- Coal extracted from federal land is an important source of energy and revenue in the United States, and the federal government owns roughly one-third of total coal reserves.

- The royalty structure is costly to administer, and the average current reported tax rate (10.9%) is less than the average statutory rate (12.3%). Measured as a share of the delivered costs, the effective coal royalty rate is 4.9 percent, which is lower than the comparable effective rates paid by oil and natural gas.

- Moving valuation from the mine price to the market price simplifies the process, creates transparency, lowers administrative costs, and allows for a more accurate assessment of whether taxpayers are receiving a fair return.

The Obama Administration currently is considering possible changes to the federal coal royalty valuation policy. This report analyzes how revenues from federal coal are obtained, reviews problems with the current system, estimates current effective royalty rates, and offers several reform options.

Today, coal extracted from federal land is an important source of energy and revenue in the United States, and the federal government owns roughly one-third of total coal reserves.

Despite the importance of federal coal resources, the current royalty structure is opaque and costly to administer, and the returns to the U.S. public are unclear.

Findings

This report’s analysis suggests that the federal government is not receiving a fair return for American taxpayers.

The average current reported tax rate (10.9%) is less than the average statutory rate (12.3%). Measured as a share of the delivered costs, the effective coal royalty rate is 4.9 percent, which is lower than the comparable effective rates paid by oil and natural gas.

As a result, current federal policies cost taxpayers roughly $850 million between 2008 and 2012.

Moving the point of valuation from the mine price to the market price simplifies the royalty structure, creates transparency, and lowers administrative costs—and allows for a more accurate assessment to determine whether the federal government is receiving a fair return for taxpayers.

Challenges with Current Royalty Structure

Federal coal leasing has multiple objectives: a fair return for U.S. taxpayers, economic development and jobs, energy security, and environmental protection.

However, significant changes in the structure of the coal market–including a larger share of production from western surface mines, an increasing role for brokers in the coal market, and the potential for significant new coal exports–have raised concerns about the current balance between competing interests.

The Bureau of Land Management (BLM) and the Office of Natural Resource Revenue (ONRR) administer the federal coal leasing and royalty program. Royalties are the owner’s share of the resource value.

Today, the ONRR often accepts less than full value—the effective coal royalty rate is 4.9 percent of the gross market value of coal extracted between 2008 and 2012 (compared to the average statutory rate of 12.3 percent which is based on net market value).

Evaluating the effective returns earned by the ONRR under the current royalty structure reveals several problems:

- Transparency: The royalty rates applied to each lease, prices used to determine royalties due, and allowable cost deductions are all considered proprietary and data are withheld from the public. As a result, there is little outside oversight of the royalty structure, engendering uncertainty about how the government is balancing competing interests.

- Cost of Administering: The current royalty structure is complex and confusing. Royalties are often based on non-market transactions where prices are uncertain and the ONRR uses complex valuation methods that are expensive to administer.

- Fair Returns: The ONRR now values coal for royalties at the first point of sale at or near the mine, precluding royalty collections when the coal is remarketed at significantly higher prices, including for export.

Reform Options

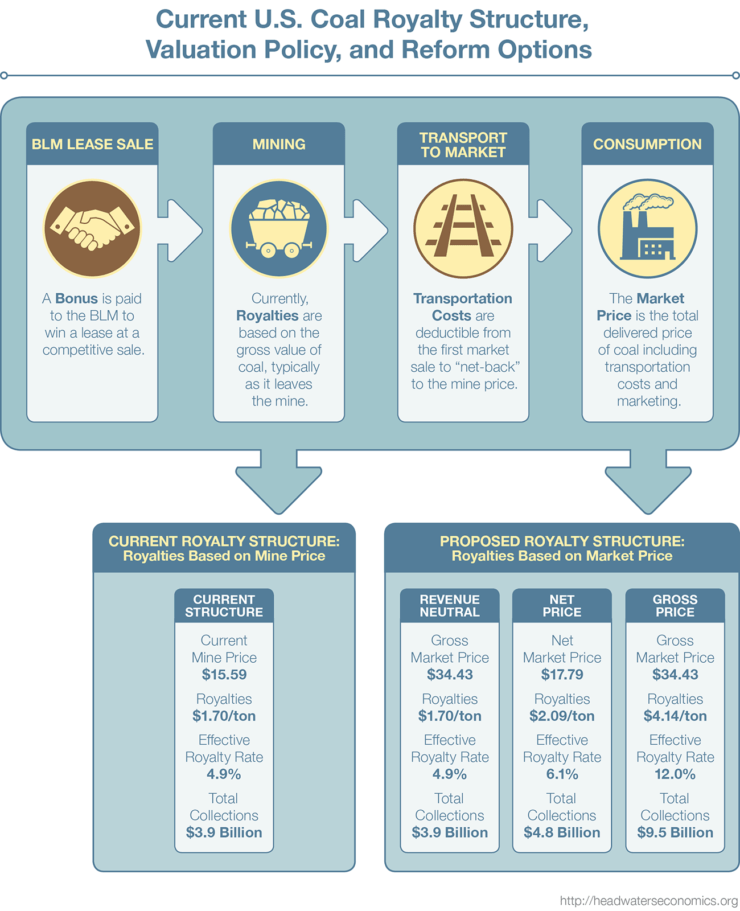

The graphic above illustrates the current coal royalty structure along with the outcomes of three reform options.

Currently, royalty rates and the prices used to determine royalty valuation are not reported. This report uses actual coal sales and royalty collections between 2008 and 2012 to determine that the effective royalty rate was 4.9 percent of the gross market price, and royalty collections averaged about $1.70 per ton during that time.

Moving the point of valuation would improve transparency. Market prices of coal are known and the federal government and public would have easy access to coal valuation data. This in turn would greatly simplify the valuation process and reduce administrative costs while making it easier to assess a fair return balanced against other competing interests.

The first reform option, using market prices to determine royalty valuation, is revenue neutral, showing that there can be more transparency and lower administrative costs without changing total royalty collections.

The second reform option bases coal valuation on net market prices, resulting in an effective royalty rate of 6.1 percent and average royalty collections of $2.09 per ton, and total collections of more than $850 million higher ($4.8 billion in total revenue compared to the current $3.9 billion). Royalty collections are higher because the average net market price paid for coal delivered from states with federal leases between 2008 and 2012 was $17.79, about $2 per ton more than the current reported sales price at the mine.

The third reform option uses the gross market value of coal—meaning transportation costs are no longer deductible expenses—with an effective royalty rate of 12 percent and average collections per ton of $4.14 per ton, and total royalty collections of $9.5 billion or about $5.5 billion more than current royalties.