- To put the federal coal program in context, it made up more than 42 percent of total U.S. coal production in 2014, but accounted for only 20 percent of the total value of coal mined nationally that year.

- Because federal coal is produced primarily from efficient surface mines, federal coal production employs relatively few people. Coal mines with federal leases employed only 19 percent of total coal workers in the U.S. in 2014.

- Royalty and tax revenue from federal coal is an important source of revenue for some states and local governments. Wyoming is most heavily dependent on coal tax revenues, receiving more than 12 percent of state and local tax revenues from that source alone.

Headwaters Economics has published detailed data and research that describe the current contributions of the federal coal program and put the federal coal program in context.

Federal Coal Production

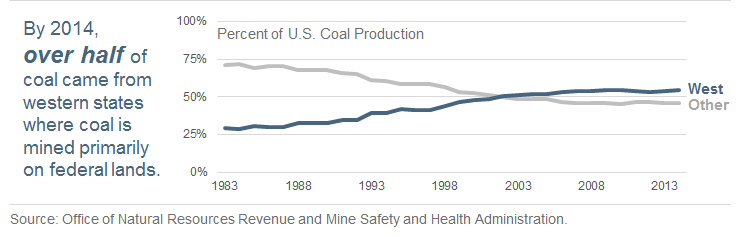

Since the late 1970’s, coal production has shifted away from privately-owned coal resources in the eastern United States. Western states have contributed more than half of total U.S. coal production annually since 2002, and in the West coal resources are primarily federally-owned. In 2014, more than 54 percent of total U.S. coal production came from western states.

In early 2016, the Department of Interior imposed a three-year pause on new federal coal leases. During the pause, the Bureau of Land Management will consider the social and economic context of federal coal leasing to understand the potential impacts reforms may have on communities and workers. Because federally owned coal is mined predominantly in the West, reforms may disproportionately affect western communities.

Where Is Federal Coal Produced?

Federal Coal Employment

The efficiency of Western coal mines where most federal coal is extracted means that federal coal production employs relatively few workers; consisting of just 19 percent of the coal mining workforce nationally.

The shift to federal production and away from Appalachia that began in the late 1970’s resulted in sharp job losses. Total coal production in the U.S. was higher in 2015 than in 1985, but employment declined by 120,000 jobs during the same period.

How Many Mining Jobs Does the Production of Federal Coal Support?

Federal coal supported an estimated 13,373 mining jobs in 2014, equal to approximately 1.5 percent of total employment within the 28 counties where the mines are located. In ten counties, jobs at mines that produced federal coal in 2014 exceeded five percent of total employment, and reached as high as 15 percent in Campbell County, Wyoming.

Nearly all coal mining states are less dependent on coal mining for employment than at any time since the 1970s. Coal mining jobs make up 1.6 percent of total employment in Wyoming, the state most reliant on coal for jobs.

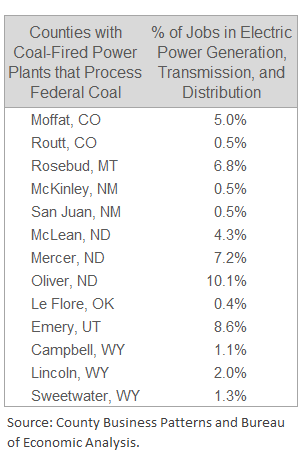

Mines supply coal-fired power plants across the U.S., adding to the number of jobs directly associated with coal production. Thirteen counties have both coal mines with federal leases and coal-fired power plants supplied from these adjacent mines. Within these 13 counties, coal-fired power plants employed 3,782 people in 2014, approximately 1.9 percent of total employment within the 13 counties. These workers also potentially are affected by changes to federal coal leasing and royalty policy.

Headwaters Economics developed several new tools that can be used to understand the role of coal mining and power generation in local and regional economies, and to compare coal-dependent counties to their peer counties across the West.

Federal Coal Tax Revenue

Coal extracted from federal land is an important source of revenue for some states and local governments. Coal production in states with federal leases generated $1.1 billion in royalties and tax revenues in 2014.

Federal coal revenue is a relatively larger contribution to state economies compared to employment. Coal revenue made up 12.5 percent of total state and local government budgets in Wyoming in 2012 (the latest year for which accurate, national data on total state and local government budgets is available). By comparison, coal mining jobs made up only 1.8 percent of total employment in 2012. This same relationship holds in the other states, although the relative importance of federal coal revenues is significantly lower.

How Dependent Are State and Local Governments on Federal Coal Tax Revenues?

Fiscal policy can help mitigate the acute impacts associated with mining activity and related population growth, manage revenue volatility over time, and make long-term investments in economic development.

Communities facing declining coal production and employment are also faced with significant revenue losses. How states and local governments tax coal mining and spend the resulting revenue can lead to greater or less risks of fiscal crisis.

In some cases, coal revenue largely is spent on annual general government expenses and to lower taxes on individuals and other economic sectors. These policy decisions create greater exposure to revenue volatility. By comparison, states that save coal revenue and make long-term investments in education and infrastructure (limiting annual expenditures and tax switching) are more resilient to changes in the coal markets.

Headwaters Economics has published detailed data and research that describe the current contributions of the federal coal program.

Summary: Federal Coal Program in Context

Federal coal production is concentrated in relatively few places and extracted from highly efficient coal mines. These facts offer important context for the ongoing review process. Changes to the federal coal program will be felt acutely in rural communities dependent on coal mining for employment and tax revenue. However, these impacts will be limited in scale. Recent modeling of leasing and royalty reform options suggests new revenues will outweigh the costs associated with reform on a national basis, creating opportunities to assist communities potentially affected by reforms.