Fiscal policy is important for local communities for several reasons, and this analysis shows that many Colorado communities are not receiving the resources necessary to build and maintain infrastructure and to provide services during the boom. The Colorado report is part of a larger series that looks at major energy producing states.

The focus on unconventional horizontal drilling and hydraulic fracturing technologies have led a resurgence in energy production in the U.S. Unconventional oil plays, for example, require more wells to be drilled on a continuous basis to maintain production than comparable conventional oil fields. This expands potential employment, income, and tax benefits, but also heightens and extends public costs.

Mitigating the acute impacts associated with drilling activity and related population growth requires that revenue is available in the amount, time, and location necessary to build and maintain infrastructure and to provide services. In addition, managing volatility over time requires different fiscal strategies, including setting aside a portion of oil revenue in permanent funds.

Summary Findings

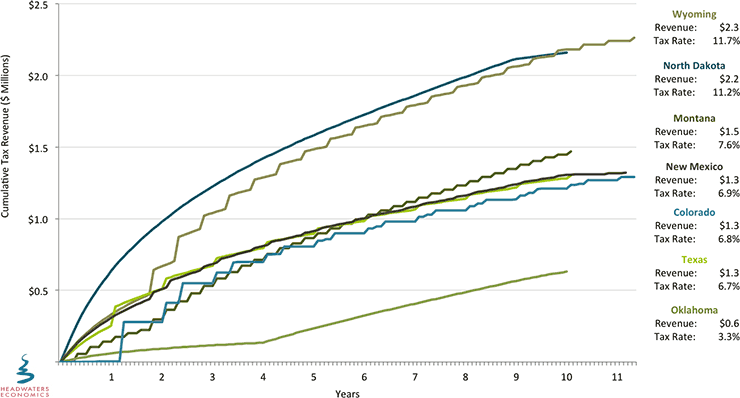

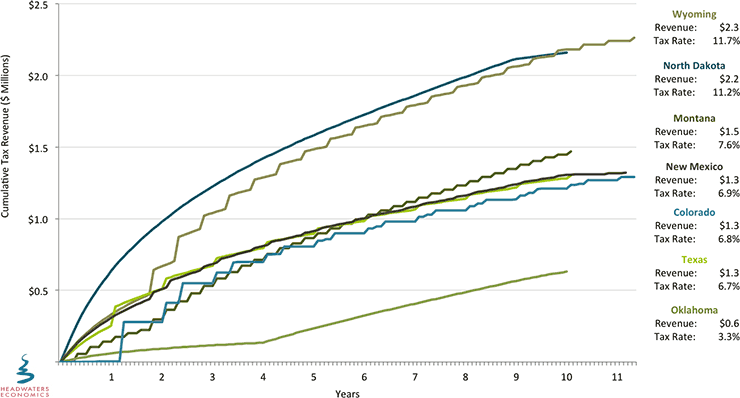

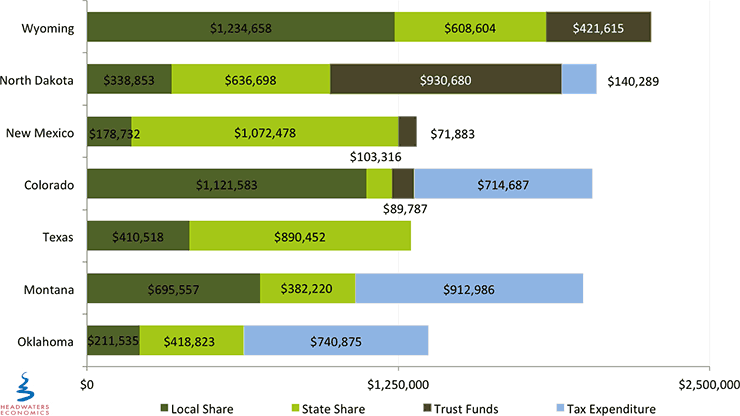

- Colorado’s effective tax rate of 6.8 percent ranks fifth of the seven states we compared. Colorado levies a severance tax at the state level, and local governments collect property taxes on the value of oil production within their jurisdictions (see Figure 1 below).

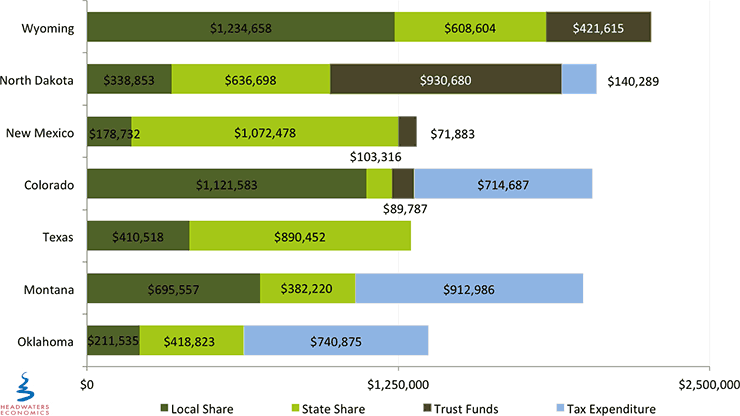

- Colorado’s severance tax incentive greatly exacerbates severance tax revenue volatility and makes property taxes the largest source of production tax income (72% of total production taxes from the typical unconventional oil well over ten years). The incentive creates an interaction between two taxes that are assessed on production that occurs at different times. In the first year, the incentive effectively is not available (the value of the incentive is zero). In subsequent years, the value of the incentive can exceed total severance tax liability (severance tax collections can be zero).

- Local government reliance on property taxes is problematic as revenue accrues to the taxing jurisdictions where production occurs, and not to adjacent cities and counties experiencing impacts. Property taxes also delay revenue collections by more than two years after initial oil production begins. State severance tax distributions are progressive in that they consider impact related criteria in addition to production location, but low severance tax collections reduce their effectiveness.

Figure 1. Comparison of Production Tax Revenue Collected from a Typical Unconventional Oil Well

Figure 2. Comparison of Distribution of Production Tax Revenue from a Typical Unconventional Oil Well

Background

Unconventional oil is extracted from tight shale formations using horizontal drilling and hydraulic fracturing technologies. The focus on unconventional oil is important as horizontal drilling and hydraulic fracturing technologies have led a resurgence in oil production in the U.S. Unconventional oil plays require more wells to be drilled on a continuous basis to maintain production than comparable conventional oil fields. This expands potential employment, income, and tax benefits, but also heightens and extends impacts on communities and public costs.

State and local governments levy different types of production taxes, at different rates, and offer a complex array of exemptions, deductions, and incentives. The various approaches to taxing oil and natural gas make comparisons between states difficult, although not impossible. This report applies each state’s fiscal policy, including production taxes and revenue distributions, to a typical new unconventional oil well over ten years of production. This allows for a comparison of how states tax oil extracted using unconventional technologies, and how this revenue is distributed to communities over time.

To provide a simple framework for the comparison, we assess state production tax policies on four criteria: the amount, time, location, and predictability of revenue distributions to local governments where extraction and associated impacts occur. We also provide a summary of the methods and data used to compare state fiscal policies.

The various approaches to taxing oil make comparisons between states difficult, although not impossible. To compare states, we apply each state’s fiscal policy, including production taxes and revenue distributions, to a typical unconventional oil well. This allows for a comparison of how states tax oil extracted using unconventional technologies, and how this revenue is distributed to communities.

We hope these data and resources will be useful to states and communities with unconventional oil development that are trying to mitigate the short-term impacts of oil extraction while making investments in long-term economic development opportunities.