s public finance system. Taxing mineral extraction—and receiving large disbursements from federal mineral revenue—has allowed the state to maintain relatively low property and sales tax levels by national standards and has allowed Wyoming to avoid imposing state income taxes altogether. Using mineral revenue to fund government in Wyoming is similar to the choice to use timber revenue to fund local governments in Oregon. Using federal energy revenue to fund Wyoming’s state and local governments is popular because resource taxes are largely exported (or paid by consumers in other states who are consuming energy resources exported from Wyoming) meaning Wyoming residents enjoy relatively low taxation and relatively high levels of service.

Table 3 describes the total revenues received by the state versus revenues from mineral extraction alone. Two problems are evident. Not only is the share of state revenues coming from minerals extreme, but the tax structure exacerbates the impact of mineral boom and bust cycles on the state, reducing the state’s fiscal resiliency to energy market downturns. When mineral extraction and prices are high, public revenues rise disproportionately, creating a reinforcing stimulus to the state. Energy downturns, however, have the opposite effect, leading to a disproportionate decrease in public revenues and a need for significant fiscal austerity to balance budgets, something the state has known well since 2015.

Table 3: Wyoming total state and mineral revenue comparison. (Source: Wyoming Taxpayers Association, 2018.)

| Year |

Total State Revenue

(millions) |

Mineral Revenue

(millions) |

Mineral Revenue Share of Total Revenue |

|---|---|---|---|

| 1995 | $1,556 | $753 | 48% |

| 2005 | $3,821 | $2,436 | 64% |

| 2006 | $4,814 | $3,256 | 68% |

| 2007 | $4,772 | $3,034 | 64% |

| 2008 | $5,534 | $3,657 | 66% |

| 2009 | $5,412 | $3,524 | 65% |

| 2010 | $4,552 | $2,852 | 63% |

| 2011 | $5,024 | $3,237 | 64% |

| 2012 | $5,210 | $3,290 | 63% |

| 2013 | $5,161 | $3,198 | 62% |

| 2014 | $5,670 | $3,492 | 62% |

| 2015 | $5,692 | $3,445 | 61% |

| 2016 | $4,231 | $2,159 | 51% |

| 2017 | $4,217 | $2,203 | 52% |

Wyoming’s decision to be dependent on energy commodity taxes has caused an economic and political “mineral tax trap” wherein a political culture and commitment has developed around protecting the self-interest of low taxes and the status quo, dynamics described by Freudenburg as “addictive economies.” The state is aware of the risks of its extreme dependency on coal, oil, and natural gas production, and the need to diversify away from these activities to increase economic development and resiliency. The mineral tax trap includes a pernicious problem that makes it difficult to make policy changes during a downturn—when the ability to make public investments in diversification are most difficult—or during a boom in energy prices and production when the incentive to change the state’s revenue structure is reduced.

For example, the state’s Tax Reform 2000 study proposed fiscal reforms after a decade-long bear market in oil. When prices and production recovered during the next decade, the report and its hard choices were largely shelved. More recently, the state’s Economically Needed Diversification Options for Wyoming initiative (ENDOW) was launched in 2016 during a historic downturn in oil, natural gas, and coal revenue concurrently resulting in a new fiscal crisis. ENDOW is tasked with developing a 20-year strategic plan to diversify the state economy, but it remains unclear whether momentum can be maintained to implement necessary reforms.

The state tax revolt that limits Oregon’s local governments’ fiscal autonomy also expressed itself in Wyoming. In 1974, Wyoming residents passed a new constitutional amendment mandating that in the event a future Legislature implemented an income tax, new revenue would first be used as tax relief, providing credits from sales, use, and property taxes Wyoming residents pay, undermining any benefit of efforts to reduce dependence on energy revenue, or to maintain budgets when energy revenue declines permanently (see Article 15, Section 18 of the Wyoming Constitution at https://soswy.state.wy.us/Forms/Publications/09WYConstitution.pdf).

The state revenue structure, combined with self-imposed barriers to reform, leads to an unintended consequence—sudden flourishing of new and diverse economic activity would not solve the state’s fiscal problems. The additional public service costs of such a change would outstrip the additional tax revenues this activity would create, making the state worse off. A study conducted in 2018 by REMI found that if 100 workers were added in any non-energy sector, the public service costs incurred by these workers and their families would outstrip the state tax revenue they generate; in REMI’s words “…only growth in resource sectors has positive fiscal impacts.”

Wyoming’s resource curse arising from its public land wealth is real. Not only has it distorted the state economy and its demography, it has also distorted its tax structure, and that in turn has created a wicked problem in the classic sense: to escape the state’s resource curse will require making a costly bet to attract new industry with an uncertain payoff. Compounding this cost, if such efforts were successful, they would lead to worsening fiscal outcomes unless an even tougher decision is made. To escape the curse will also require residents to assume a much larger share of their own tax burden, a decision stymied by the well-understood but powerful addiction to mineral revenue.

Despite the actions of the state, federal fiscal policy is implicated in Wyoming’s resource curse on several levels. Volatile revenue from fossil fuels rarely distorts annual budgets and economic policy at the federal level. Federal disbursements to Wyoming, however, make up a substantial portion of the state’s revenue. Federal actions that stabilized disbursements (via a federal endowment as proposed for timber revenue in Oregon, for example) or reforms that place local concerns and local economies at the forefront of federal compensation and impact mitigation payments should be considered. Examples may include diversified revenue from a broader set of services provided by federal lands (e.g., renewable energy and ecosystem services) or consistent funding for reclamation and transition planning in Wyoming’s rural communities.

Conclusion

Public lands offer a variety of benefits, including valuable resource endowments that when extracted generate substantial wealth. But if this wealth is not well managed, natural resources can turn into a curse. The fiscal relationship between federal public lands, states, and local governments is a key driver of dependence that can slow growth and increase economic and fiscal risks presented by a transitioning rural economy. Reforms to fiscal policy that retain and build wealth over time can begin to unwind dependence and increase the resilience of rural communities, a necessary step toward attaining the full economic benefits of public lands.

Suggested Reading

Data Resources for Federal Land Payments

- Headwaters Economics. 2019. Economic Profile System, Federal Land Payments Report. Bozeman, MT.

https://headwaterseconomics.org/tools/economic-profile-system/.

- Headwaters Economics. 2017. Commercial Activities on National Forests. Bozeman, MT. https://headwaterseconomics.org/public-lands/county-payments/commercial-activities-national-forests/.

- U.S. Department of the Interior, Office of Natural Resources Revenue. 2017. Federal disbursements by recipient.

Background on Federal Land Payment Programs

- Corn, M.L. 2008. PILT (Payments in Lieu of Taxes): Somewhat Simplified. Washington, DC: Congressional Research Service.

- Corn, M.L. 2014. Fish and Wildlife Service: Compensation to Local Governments. Report R42404. Washington, DC: Congressional Research Service.

- Hoover, Katie. 2015. Reauthorizing the Secure Rural Schools and Community Self-Determination Act of 2000. Washington, DC: Congressional Research Service.

- Public Land Law Review Commission. 1970. One Third of the Nation’s Land: A Report to the President and to the Congress. Washington, DC.

- Schuster, Ervin G. 1995. PILT—Its Purpose and Performance. Journal of Forestry 93(8):31-35.

Resource Curse and Addictive Economies

- Freudenburg, W.R. 1992. Addictive Economies: Extractive Industries and Vulnerable Localities in a Changing World Economy! Rural Sociology 57(3): 305-332.

- Gunton, Thomas. 2003. Natural Resources and Regional Development: An Assessment of Dependency and Comparative Advantage Paradigms. Economic Geography 79(1):67-94.

- Krannich, R.S., and A.E. Luloff. 1991. Problems of resource dependency in U.S. rural communities. Progress in Rural Policy and Planning 1: 5-18.

- Papyrakisa, E. and R. Gerlagh. 2007. Resource abundance and economic growth in the United States. European Economic Review 51(4): 1011–1039.

- Sachs, J.D. and Andrew M. Warner. 2001. Natural Resources and Economic Development: The curse of natural resources. European Economic Review 45: 827-838.

Oregon Economy

- Adams, V. 2009. Local government responses to fiscal stress: how do Oregon counties compare? OSU Rural Studies Program Working Paper No. RSP 0902. Corvallis, OR: Oregon State University.

- Haggerty, M. 2018. Rethinking the Fiscal Relationship Between Public Lands and Public Land Counties: County Payments 4.0. Humboldt Journal of Social Relations 1(40): 116-136.

- Johnson, Kirk. 2017. Where Anti-Tax Fervor Means “All Services Will Cease.” New York Times, May 13.

- Oregon Governor’s Task Force on Federal Forest Payments and County Services. 2009. Final Report. Salem, OR: Office of the Governor.

- Rasker, Ray. 2017. The Transition from Western Timber Dependence: Lessons for Counties. Bozeman, MT: Headwaters Economics.

https://headwaterseconomics.org/wp-content/uploads/Lessons_Timber_Transition.pdf.

Wyoming Economy

- Western, S. 2002. Pushed Off the Mountain, Sold Down the River: Wyoming’s Search for Its Soul. Jackson, WY: Homestead Publishing.

- REMI. 2018. Presentation to Wyoming Joint Revenue Committee dated June 4, 2018, see

https://www.wyofile.com/study-without-tax-reform-economic-diversification-hurts-state/.

- State of Wyoming. Tax Reform 2000 Report, Building Wyoming’s Tax Structure for the 21st Century. Preliminary Report (January 11, 1998), Executive Summary and Final Reports (June 1999).